By Saurabh Shukla

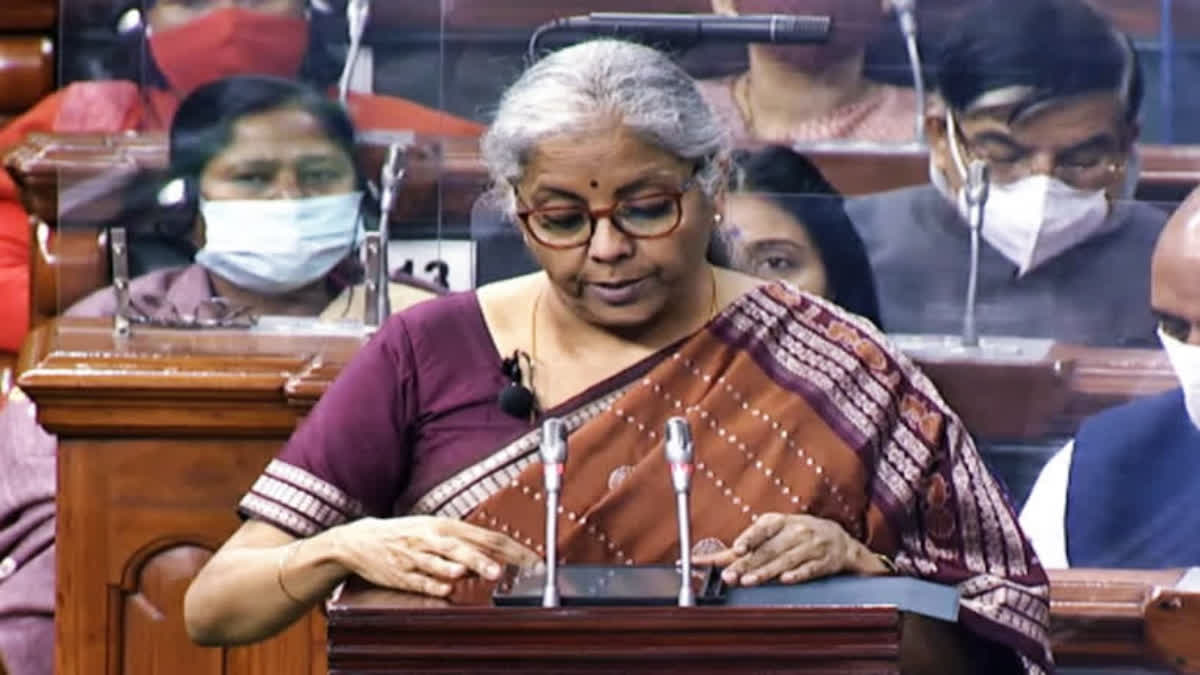

New Delhi: After presenting her 8th budget, Finance Minister Nirmala Sitharaman said that we have done reforms regarding income tax and the bill is scheduled for next week's parliament session. She said that with the announcement of tax reduction under the new regime, there will be no reduction to the capital expenditures and fiscal prudence has been maintained.

Addressing a press conference here, she also added that in the proposed new tax regime, the maximum total income for which tax liability for individual taxpayers is NIL is Rs 12.75. Earlier the limit of income for nil tax payment was Rs 7 lakh. By increasing this limit to Rs 12 lakh around one crore assessees, who were earlier required to pay tax varying from Rs 20,000 to 80,000 will be now paying nil tax. And more than one crore people are going to benefit and will pay no tax.

As per the government, the benefit of such Nil tax liability mentioned above is available only in the new tax regime. This New tax regime is the default regime. To avail of the benefit of rebate allowable under proposed provisions of the new tax regime, only a return is to be filed otherwise no other step is required to be taken.

Revenue Secretary Tuhin Kanta Pandey said that any individual earlier was required to pay a tax of Rs 80,000 (in the new regime) for an income of Rs 12 lakh, now he will be required to pay nil tax on such income.

It's a gradual thing that has been done and everyone gets benefited with this...extra rebate be given post-Rs 7 lakh earning people, he added.

Sitharaman also says that if you compare what we did today with the Congress what they did in 2014, if someone earning Rs 8 lakh was giving Rs 1 lakh tax and today it is zero. Across the board everyone is getting benefited because tax rates also reduced, she added.

Standard Deduction

Frequently asked questions released by the government say that there will be a standard deduction of 75,000 Rupees available to a taxpayer in the new regime. Therefore, a salaried taxpayer will not be required to pay any tax where his income before the standard deduction is less than or equal to Rs 12,75,000. A standard deduction of Rs. 50,000 is available in the old regime. Presently, for AY 2024-25, about 8.75 crore persons have filed their ITRs. Experts call this announcement a game-changer.

Tax expert Devendra Kumar Mishra told ETV Bharat that this announcement will not only benefit taxpayers but also reduce last-minute saving hurdles every taxpayer follows the old regime faces. According to Mishra, the government will have revenue forgone on Rs 1 lakh crore due to this and that money will in a way come back to the system in terms of extra disposable money in the hands of people.

"This will boost the economy in a good way," added Mishra.