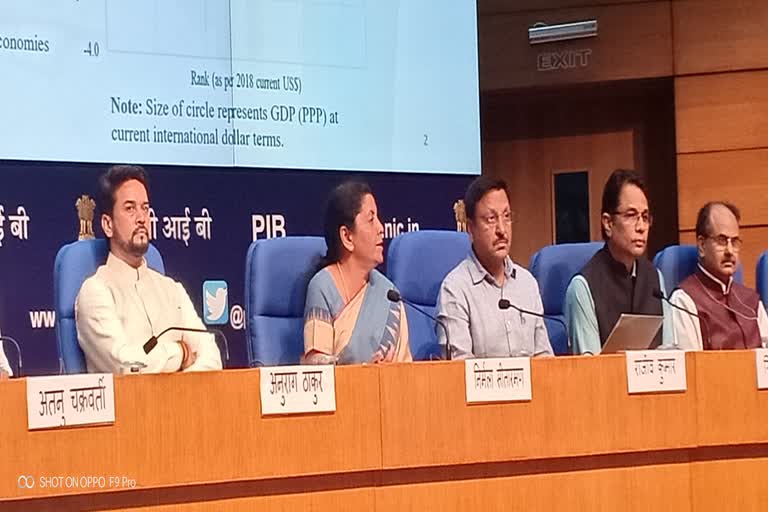

New Delhi: Giving in to the demands of overseas investors, Finance Minister Nirmala Sitharaman on Friday announced a rollback of enhanced surcharge on foreign portfolio investors levied in the Budget.

Surcharge on long and short term capital gains arising from the transfer of equity shares has been withdrawn, she said.

"The pre-Budget position is restored," the minister said.

It is being done to encourage investment in the capital market, the finance minister said.

The decision taken in the Budget to levy enhanced surcharge had spooked the stock markets.

Following the increase in surcharge in the Budget, the effective income tax rate for individuals with a taxable income of Rs 2-5 crore went up to 39 per cent from 35.88 per cent and for those above Rs 5 crore to 42.7 per cent.

Earlier this month, capital market participants and foreign institutional investors presented a charter of demands to Sitharaman, which included a rollback of surcharge on FPIs and review of dividend distribution tax.

Sitharaman further said that to mitigate genuine difficulties of startups and their investors, it has been decided to withdraw angel tax provisions for them.

A dedicated cell under a member of CBDT too will be set up for addressing the problems of startups.

Read more:Explained: 32 decisions of the Government to boost the economy