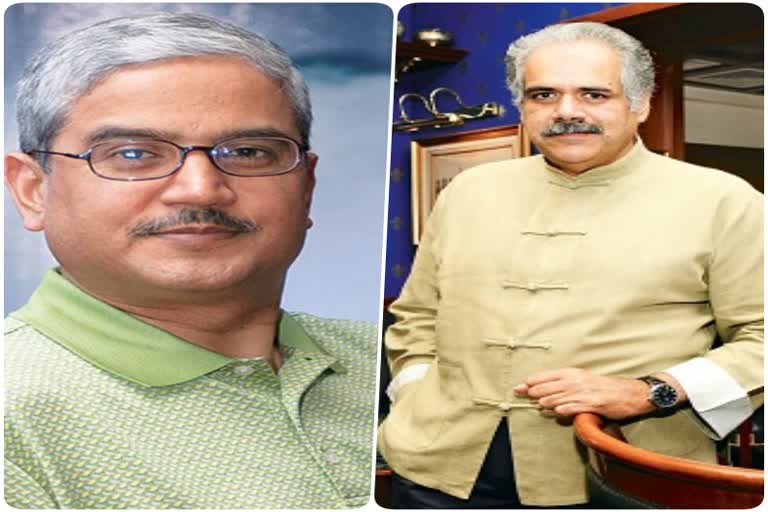

New Delhi: Tussle between the promoters of the IndiGo might make it's future difficult in the aviation industry as its promoters Rahul Bhatia and Rakesh Gangwal are playing the blame game on each other.

Rahul Bhatia one of the promoters said, "The InterGlobe Enterprises( IGE ) Group would have invested more equity, but given that Rakesh Gangwal did not have the appetite to invest more, IndiGo's paid-up equity capital was pegged at Rs 30 crore, the minimum required by regulations".

According to the IGE, Rakesh Gangwal has always limited its financial risk in the airline. Even when the airline operations were at risk Gangwal was missing and even pushed to sell out the business.

Read more:IndiGo Board of Directors to meet on July 19

In the year 2005, when a conversation with the Airbus was underway for the airline to acquire it, Airbus wanted both IGE and Gangwal to support IndiGo through the joint undertaking. Both the parties undertook to invest an amount not less than Rs 200 crore.

IGE singly invested Rs 110 crore in IndiGo just to fullfill the conditions placed by Airbus. IGE also added that Gangwal's allegations about lack of corporate governance were "much ado about nothing".

Airline Co-promoter and former US Airways chief Executive Rakesh Gangwal went on record to lodge its grivences against IndiGo. He also sought regulatory intervention from SEBI to resolve the issue.