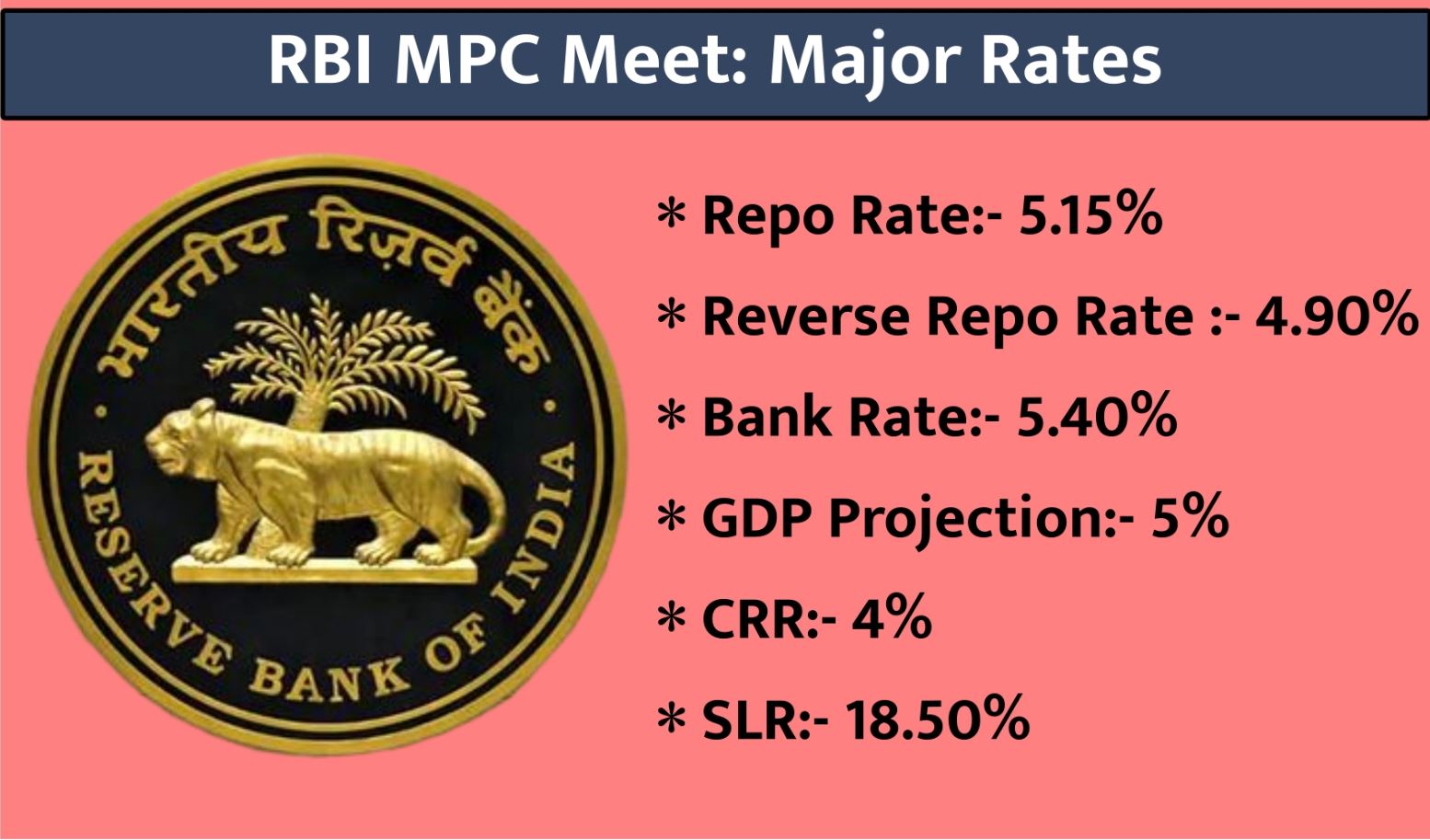

Mumbai: The Reserve Bank of India on Thursday kept the key policy rate unchanged at 5.15 per cent and decided to continue with its accommodative stance to support the economy.

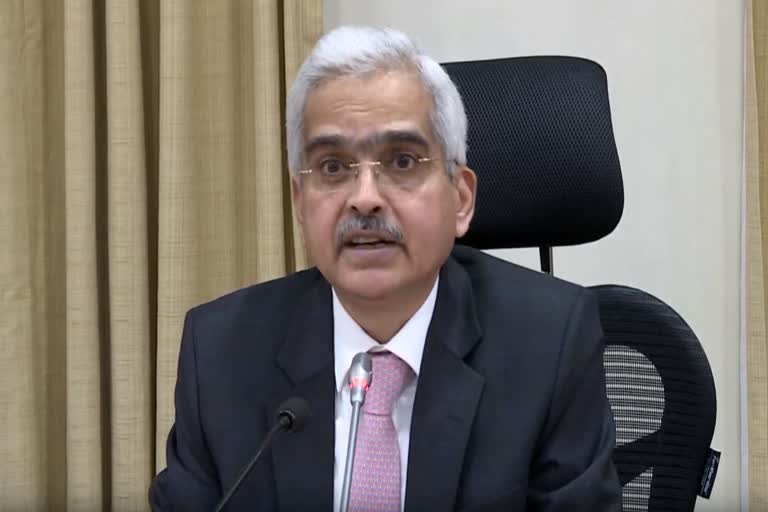

The six-member monetary policy committee under the chairmanship of RBI Governor Shaktikanta Das began their meet on December 3 for the fifth bi-monthly policy statement for 2019-20.

Consequently, the reverse repo rate under the LAF remains unchanged at 4.90 per cent, and the marginal standing facility (MSF) rate and the Bank Rate at 5.40 per cent.

The MPC also decided to continue with the accommodative stance as long as it is necessary to revive growth, while ensuring that inflation remains within the target.

These decisions are in consonance with the objective of achieving the medium-term target for consumer price index (CPI) inflation of 4 per cent within a band of +/- 2 per cent, while supporting growth.

Real GDP growth for 2019-20 is revised downwards from 6.1 per cent in the October policy to 5.0 per cent –4.9-5.5 per cent in H2 and 5.9-6.3 per cent for H1:2020-21.

"The Monetary Policy Committee recognises that there is monetary policy space for future action. However, given the evolving growth-inflation dynamics, the MPC felt it appropriate to take a pause at this juncture," the RBI said in its fifth bi-monthly monetary policy for this fiscal.

Das said this was a "temporary pause" in the interest rate cutting cycle and the MPC will be better placed to decide on it in February after more data comes in and the government brings out its Budget for 2020-21.

The panel decided to continue with the accommodative stance as long as it is necessary to revive growth, while ensuring that inflation remains within the target.

All the six members of the MPC voted in favour of a rate pause.

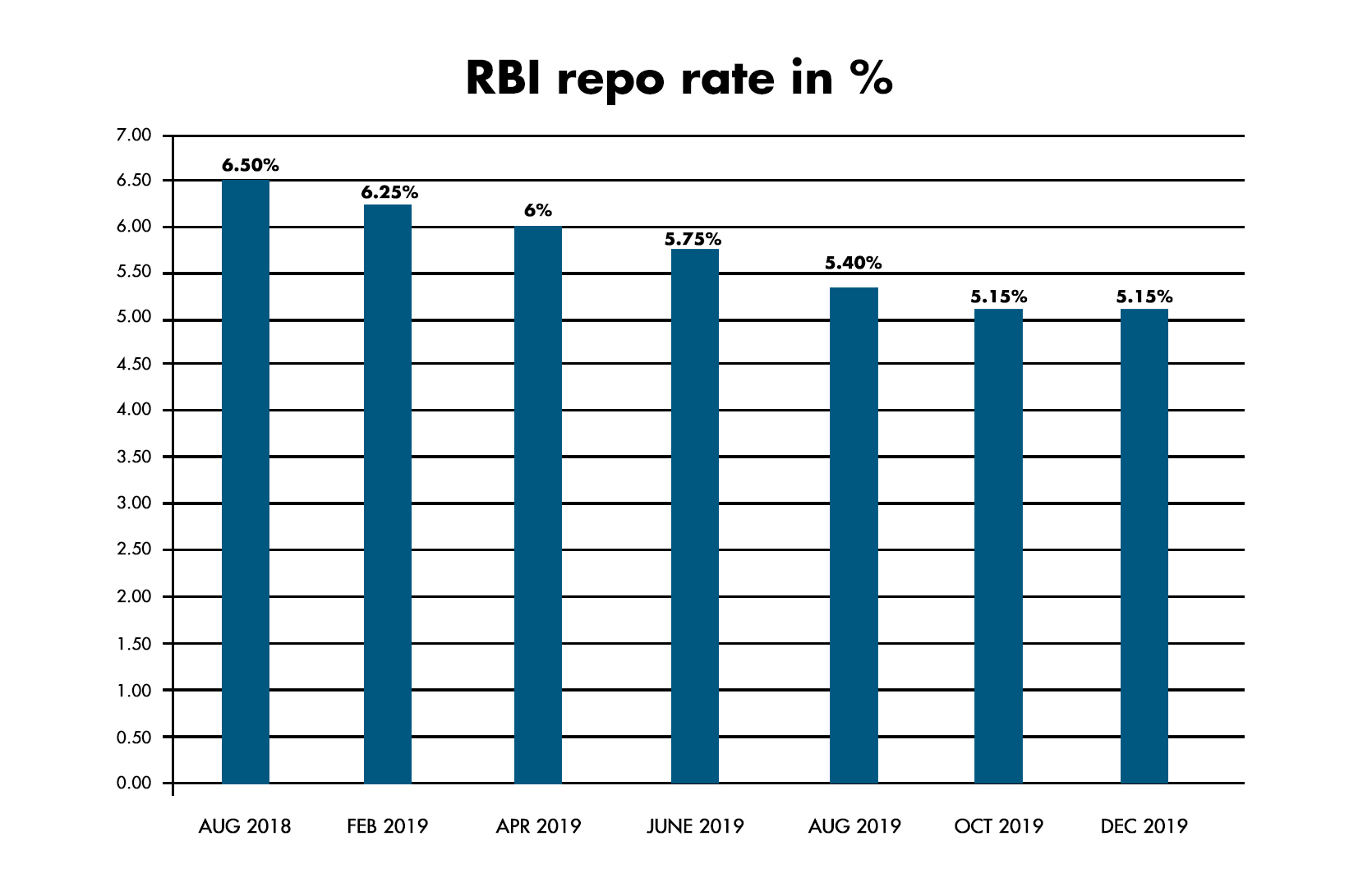

Between February and October 2019, the RBI has reduced repo rate by 135 basis points.

Stating that headline inflation at 4.6 per cent in October was "much higher than expected," the central bank raised upwards its inflation forecast for the second half of the fiscal year to 5.1-4.7 per cent from 3.5-3.7 per cent seen previously.

Inflation in October for the first time in more than a year breached the RBI's 4 per cent medium-term target. This primarily was due to uptick in prices of vegetables such as onion and tomatoes, Das said.

What is Repo Rate?

Repo rate is the rate at which RBI lends to commercial banks for a short period of time. The back to back cuts in the key lending rate would enable banks to give personal, auto and home loans to customers at a reduced rate of interest. Consequently, the equated monthly instalments (EMI) would come down.