Hyderabad: The National Payments Corporation of India (NPCI), which has announced the interchange fee on the Unified Payments Interface (UPI) transactions over Rs 2000 from Apr. 1, on Wednesday clarified that the interchange charges will be only applicable for the Prepaid Payment Instruments (PPI) merchant transactions adding no charges will be levied on customers.

In a press statement, the NPCI, an umbrella organisation for all retail payments system in India, said that interchange charges introduced are only applicable for the PPI merchant transactions and there is no charge to customers. “It is further clarified that there are no charges for the bank account to bank account based UPI payments (i.e. normal UPI payments),” the NPCI statement read.

-

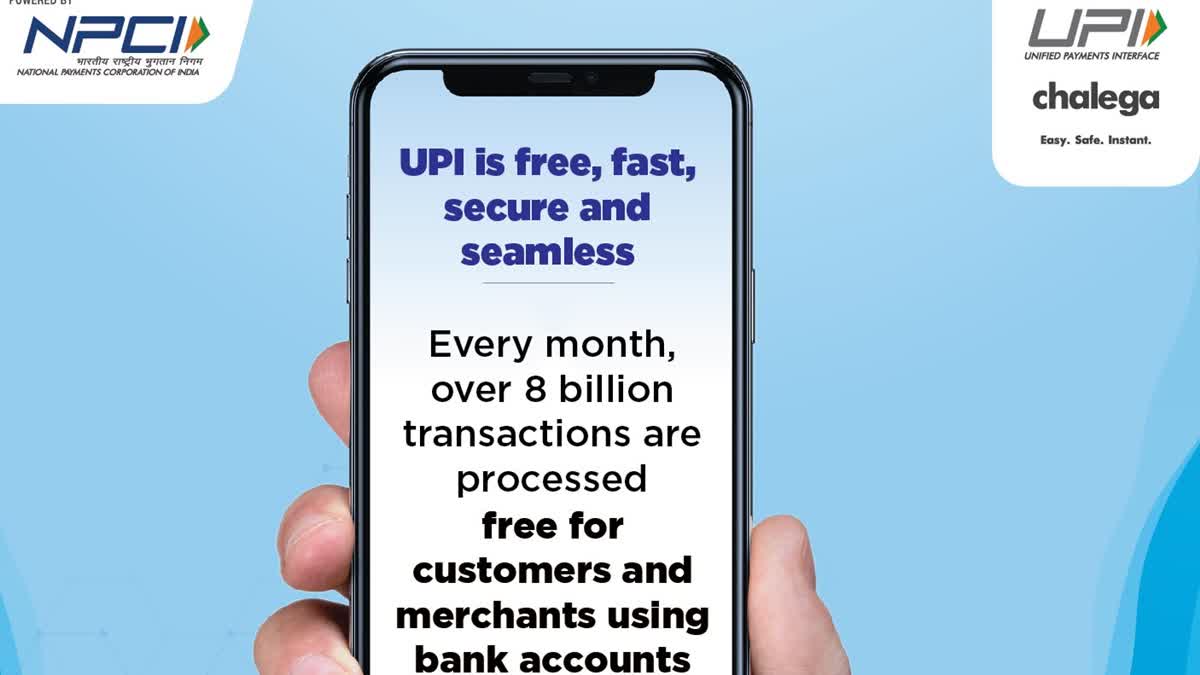

NPCI Press Release: UPI is free, fast, secure and seamless

— NPCI (@NPCI_NPCI) March 29, 2023 " class="align-text-top noRightClick twitterSection" data="

Every month, over 8 billion transactions are processed free for customers and merchants using bank-accounts@EconomicTimes @FinancialXpress @businessline @bsindia @livemint @moneycontrolcom @timesofindia @dilipasbe pic.twitter.com/VpsdUt5u7U

">NPCI Press Release: UPI is free, fast, secure and seamless

— NPCI (@NPCI_NPCI) March 29, 2023

Every month, over 8 billion transactions are processed free for customers and merchants using bank-accounts@EconomicTimes @FinancialXpress @businessline @bsindia @livemint @moneycontrolcom @timesofindia @dilipasbe pic.twitter.com/VpsdUt5u7UNPCI Press Release: UPI is free, fast, secure and seamless

— NPCI (@NPCI_NPCI) March 29, 2023

Every month, over 8 billion transactions are processed free for customers and merchants using bank-accounts@EconomicTimes @FinancialXpress @businessline @bsindia @livemint @moneycontrolcom @timesofindia @dilipasbe pic.twitter.com/VpsdUt5u7U

“With this addition to UPI, the Customers will have the choice of using any bank accounts, Rupay Credit card and prepaid wallets on UPI enabled apps,” it added. The statement came close to the heels of the NPCI announcement that transactions over Rs 2000 on UPI through the PPIs will be charged 1.1 percent effective from Apr. 1.

Also read: Travellers from G20 nations can use UPI for payments in India, says RBI

The move is said to be aimed at increasing the revenue of the banks and the UPI service providers. Over the latest guidelines, the NPCI said that the Prepaid Payment Instruments (PPI Wallets) have been permitted to be part of interoperable UPI ecosystem. “In view of this NPCI has now permitted the PPI wallets to be part of interoperable UPI ecosystem,” it said.

It further claimed that in the recent times, UPI has emerged as preferred mode of digital payment by offering free, fast, secure and seamless experience”. “Traditionally, the most preferred method of UPI transactions is linking the Bank account in any UPI enabled app for making payments which contributes over 99.9% of total UPI transactions.

These Bank account-to-account transactions continue to remain free for Customers and Merchants,” added the NPCI. Pertinently, the NPCI was incorporated in 2008 as an umbrella organization for operating retail payments and settlement systems in India.