New Delhi: Reserve Bank of India (RBI) on Monday announced a 25 basis point cut in the policy rate to 6.25 per cent for the first time in nearly five years, citing the need for economic efficiency while maintaining financial stability.

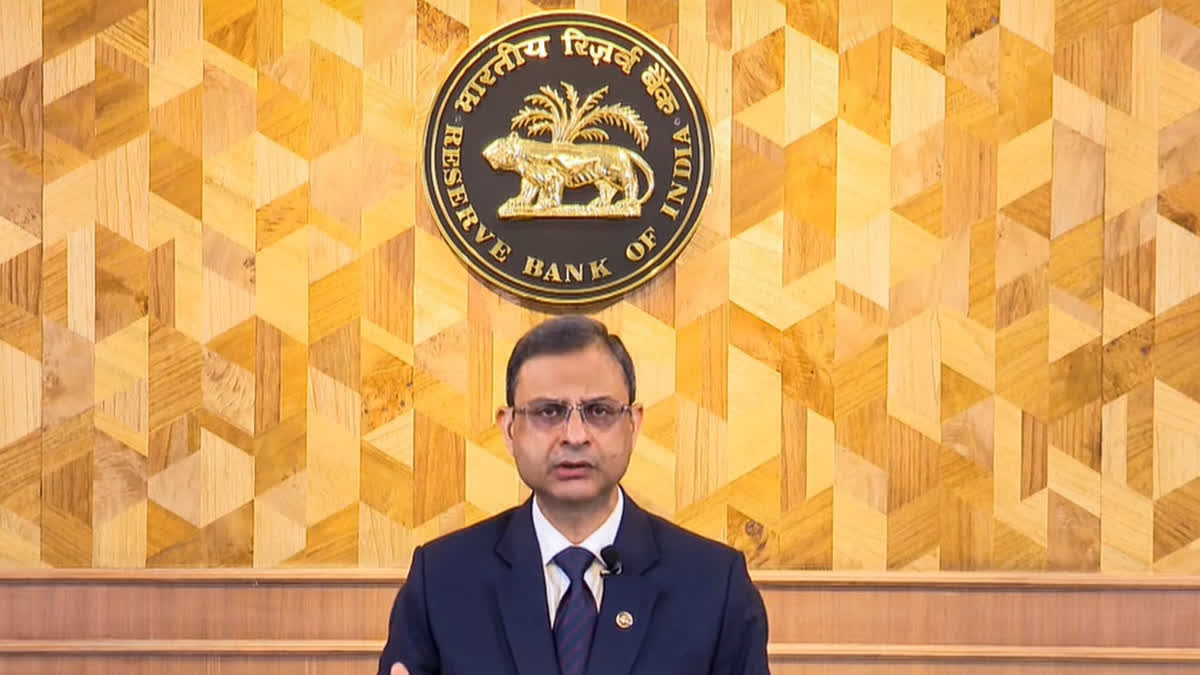

Governor Sanjay Malhotra said the Monetary Policy Committee (MPC) unanimously decided to slash the policy rate by 25 basis points to 6.25 per cent.

Last time the rate cut was done in May 2020 by 25 basis points. The last revision of rates happened in February 2023. The upward revision saw the policy rate hiked by 25 basis points to 6.5 per cent.

The interest rate pruning comes within a week of Finance Minister Nirmala Sitharaman in Budget 2025-26 providing the biggest-ever tax break to the middle class to boost consumption after the economy has slowed to its lowest pace since the pandemic.

The rate increase cycle was paused in April 2023 after six consecutive rate hikes, aggregating to 250 basis points since May 2022.

Post Budget, the Finance Ministry made a case for rate cuts by saying that fiscal and monetary policy should work in tandem.

It was an indication that the RBI should cut the rate as the Union Budget has announced several measures including income tax relief.

Earlier this week, Finance Secretary Tuhin Kanta Pandey had said the government has taken measures to lower fiscal deficit and delivered a non-inflationary Budget, and hoped that the RBI’s monetary policy will work in tandem with fiscal policy to support growth.

The Budget 2025-26 announced a slew of measures including significant income tax cuts for the middle class, benefiting 1 crore taxpayers.

Besides, the government has bettered its fiscal deficit projections for the current fiscal as well as the next. The fiscal deficit for FY25 has been pegged at 4.8 per cent of GDP, lower than the budgeted 4.9 per cent, while for FY26, the deficit is projected at 4.4 per cent, lower than what was given in the consolidation roadmap.