New Delhi: In a decision that runs contrary to the Union government’s efforts to ease the compliance burden of the business community during the period of a nationwide lockdown, the Central Board of Indirect Taxes & Customs (CBIC) has asked millions of GST payers, to provide additional details in the GSTR-2A form to claim input tax credit (ITC) refunds.

“The nationwide lockdown was announced on March 24 and a week later CBIC has created this new requirement to provide HSN and SAC numbers to claim ITC refunds,” said a source in the industry.

Harmonised System of Nomenclature (HSN) number and Service Accounting Code (SAC) denote the precise category of goods and services supplied by a vendor. These numbers are widely used worldwide for taxation purposes and also in international trade.

It is mandatory to mention the relevant HSN or SAC number in an invoice but they were never fed in the GSTR-1 form uploaded by a supplier in the GSTN portal. In fact, the relevant fields were never created in the GSTR-1 form. Though, suppliers feed summarised HSN, SAC data in the GSTR-1 form but it is only shared with the government and not with the recipient or buyers.

GSTR-1 form uploaded by a supplier auto-populates a recipient’s GSTR-2A form in the GSTN Portal but it does not carry these two numbers asked by the board through its circular dated March 31.

To prevent input tax credit frauds, the CBIC had issued stringent guidelines in November last year. However, even then it did not ask the companies to provide these details to claim the input tax credit.

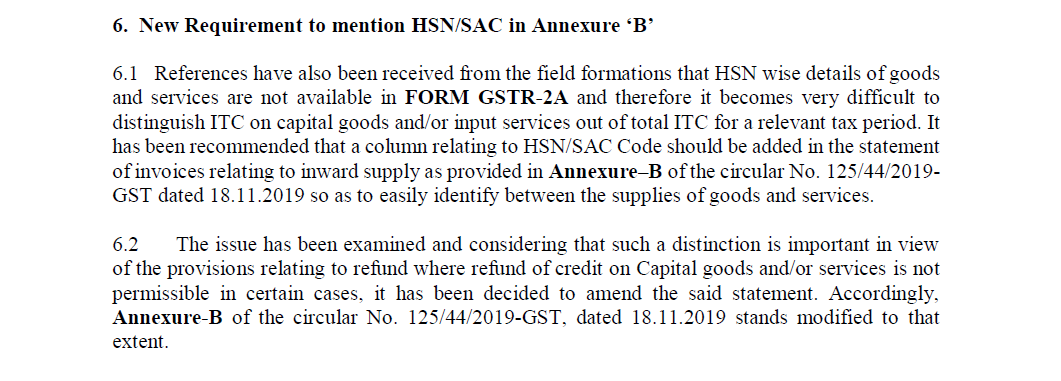

Now the CBIC has asked the companies to provide HSN & SAC numbers by amending the format of Annexure-B which a company is required to upload along with the GSTR-2A form.

Read more: PM reviews impact of COVID-19 on economy; 2nd stimulus in consideration

In the circular CBIC said it was done as its field formations found it difficult to distinguish ITC on capital goods and input services out of the total ITC for a relevant tax period.

“If a company or recipient is going to claim refund then they will have to look through thousands of invoices and manually collect HSN and SAC numbers which then will be fed manually in the annexure to upload them on the portal,” said the industry source.

He said during the lockdown it is not possible to visit company premises and manually collect and feed such data.

“Why to create a new requirement during a nationwide lockdown,” he asked.

He said these HSN and SAC numbers are available with the recipient companies, and if the board subsequently detects any fraud then it can always initiate action.

Relief measures announced so far

Finance Minister Nirmala Sitharaman had announced a slew of measures to reduce the pain felt by businesses and individual taxpayers during the nationwide lockdown announced by Prime Minister Narendra Modi to prevent the community spread of novel coronavirus in the country.

A day after the passage of Finance Bill 2020 in Parliament on March 23, Nirmala Sitharaman announced the extension of most of the deadlines for filing of Income Tax, GST and other returns till June end this year. She also extended the deadline for Aaadhar-PAN linking.

Industry sources expressed dismay over the CBIC’s decision to create a new compliance requirement amid the complete lockdown, which has now been extended till May 3.

The Sars-Cov-2 Virus has killed more than 400 people in the country and over 1.36 lakh people worldwide, wreaking havoc on business and industry.

(Article by Krishnanand Tripathi)