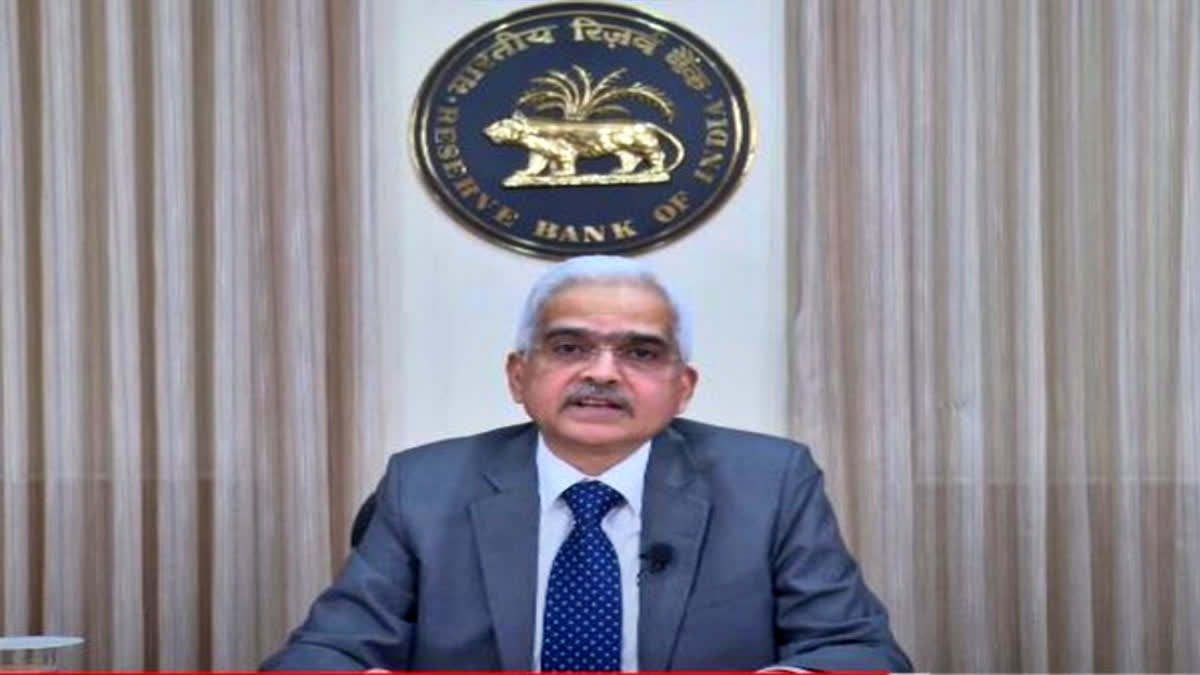

Mumbai (Maharashtra): Reserve Bank of India (RBI) Governor Shaktikanta Das said on Monday said banks will now be able to issue RuPay Prepaid Forex cards.

While reading out the monetary policy statement after a three-day deliberation, he said it will expand the reach and acceptance of RuPay cards globally. RBI Governor said RuPay Debit and Credit cards issued by banks in India are gaining increased acceptance abroad. "It has now been decided to permit the issuance of RuPay Prepaid Forex cards by banks. This will expand the payment options for Indians travelling abroad. Further, RuPay cards will be enabled for issuance in foreign jurisdictions," Das said.

Meanwhile, RBI's monetary policy committee unanimously decided to keep the repo rate unchanged at 6.5 per cent. The repo rate is the rate of interest at which RBI lends to other banks. A consistent decline in inflation (currently at an 18-month low) and its potential for further decline may have prompted the central bank to put the brake on the key interest rate again.

Most analysts had expected the RBI to continue to keep the repo rate unchanged. Inflation has been a concern for many countries, including advanced economies, but India has managed to steer its inflation trajectory quite well. The RBI in its April meeting, the first in 2023-24, had paused the repo rate.

Barring the April pause, the RBI raised the repo rate by 250 basis points cumulatively to 6.5 per cent since May 2022 in the fight against inflation. Raising interest rates is a monetary policy instrument that typically helps suppress demand in the economy, thereby helping the inflation rate decline.

Coming to the GDP outlook, the RBI expects India's 2023-24 GDP growth at 6.5 per cent, with quarter Q1 at 8.0 per cent, Q2 at 6.5 per cent, Q3 at 6.0 per cent, and 5.7 per cent. The RBI governor Shaktikanta Das, while reading the monetary policy statement today, said the central bank sees risks to these GDP figures as evenly balanced.