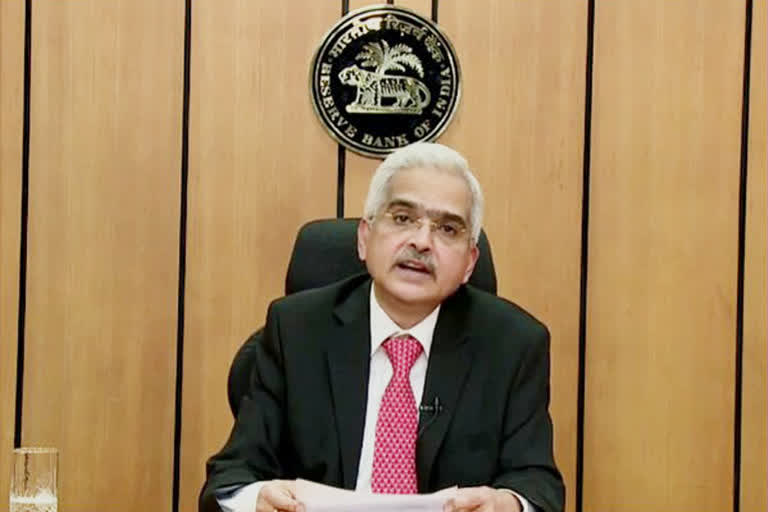

Mumbai: The country's financial system is sound but lenders should desist from extreme risk aversion during COVID-19 pandemic and beyond, Reserve Bank Governor Shaktikanta Das said on Friday.

In his foreword to the bi-annual Financial Stability Report (FSR), Das said the top priority right now for banks and financial intermediaries should be for augmenting capital levels and improve resilience.

"In the evolving milieu, while risk management has to be prudent, extreme risk aversion would have adverse outcomes for all," Das said.

The comments from Das come at a time when credit growth has declined.

"The financial system in India remains sound; nonetheless, in the current environment, the need for financial intermediaries to proactively augment capital and improve their resilience has acquired top priority," Das said.

Financial sector stability is a prerequisite for giving confidence to businesses, investors and consumers, he said, adding "we have to remain extremely watchful and focused".

Das said governments, central banks and other public agencies across countries have made coordinated efforts to alleviate financial stress and build confidence and these measures have stabilised the financial system and markets.

However, the outlook for the financial system and markets "remains highly uncertain", he added.

Read more:US-China conflict to impair global trade which is vital for India's reopening: Raghuram Rajan

In a reference to the boom in stock markets amid the pandemic, which is set to contract the GDP in FY21, Das said the release of the FSR coincides with a growing disconnect between the movements in certain segments of financial markets and real sector activity.

"The pandemic hit India in a period of growth moderation. The ensuing disruptions in demand conditions and supply chains have been aggravated by global spillovers," the Reserve Bank of India Governor said.

He, however, said signs of gradual recovery from the nationwide lockdown are visible.

The challenges that lie ahead have to be addressed with the overarching objective of preserving long-term stability of the financial system, which is critical for nurturing the recovery, he said, adding in the post-pandemic world, the focus will be on calibrated unwinding of the special dispensations introduced in the last few months.

The governor asked financiers to undertake a reappraisal of business models and asset markets to adapt to a new normal in a non-disruptive manner.

Constant vigilance is a necessity because of the contagion risks, he noted.

IT platforms have worked well in the times of social distancing but the gains need to be consolidated, he said, making it clear that there is no room for complacency on cyber security.

Banks' gross NPA may rise to 12.5% by March 2021

Gross non-performing assets of all banks may jump to 12.5 per cent by the end of this fiscal under the baseline scenario, from 8.5 per cent in March 2020, according to the Financial Stability Report (FSR) released by the Reserve Bank.

Under the 'very severely stressed scenario', gross NPA of banks may increase to 14.7 per cent by March 2021, the report said.

“The stress tests indicate that the GNPA ratio of all scheduled commercial banks (SCBs) may increase from 8.5 per cent in March 2020 to 12.5 per cent by March 2021 under the baseline scenario.

“If the macroeconomic environment worsens further, the ratio may escalate to 14.7 per cent under the very severely stressed scenario,” the report showed.

The resilience of Indian banking in the face of macroeconomic shocks was tested through macrostress tests which attempt to assess the impact of cumulative shocks on banks balance sheet and generate projections of GNPA ratios and capital to risk-weighted assets ratio (CRARs) over a one year horizon under a baseline and three adverse - medium, severe and very severe – scenarios, it said.

The baseline scenario is derived from the forecasted values of macroeconomic variables such as GDP growth, combined gross fiscal deficit-to-GDP ratio and CPI inflation among others, the report said.

(PTI Report)