Mumbai: Equity benchmark BSE Sensex plummeted 434 points on Friday, dragged by heavy losses in banking stocks after the RBI slashed the country's economic growth outlook for this fiscal.

In its fourth bi-monthly policy review, the central bank also reduced its benchmark lending rate by 0.25 per cent to revive growth that has hit a six-year low.

After opening nearly 300 points higher, the 30-share index gave up all the gains to turn negative after the policy announcement by the Reserve Bank of India (RBI).

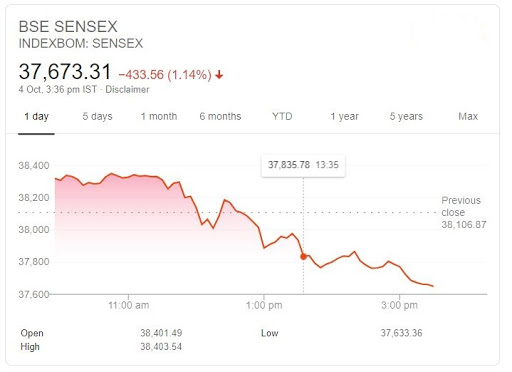

After gyrating 770 points during the day, the 30-share Sensex ended 433.56 points, or 1.14 per cent, lower at 37,673.31. It hit an intra-day low of 37,633.36 and a high of 38,403.54.

The broader NSE Nifty plunged 139.25 points, or 1.23 per cent, to close at 11,174.75.

Top laggards in the Sensex pack included Kotak Bank, ICICI Bank, HDFC Bank, Tata Motors, L&T, SBI, Tata Steel and Axis Bank, falling up to 3.46 per cent.

On the other hand, TCS, Infosys, ONGC, Tech Mahindra, IndusInd Bank and NTPC rose up to 1.03 per cent.

Rate-sensitive banking stocks faced the heat, with the BSE bankex, finance, auto and realty indices tanking up to 2.45 per cent.

The Reserve Bank on Friday sharply cut its economic growth projection for this fiscal to 6.1 per cent from 6.9 per cent earlier.

The central bank's estimates come in the wake of GDP growth sliding to a six-year low of 5 per cent in the June quarter, on a massive slowdown in consumption and private sector investments.

Further, the RBI's Monetary Policy Committee cut its benchmark lending rate by 0.25 per cent to revive growth that has hit a six-year low of 5 per cent, and affirmed commitment to remain accommodative to address growth concerns 'as long as necessary'.

According to Gaurav Dua, Sr VP, Head Capital Market Strategy & Investments, Sharekhan by BNP Paribas, despite the rate cut and the dovish commentary, the equity market has reacted negatively, especially banks.

"That is because of the RBI's focus on the quick transmission of lower interest rates would put pressure on margins of banks," he pointed out.

Also, the economic growth outlook remains concerning despite the 135 bps policy rate cuts in 2019 and there is limited elbow room with RBI now to further take monetary actions to support the economy, he said.

Elsewhere in Asia, Hang Seng and Kospi settled on a negative note, while Nikkei closed in the green. Chinese markets are closed for a holiday.

Equities in Europe were trading lower in early sessions.

Meanwhile, the Indian rupee depreciated 9 paise to 70.97 against the US dollar intra-day.

Brent crude futures, the global oil benchmark, advanced 0.78 per cent to USD 58.16 per barrel.

Read more: Maruti Suzuki sells over 2 lakh units of BS VI cars in 6 months