New Delhi:The Indian aviation industry is projected to continue its upward trajectory in FY2025, despite operational difficulties and supply chain challenges, according to a new report from rating agency ICRA. The report indicates a 7-10% year-on-year (YoY) growth in domestic passenger traffic, alongside robust expansion in international passenger volumes. While these positive trends signal recovery, the financial outlook remains cautiously optimistic, with the industry still expected to report losses in the next two fiscal years.

Growth Momentum in Passenger Traffic

ICRA forecasts a significant surge in domestic air passenger traffic, which is expected to rise to 164-170 million in FY2025. In the first half of FY2025, 79.3 million passengers were recorded, marking a modest 5.3% YoY growth despite disruptions from severe weather, including heatwaves. This growth signals a continued recovery in domestic travel.

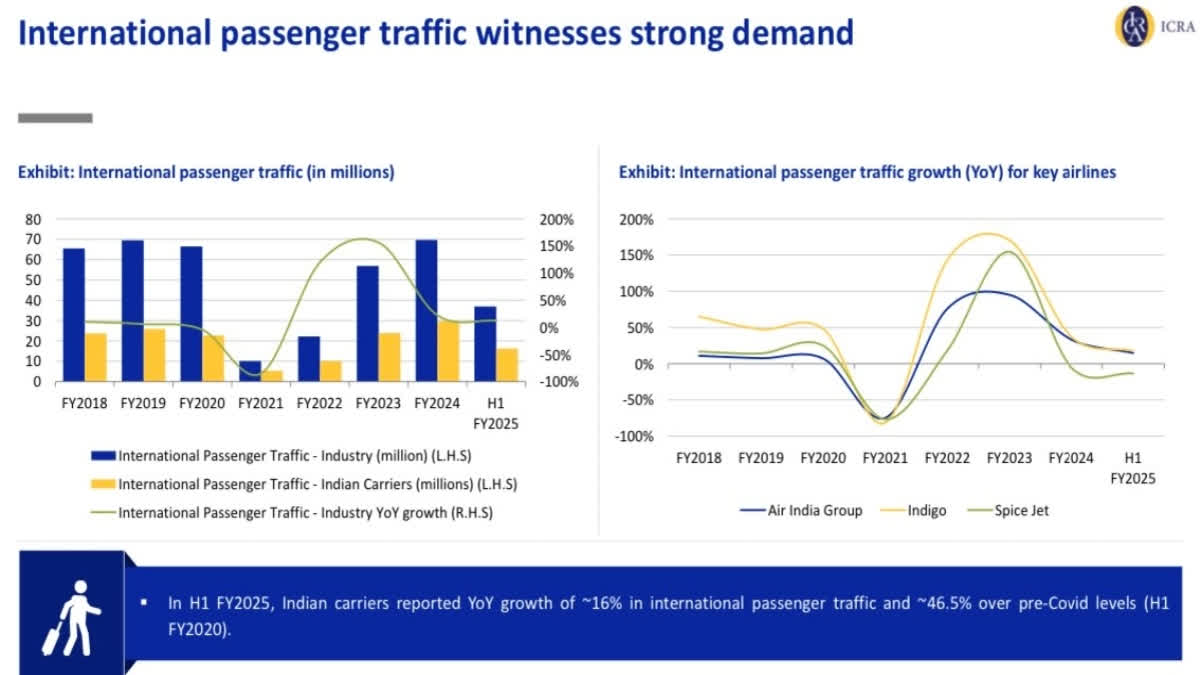

On the international front, Indian carriers have shown stronger growth, with a 16.2% increase in traffic during the first half of FY2025. Projections suggest that by the end of FY2025, international passenger volumes could reach 34-36 million, representing a 15-20% YoY increase. This upward trend reflects not only growing demand but also the expanding role of Indian airlines in the global market.

Financial Outlook: Modest Losses Amid Growth

While passenger traffic remains strong, the financial performance of the aviation sector continues to be a balancing act. The ICRA report estimates that the industry will face net losses of ₹20-30 billion in FY2025 and FY2026. These figures are considerably lower than losses experienced in prior years, with the improvement attributed to airlines' strengthened pricing power.

Kinjal Shah, Senior Vice-President and Co-Group Head at ICRA highlighted, "ICRA expects the industry to report a net loss of Rs. 20-30 billion in FY2025 and FY2026 each, significantly lower than the losses witnessed in the past supported by improved pricing power of the airlines." Shah further noted that while the financial outlook is improving, challenges persist: "The spread between revenue per available seat kilometre (RASK) and cost per available seat kilometre (CASK) saw some moderation in H1 FY2025 over FY2024 due to higher fuel prices and overall increased costs amid grounding of aircraft, while yields moderated marginally as airlines strove to maintain adequate passenger load factors (PLFs)."

These insights emphasize that, despite the ongoing cost pressures, especially in terms of aviation turbine fuel (ATF) prices and increased operational expenses, the aviation industry is better positioned than before. With airlines focusing on maintaining competitive yields and adjusting to fuel price fluctuations, Shah suggests that there will be a recovery in the second half of FY2025, driven by healthy passenger traffic.

Operational Challenges Persist

Despite the growing passenger numbers, the Indian aviation industry continues to grapple with operational constraints. As of September 30, 2024, approximately 144 aircraft—around 16-18% of the total fleet, were grounded due to supply chain disruptions and engine failures. Although this is an improvement from the 20-22% grounding rate seen the previous year, it remains a significant constraint on industry capacity.