The Monetary Policy Committee (MPC) decided to:

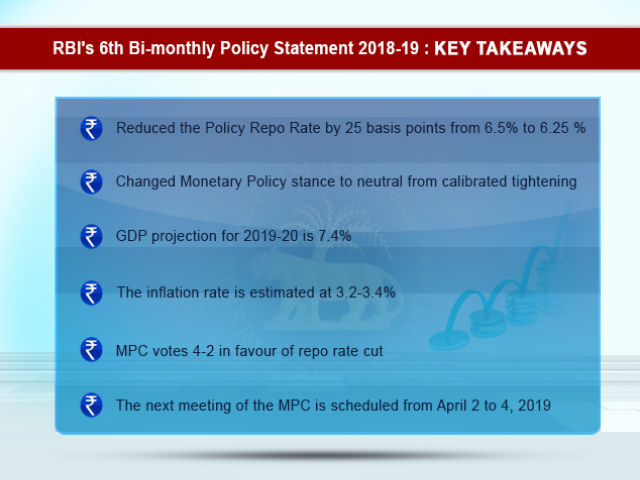

Reduce the policy repo rate under the liquidity adjustment facility (LAF) by 25 basis points from 6.5 per cent to 6.25 per cent with immediate effect. Consequently, the reverse repo rate under the LAF stands adjusted to 6.0 per cent, and the marginal standing facility (MSF) rate and the Bank Rate to 6.5 per cent.

Read more:Modi to flag off Vande Bharat Express on February 15

The central bank also changed its monetary policy stance to 'neutral' from the earlier 'calibrated tightening', signalling further softening on its approach towards interest rates.

These decisions are in consonance with the objective of achieving the medium-term target for consumer price index (CPI) inflation of 4 per cent within a band of +/- 2 per cent, while supporting growth.

In the first policy review under Governor Shaktikanta Das, the six-member Monetary Policy Committee voted 4:2 in favour of the rate cut, while the decision to change policy stance was unanimous.

The RBI cut its estimates on headline inflation which cooled off to a 18-month low of 2.2 per cent in December for the next year, and expects the number to come at 2.8 per cent in March quarter, 3.2-3.4 per cent in first half of next fiscal and 3.9 per cent in third quarter of FY20.

Benchmark interest rate was cut by 0.25 per cent to 6.25 per cent, a move that would result in lower cost of borrowing for the banks that are expected to transmit the same to individuals and corporates.

The rate cut is in consonance of achieving the medium term objective of maintaining inflation at the 4 per cent level while supporting growth, it said.

Why the repo rate has been reduced?

1. Since the last MPC meeting in December 2018, there has been a slowdown in global economic activity

2. Economic activity also slowed in some major emerging market economies (EMEs)

3. Crude oil prices

4. Decline in retail inflation from 3.4 per cent in October 2018 to 2.2 per cent in December, the lowest print in the last eighteen months

5. Continuing deflation in food items, a sharp fall in fuel inflation and some edging down of inflation excluding food and fuel contributed to the decline in headline inflation

Deputy Governor Viral Acharya and another MPC member, Chetan Ghate, voted for status quo in interest rates, while Das and three others voted for a cut in interest rates. The next meeting of the MPC is scheduled from April 2 to 4, 2019.