New Delhi: The RBI governor on Friday announced a plan to achieve 100 per cent digital payments across the country. This plan was unveiled in the press conference of the bi-monthly monetary policy review meeting.

In the execution of the plan, SLBCs will be playing a key role. "State/UT Level Bankers Committees (SLBCs/ UTLBCs) shall identify one district in their respective States/UTs on a pilot basis in consultation with banks and stakeholders." said the Governor. SLBC consists of....

As per the plan, the identified district may be allocated to a bank with a significant footprint. The chosen bank will endeavour to make the district 100% digitally enabled, wherein every individual in the district will be equipped to send or receive payments digitally in a safe, secure, quick, affordable and convenient manner.

The move is in tune with the RBI's aim to expand and deepen the digital payments ecosystem in the country.

It should be noted that since demonetization of higher denomination notes in November 2016, the government and the RBI have given importance for digital payments.

Future of Digital Payments

As per the 'High-Level Committee on Deepening Digital Payment' report headed by Nandan Nilekani the total number of digital users is approximately 10 crore.

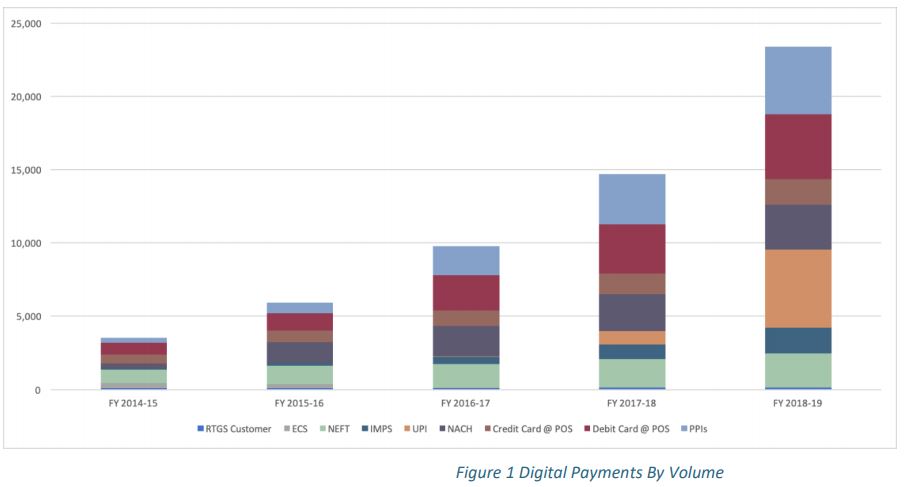

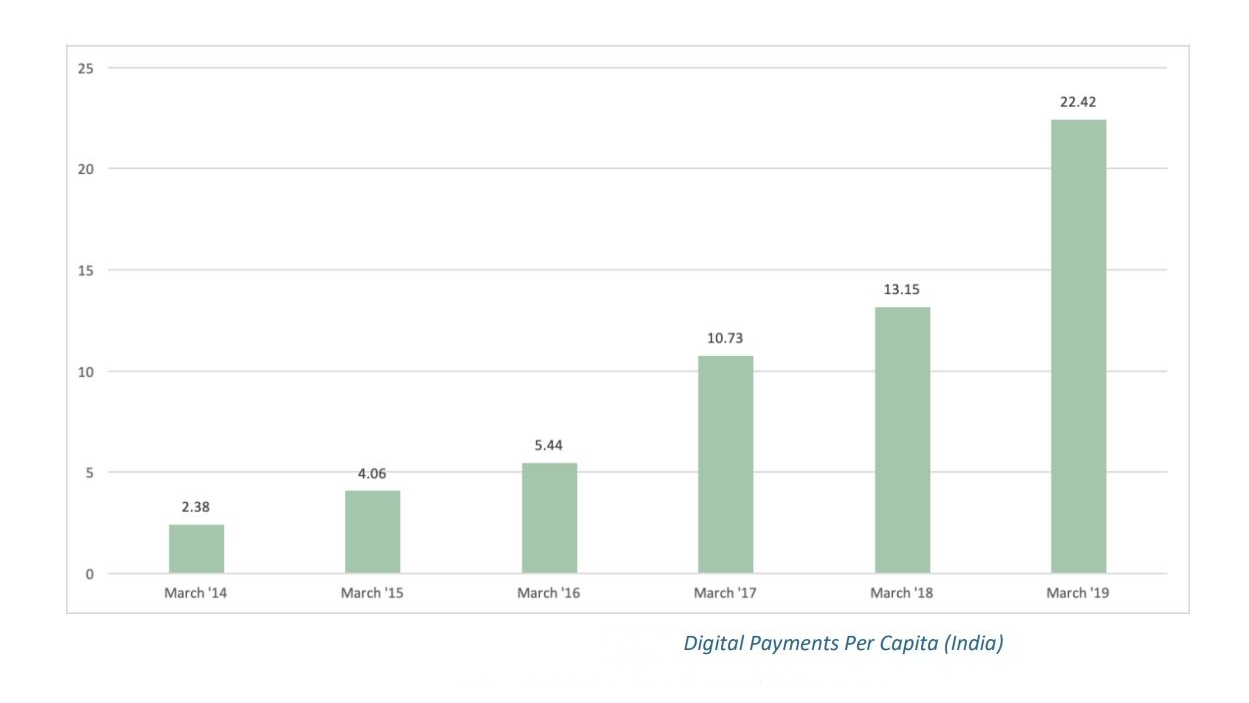

However, as per the report that was submitted in May 2019 to the RBI, though annual per capita digital transactions were increased from 2.38 in 2014 to about 22.42 in 2019, it is less compared to other countries.

As per a recent Assocham-PWC India report, digital payments in India will surge to $135.2 billion in 2023 from $64.8 billion in 2019.

Read more: PMC's suspended MD blames 'superficial auditing' for mess