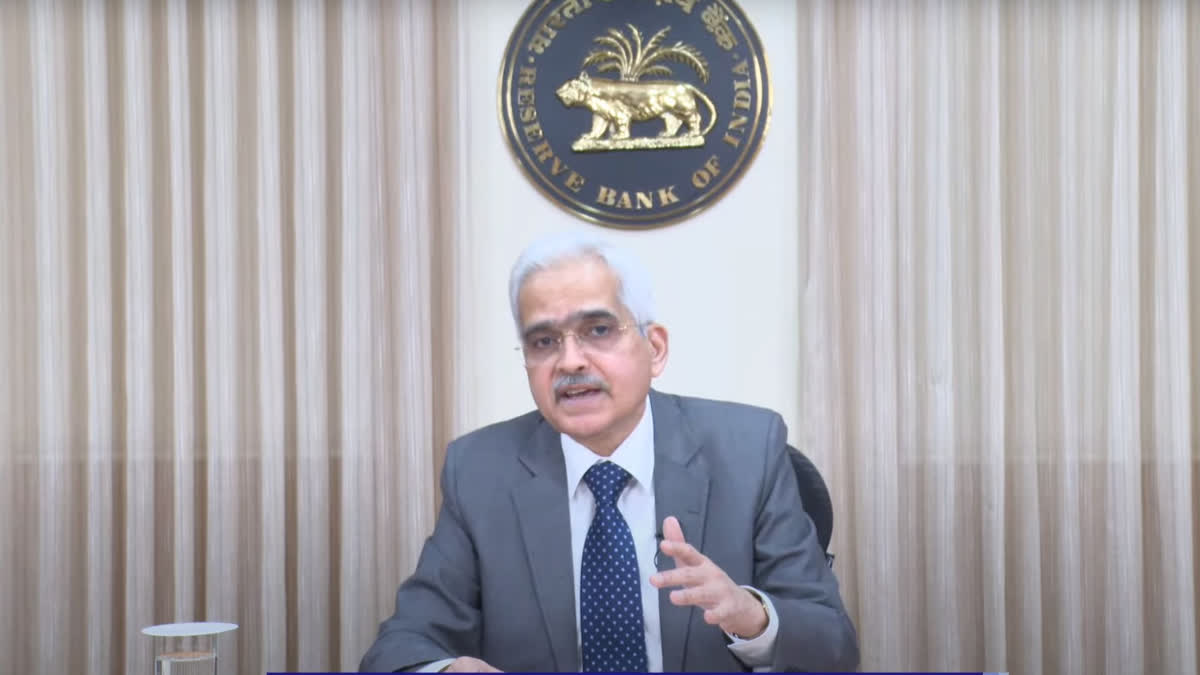

New Delhi: Announcing the bi-monthly monetary policy, RBI Governor Shaktikanta Das said made a statement on additional Developmental and Regulatory Policies decided during the meeting. The additional measures will govern (i) Financial Markets; (ii) Regulation; and (iii) Payment Systems, the RBI governor said.

Here is the list of eight measures you need to know.

- Borrowing in Call and Notice Money Markets by Scheduled Commercial Banks

The extant regulatory guidelines prescribe prudential limits for outstanding borrowing in Call and Notice Money Markets for Scheduled Commercial Banks (SCBs). With a view to providing greater flexibility for managing their liquidity, it has been decided that SCBs (excluding Small Finance Banks) can set their own limits for borrowing in Call and Notice Money Markets within the prescribed prudential limits for inter-bank liabilities. - Widening of the Scope of Prudential Framework for Stressed Assets

Compromise settlement is recognised as a resolution mechanism in respect of non-performing assets (NPA) under the Prudential Framework, which is currently applicable to SCBs and select NBFCs. It is proposed to issue comprehensive guidelines on compromise settlements and technical write-offs which will now be applicable to all regulated entities including co-operative banks. Further, it is also proposed to rationalise the extant prudential norms on restructuring of borrower accounts affected by natural calamities. - Default Loss Guarantee Arrangement in Digital Lending

The Reserve Bank had issued the regulatory framework for Digital Lending in August/September 2022. With a view to further promoting responsible innovation and prudent risk management, it has been decided to issue guidelines on Default Loss Guarantee arrangements in Digital Lending. This will further facilitate orderly development of the digital lending ecosystem and enhance credit penetration in the economy. - Priority Sector Lending (PSL) Targets for Primary (Urban) Cooperative Banks (UCBs)

The Reserve Bank has undertaken several initiatives in recent years to strengthen the UCB sector as well as to deepen financial inclusion. Such initiatives include revision of the priority sector lending targets for UCBs in 2020. While revising the PSL targets, a glide path up to March 2024 was provided for a non-disruptive transition to achieve the revised targets. While a number of UCBs have met the required milestones as of March 2023, a need has arisen to ease the implementation challenges faced by other UCBs. It has, therefore, been decided to extend the timelines for achieving the targets by two more years up to March 2026. Further, UCBs which have met the targets as on March 31, 2023 shall be suitably incentivised. - Rationalisation of Licensing framework for Authorised Persons (Aps) under Foreign Exchange Management Act (FEMA), 1999

The licensing framework for Authorised Persons (APs) issued under FEMA was last reviewed in March 2006. Keeping in view the developments, including progressive liberalisation under FEMA, over the last several years and to effectively meet the emerging requirements of the rapidly growing Indian economy, it has been decided to rationalise and simplify the licensing framework for APs. This is expected to improve the efficiency in the delivery of foreign exchange facilities to various segments of users including common persons, tourists and businesses. - Expanding the Scope and Reach of e-RUPI vouchers

At present, purpose-specific e-RUPI digital vouchers are issued by banks. It is now proposed to expand the scope and reach of e-RUPI vouchers by (i) permitting non-bank prepaid payment instruments (PPI) issuers to issue e-RUPI vouchers; (ii) enabling issuance of e-RUPI vouchers on behalf of individuals; and (iii) simplifying the process of issuance, redemption, etc. These measures will make the benefits of eRUPI digital voucher accessible to a wider set of users and further deepen the penetration of digital payments in the country.

Explained: RBI monetary policy allows non-banking PPI issuers to issue e-RUPI vouchers - Streamlining Bharat Bill Payment System processes and membership criteria

The Bharat Bill Payment System (BBPS) is operational since August 2017. The scope of BBPS was further expanded in December 2022. To further enhance the efficiency of the BBPS system and to encourage greater participation, it is proposed to streamline the process flow of transactions and membership criteria for operating units. - Internationalising Issuance and Acceptance of RuPay Cards

RuPay Debit and Credit cards issued by banks in India are gaining increased acceptance abroad. It has now been decided to permit issuance of RuPay Prepaid Forex cards by banks. This will expand the payment options for Indians travelling abroad. Further, RuPay cards will be enabled for issuance in foreign jurisdictions. These measures will expand the reach and acceptance of RuPay cards globally.

Read-Indian banks can issue Rupay prepaid forex cards: RBI Governor