New Delhi: The biggest ever consolidation exercise in the public sector banking space is slated to take shape on Wednesday when six PSU lender will be merged into four in a bid to make them globally competitive.

The exercise assumes significance as it is taking place at a time when the entire country is under the grip of COVID-19 outbreak. It has triggered 21-day lockdown to contain the spread of the deadly virus.

Experts said merger at this point of time will not be very smooth and seamless. However, heads of the anchor banks are exuding confidence. "We don't foresee any problem it is going as per the plan. We have reviewed in the light of this situation also. Certain modification in implementation. We have done so that there is not any disruption for employees and customers. We are ensuring zero disruption," Union Bank of India Managing Director Rajkiran Rai G told PTI.

The four anchor banks -- PNB, Canara Bank, Union Bank and Indian Bank -- are postponing some part of the implementation and processes due to the lockdown. "For merging banks, we have not changed some of the process like loan process etc, which we proposed to do earlier. However, because of the prevailing situation we will be continuing old system till the situation comes under control," he said.

Read more:Confused! know all about 3-month postponement of your bank loans, EMI

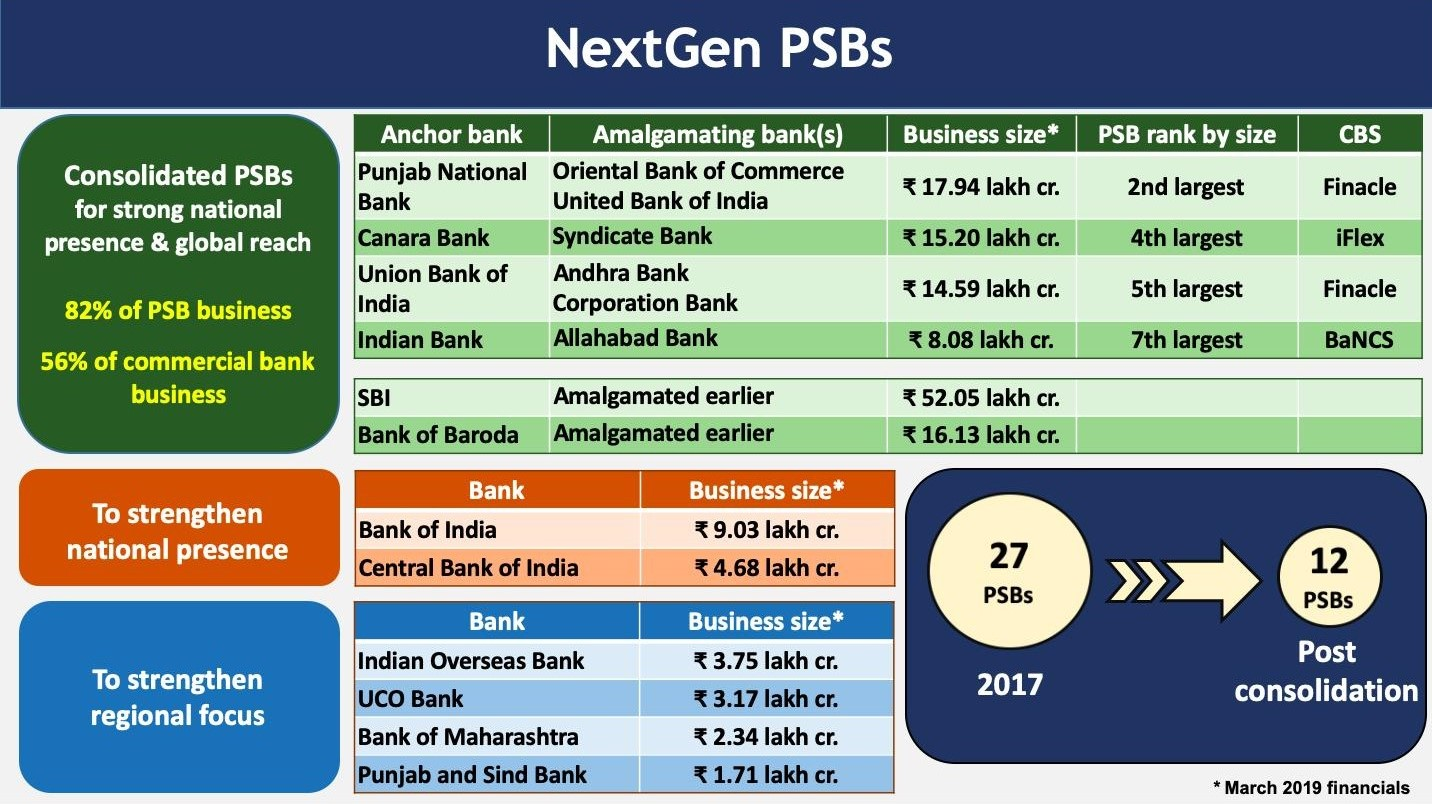

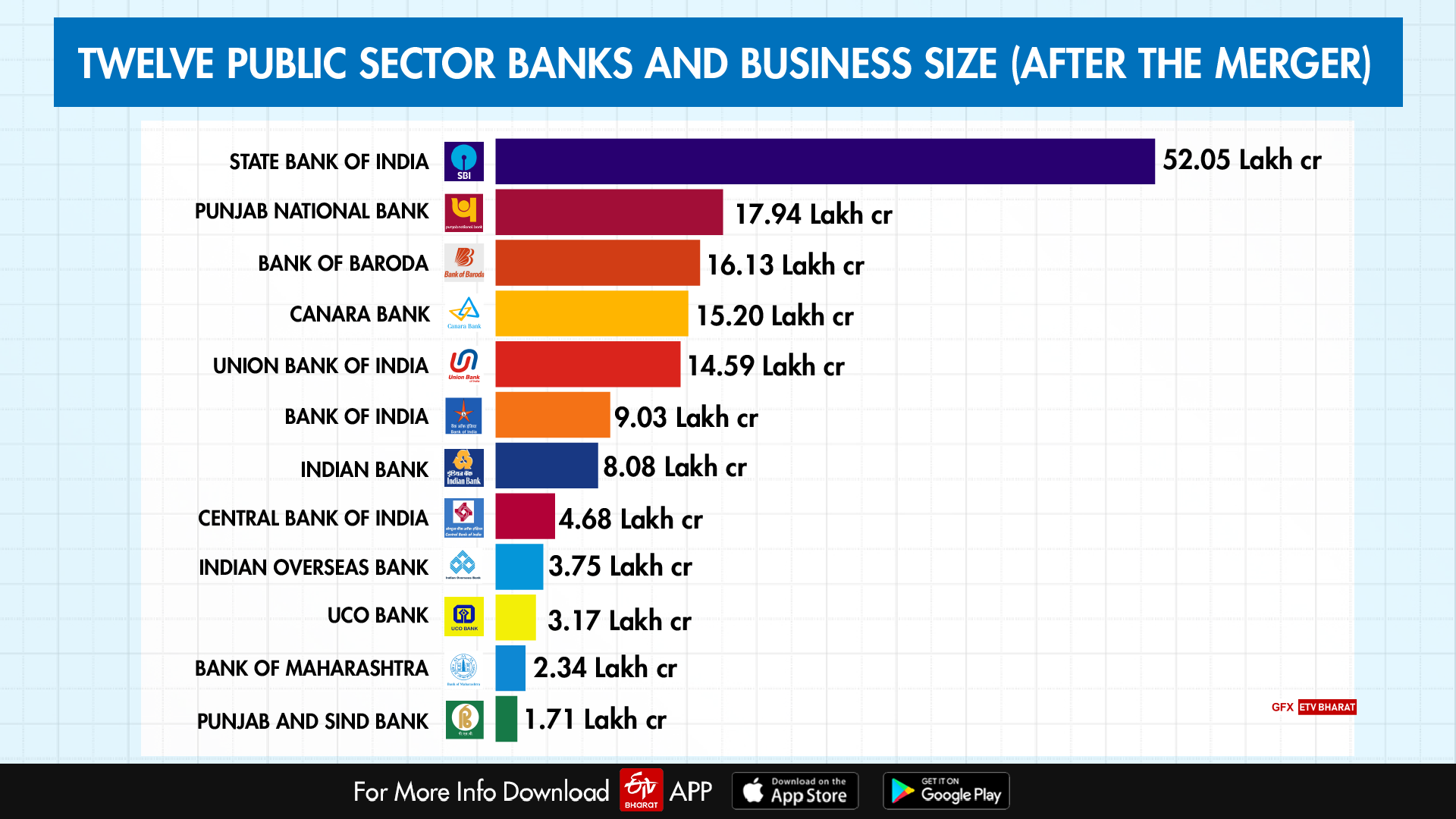

With the merger, the bank looking at more than Rs 2,500 crore of synergy benefits in the next three years, he added. As per the mega consolidation plan, Oriental Bank of Commerce and United Bank of India will merge into Punjab National Bank (PNB); Syndicate Bank into Canara Bank; Andhra Bank and Corporation Bank into Union Bank of India; and Allahabad Bank into Indian Bank.

Following the consolidation, there will be seven large public sector banks (PSBs), and five smaller ones. There were as many as 27 PSBs in 2017. The total number of public sector banks in the country will come down from 18 to 12 beginning next financial year.

In addition, consolidation would also provide impetus to merged entities by increasing their ability to support larger ticket-size lending and have competitive operations by virtue of greater financial capacity.

The government on March 4 had notified the amalgamation schemes for 10 state owned banks into four as part of its consolidation plan to create bigger size stronger banks in the public sector.

(PTI Report)