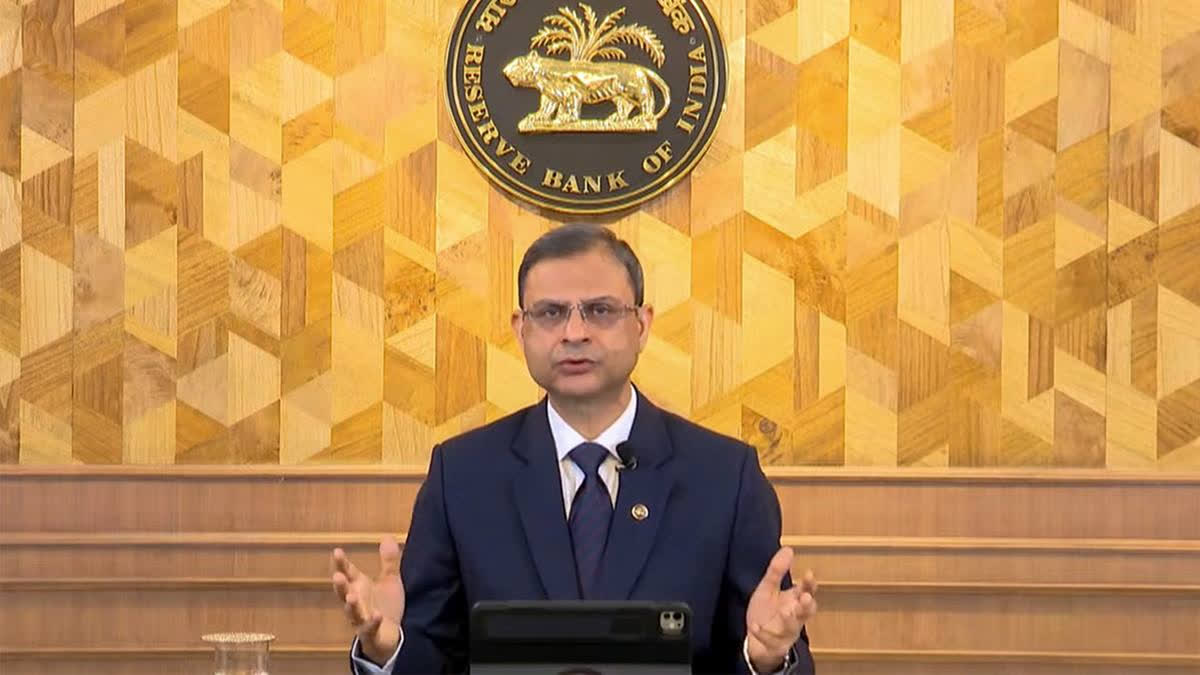

New Delhi:Reserve Bank Governor Sanjay Malhotra on Saturday said that the market forces decide the value of rupee with respect to the US dollar and the central bank is not worried about day-to-day movement of the currency value. Addressing the media after the meeting of Finance Minister Nirmala Sitharaman with the Reserve Bank board, Malhotra said that the central bank focuses on the value of the rupee in the medium to long term.

"There is no change in RBI's approach. It does not look at any price level or band. It is our endeavour to curb excessive volatility. We should not be looking at daily movement or exchange rate," he said in reply to a query on the rupee depreciation. On the impact of the depreciation of the rupee against the US dollar on price rise, he said 5 per cent depreciation impacts domestic inflation to the extent of 30-35 bps.

He further said that RBI took on board the current rupee-dollar rate while working out the growth and inflation projections for the next financial year. The rupee recovered 9 paise from its all-time low level to close at 87.50 against the US dollar on Friday after the Reserve Bank of India reduced the key policy rate by 25 basis points in line with street expectations.

The Governor also said most of the depreciation in the Indian currency is driven by the uncertainties which have come up because the global issues and especially, the tariff-related announcements by US President Donald Trump. "...hopefully that should settle down and that should help us in the downward movement of inflation," he said. Malhotra also sought to assure that the RBI will be "nimble and agile" to provide adequate liquidity in the banking system.

"We have a number of instruments at our hands to control and manage liquidity and we will use them. We have OMO, we have the buy-sell swaps of forex, we have various other tools, we have the LAF, we have the VRR and we are using all of these measures to provide sufficient liquid. We need not be worried on that account," the Governor said.