New Delhi: Union Finance Minister Nirmala Sitharaman has defended the decision of the Goods and Services Tax (GST) Council, which retained the tax rate on Covid-19 vaccines manufactured in India at 5 per cent, saying it will not put any additional burden on citizens as the Central Government has been providing Covid-19 vaccines at free of cost.

Briefing the media on the decisions taken by the 44th GST Council which met earlier today, the minister said: "Central government is purchasing 75 per cent and is paying GST also. But the impact of this GST on people will be nil since people would be getting vaccines free of cost at government hospitals. Centre is purchasing and it is given free to people.”

Echoing Sitharaman’s views, Revenue Secretary Tarun Bajaj said that the decision was taken only after deliberations in the meeting of the GST Council which has representatives from the Centre, States and Union Territories. "The GST will also be borne by the Centre. But out of the income from GST, 70 per cent will be shared with the states... As far as people are concerned who are coming to get their inoculation done, it is tax free. It is not an issue with the people, they are not paying any tax, cost of the vaccine. So it is free for them," the senior official in the finance ministry said.

Tax professionals welcomed the move

Speaking to PTI, EY Tax Partner Abhishek Jain said a majority of the population will not be affected on account of no GST rate cut on COVID vaccines as most people are opting for free of cost vaccinations from the government. "For the limited few considering getting vaccinated at the private hospitals, the 5 per cent GST will continue to be a cost," Jain added. Deloitte India Partner Mahesh Jaising said the decision of the Council will help in maintaining the GST credit chain.

“The GoM seems to have taken a balanced approach of retaining it (tax on Covid-19 vaccines) at 5 per cent…This is particularly as the GST credit chain is not broken and in any case, a significant portion of vaccine procurements is by the government itself," he said.

In his address to the nation on June 7, Prime Minister Narendra Modi announced that the Central Government would procure 75 per cent of the Covid-19 vaccines manufactured in India and those vaccines would be provided free of cost to all those above the age of 18 years.

GST Council took decisions based on GoM’s recommendations

In the previous meeting of the GST Council on May 28, taxes on COVID-19 vaccines and medical supplies were left unchanged after the BJP- and Opposition-ruled states sparred over whether the tax cut benefits will reach the common man.

An 8-member GoM, under Sangma, was set up to resolve the differences and recommend new GST rates on Covid-19 essentials. The other members of the GoM are Gujarat Deputy Chief Minister Nitinbhai Patel, Maharashtra Deputy Chief Minister Ajit Pawar, Goa Transport Minister Mauvin Godinho, Finance ministers of Kerala (K N Balagopal), Odisha (Niranjan Pujari), Telangana (T Harish Rao) and UP (Suresh Kr Khanna).

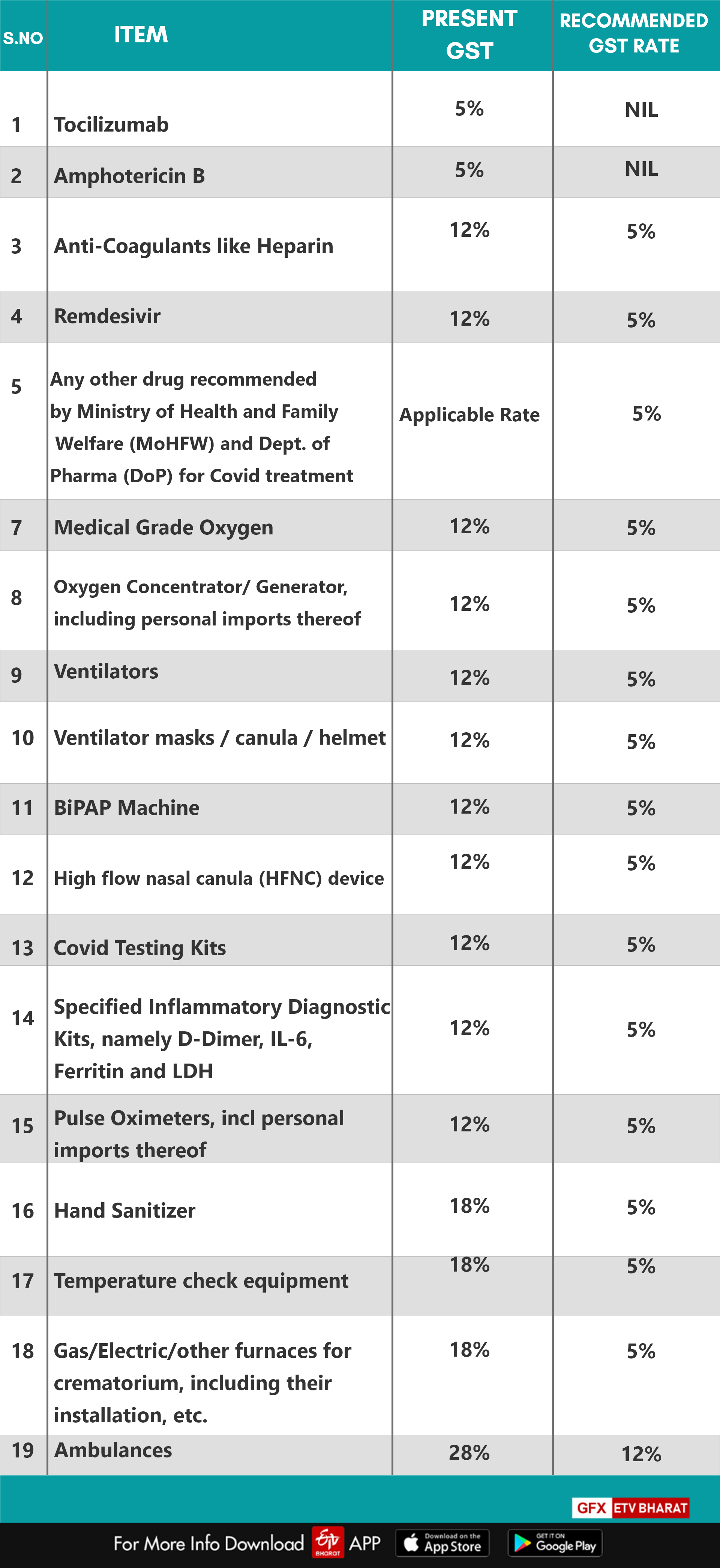

The GoM submitted its report to the Union Finance Ministry on June 6. Acting on the recommendations of the GoM, the Council has slashed tax rates on most of the drugs used for Covid-19 treatment. The Council has also retained the existing 5 per cent tax on Covid-19 vaccines manufactured in India.

(With PTI Inputs)

Read More: GST Council slashes taxes on drugs used to treat Covid-19, Black Fungus