Hyderabad: In a taxpayer and business friendly move that will cut the time to get a GST number from 3 weeks to just 3 days, the finance ministry last week rolled out Aadhaar based GST registration facility for new businesses. This new facility will not only reduce the required time but a physical verification of the premise will also not be required in most cases.

ETV Bharat has prepared a step-by-step guide for its readers to get a GST number through Aadhaar based authentication.

How Aadhaar based GST registration works?

At the time of making the application for registration of a new business under the GST, the applicant is given an option to select Aadhaar based GST registration.

It is completely up to the applicant whether he or she wishes to opt for Aadhaar based registration or not. The applicant has full freedom to choose either YES or NO for Aadhaar based GST registration.

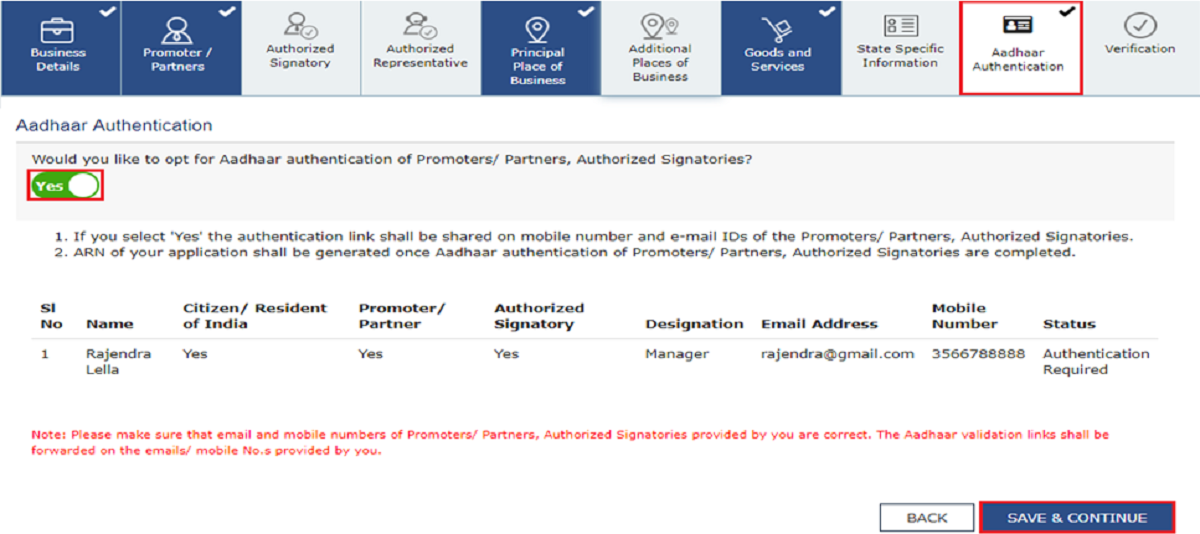

If an applicant clicks on YES, an authentication link will be shared on GST registered mobile number and e-mail IDs of the promoters or partners and also with the authorized signatories.

Read more:Get GST Number in just 3 days, Govt rolls out Aadhaar based GST registration

Thereafter the applicant will have to click on the authentication link, a screen will be displayed with a declaration where the applicant will be required to enter the Aadhaar number and then click on the ‘validate’ button.

Upon successful matching of the details in registration form with the UIADI, an OTP will be sent the email ID and mobile number registered with the Aadhaar that has been entered by the applicant.

Once the applicant enters the OTP number, the validation process will be complete and a message of successful e-KYC authentication will be shown on the screen.

How to avail the facility?

Log on to www.gst.gov.in and navigate to Services > Registration > New Registration option. Alternatively, a taxpayer can also click on the REGISTER NOW link and then opt for Aadhaar authentication as shown in the screenshot below:

How to verify which mobile number is registered with Aadhaar?

It is important to ensure that a user's Aadhaar has an updated registered mobile number and email ID for swift completion of Aadhaar based GST registration.

OTP for Aadhaar authentication would be sent on the mobile number and e-mail address registered with Aadhaar.

An applicant can verify which of his or her mobile number is registered with Aadhaar by visiting https://resident.uidai.gov.in/verify where the last three digits of their registered mobile number will be shown.

Who can avail Aadhaar based GST registration?

According to finance ministry officials, the facility of quick approval of GST registration through Aadhaar authentication can be availed by all Indian Citizens.

However, it is not required for tax deductors, tax collectors, Online Information Database Access and Retrieval services (OIDARs), Taxpayers having Unique Identification Number (UIN) and Non-resident taxpayers.

Non-Aadhaar based GST Registration

If an applicant does not want an Aadhaar based GST registration for the business then they may simply choose NO as an option.

However, in such cases, the GST registration application would be sent to the concerned jurisdictional tax authority, that may carry out necessary documentary and physical verification of the premise before approving the non-Aadhaar based GST registration.

Time schedule for Aadhaar, non-Aadhaar based GST registration

According to tax officials, Aadhaar based GST registration facility has been rolled out for those taxpayers who want to use their Aadhaar number for quick registration of their business in the GST.

In both the cases Aadhaar and non-Aadhaar based GST registration, the concerned officer needs to act within a specified time.

The time limit for Aadhaar based GST registration is 3 days for non-Aadhaar based GST registration it is 3 weeks.

Automatic approval of GST registration application

In yet another business friendly measure, the government has provided for automatic approval of GST registration if the concerned officer neither accepts the application nor issues a notice of rejection.

In such a situation, the application for GST registration shall be deemed to be approved after the lapse of specified time, 3 days for Aadhaar based GST registration and 21 days for non-Aadhaar based GST registration.

For more information, taxpayers can visit the news and update section of the GST portal.

(ETV Bharat Report)