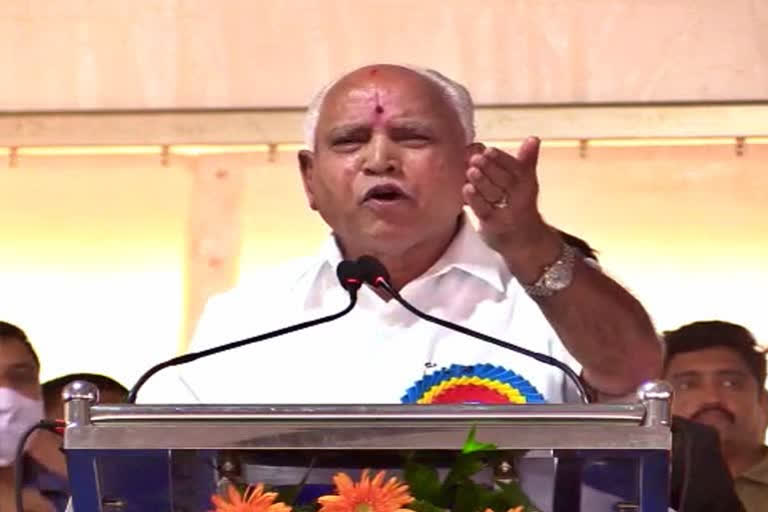

Bengaluru: Karnataka Chief Minister BS Yediyurappa has proposed a two per cent reduction in stamp duty on the first registration of apartments valued between Rs 35 lakh and Rs 45 lakh.

Presenting the State Budget for FY 2021-22, Yediyurappa, who also holds the finance portfolio, said that the move to reduce duty from 5 per cent to 3 per cent was aimed at promoting affordable housing in the state.

The move is in continuation of earlier measures to reduce stamp duties on various categories of real estate that was hit by Covid-19 induced disruptions.

Last December, the State Legislative Assembly passed the Karnataka Stamp (Second), Amendment Bill, 2020 to reduce stamp duty on units up to Rs 35 lakh.

According to the legislation, stamp and registration duty on houses costing up to Rs 25 lakh was reduced from 5 per cent to 2 per cent, whereas the duty on units costing up to Rs 35 lakh was reduced from 5 per cent to 3 per cent.

Read: Illegal explosives found in Karnataka quarry

Earlier, a similar move in Maharashtra paid rich dividends to the government.

In August 2020, stamp duty on property transfers was slashed from 3 per cent to 2 per cent.

As per the officials, the duty cut resulted in 48 per cent increase in registrations and Rs 367 crore hike in revenue in a span of four months in Mumbai.

‘Not a significant move’

Commenting on the latest duty cut, real estate experts have observed that it will not have a significant impact on registrations as 60 per cent of unsold houses in Bengaluru are above Rs 45 lakh per unit.

As per ANAROCK Research, Maharashtra could get good results as the duty cut was across all categories, whereas in Karnataka the duty cut is limited to units that cost up to Rs 45 lakh.

Read: Opposition figures face complaint in CD case

“Housing demand in Bengaluru is largely skewed towards the mid-segment, involving properties priced within the INR 50 lakh to INR 1 Crore budget range,” Anuj Puri, Chairman - ANAROCK Property Consultants said in a statement while adding, “For these properties, the stamp duty charges remain the same at nearly 5%.”

Out of the total unsold stock of nearly 59,350 units across all budget segments, only 24% is within the Rs 45 lakh price bracket, while 64% is within Rs 45 lakh to INR 1.5 Cr budget range, said Anuj Puri.

(Shravan Nune)