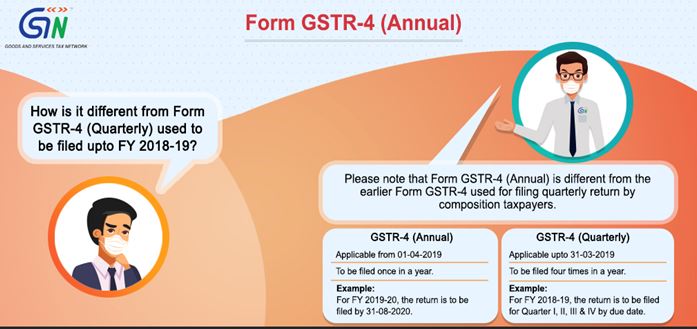

New Delhi: In a big relief for more than 17 lakh GST taxpayers who have opted for composition scheme, the GSTN on Tuesday launched the facility to file annual return in the revised GSTR-4 form. The new annual GSTR-4 form is different from the earlier GSTR-4 used by composition taxpayers to file their return on quarterly basis.

The new GSTR-4 form will be applicable for FY2019-20 and the last date for filing annual returns by GST composition scheme has been extended to August 31.

Earlier, GST composition taxpayers were required to file their returns every quarter in form GSTR-4. While both are known as GSTR-4, the one for quarterly return for period 2018-19 is completely different from the Annual Form GSTR-4 applicable from FY 2019-20. However, the facility to file annual return instead of quarterly return does not mean that these taxpayers will not have to do anything else.

Read more:Centre mulls disinvestment in banking, insurance sectors

Under the new scheme of things, instead of filing the quarterly return, GST composition scheme taxpayers will have to file a statement in GST-CMP-08 form available on the GSTN Portal.

GST composition taxpayers can log on to their dashboard in the GSTN portal and then navigate to Services>Returns>Annual Return>Select FY>Search>GSTR-4>FILE THE RETURN

Earlier this month, the Central Board of Indirect Taxes and Customs (CBIC) had also launched the facility to file nil return of GSTR-1 and GSTR-3B forms through SMS.

(ETV Bharat Report)