Hyderabad: When the international crude prices steeply fell last month, people expected a similar fall in petrol and diesel prices in India; that did not happen. But a slight increase in this input’s price has resulted in the steep hike in these product prices every day during the past several days starting June 7; cumulative effect in ten days is about Rs 6 per litre increase; prices are unlikely to be the same when this article is published as the rates change every morning, 6 AM.

The petroleum product prices defy all the common sense and logic. The compulsion often explained for the high prices like India’s high dependence on crude imports, hike in the international prices, fall in the external value of rupee, untenable fuel subsidy burden on the government, under-recoveries/ losses of the oil marketing companies, etc. need closer scrutiny since there is more to it than meets the eye.

Profiteering on petroleum

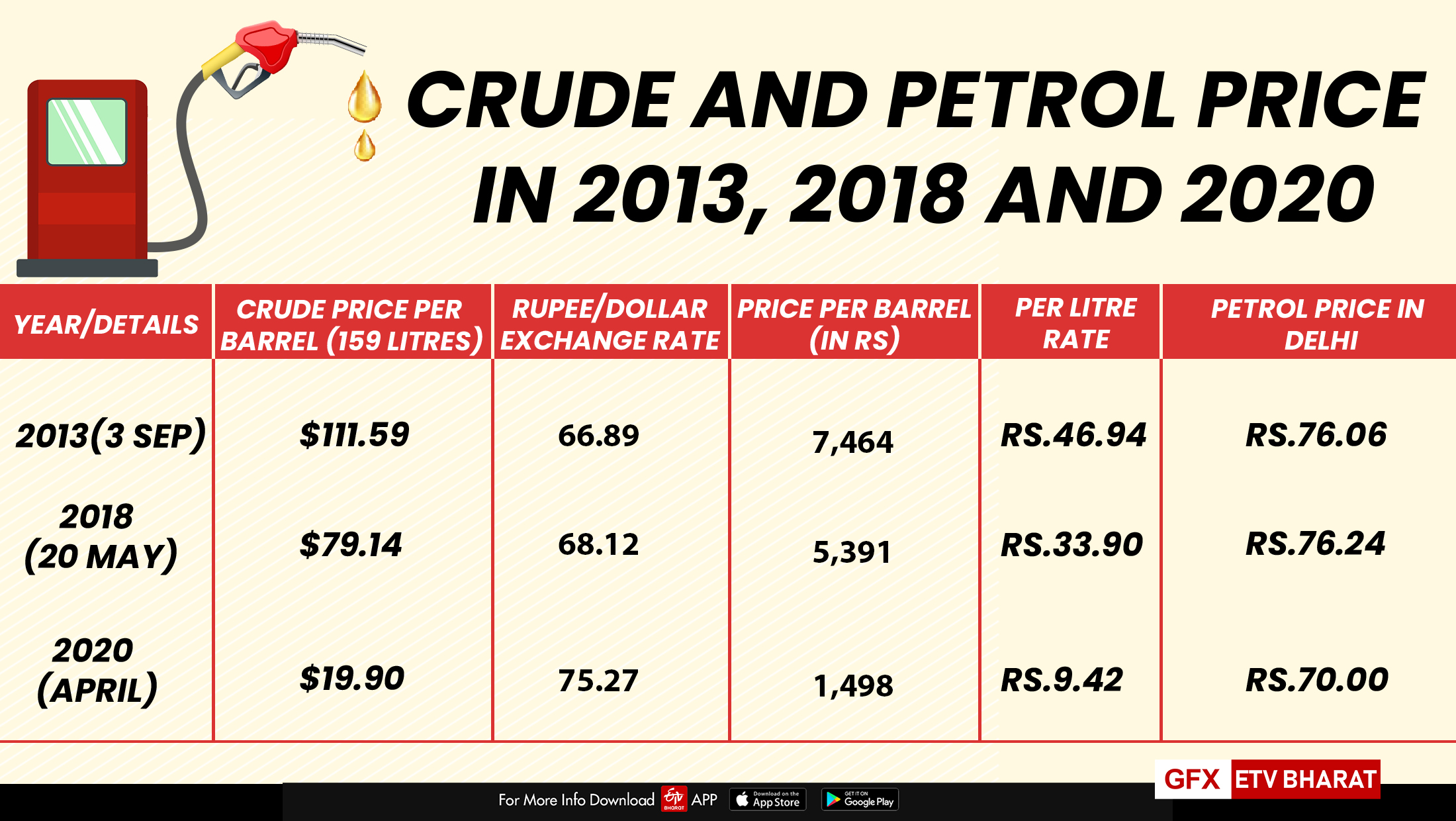

First, the high crude prices and weak rupee plea. Take the prices of petrol, for example in Delhi, during three different points in time with different exchange rates and crude prices. In 2013, the crude price per barrel (159 liters) was $111.59.

At the then prevailing rupee-dollar exchange rate of Rs.66.89, the petrol’s per litre rate works out to Rs.46.94. The petrol that time was sold at Rs.76.06. Similarly, in 2018 per litre cost, factoring in the extant exchange rate and crude price, was equal to Rs.33.90 whereas the petrol price was the same, about Rs.76.

Taking the recent period, the crude price this April bottomed to $19.90. Although the exchange rate was high Rs.75.27 the per litre cost worked out to Rs.9.42. But the price of petrol was in the same Rs.70 region. So, the excuse of high crude and weak rupee does not hold much water.

Second, the claim of the oil sector subsidy burden. The government’s data, petroleum and natural gas statistics, refute its own claim.

The oil sector contributed Rs 4,56,530 crore to the government in 2017-18. The contribution included: Royalty from crude oil (Rs 12,057 crore), Royalty from gas (Rs.1722 crore), Oil Development Cess (Rs 13,544 crore), Excise and Custom duties (Rs 2,13,012 crore), sales tax (Rs.1,86,394 crore) and dividend (Rs 29,801 crore). Similarly, the provisional estimates of gains for 2018-19 is Rs.4,33,062 crore.

Oil gives, doesn’t take!

As per the government’s data, the share of the petroleum sector in total subsidies has increased from 8.3% (Rs.24,833 crore Revised Estimate) in 2018-19 to 11.1% (Rs.37,478 crore) crore in 2019-20 Budget Estimate.

But this amount is peanuts before what the government gets from the sector, more than Rs 4 lakh crore! The total subsidies of the government in 2017-18 amounted to Rs 2,24,455 crore which include subsidy on food (Rs.1,00,282 crore), fertilizers (Rs.66,468 crore), petroleum (Rs.24,460 crore), interest subsidies (Rs.22,146 crore) and other subsidies (Rs.11,099 crore).

Read more: Centre's final stimulus package likely in Sept-Oct: Gurumurthy

The total subsidy budgeted for 2019-20 was Rs 3,38,949 crore. This means the petroleum sector is taking on it the entire subsidy burden of the government.

Third, the claim of losses to the oil companies. Again, the latest official data suggests the net profit earned by public sector oil companies during the year 2018-19 was 69,714 crore which was higher than 2017-18’s Rs.69,562 crore; the ONGC earned the highest profit of Rs 26,716 crore, followed by the IOCL Rs 16,894 crore and the BPCL Rs.7,132 crore.

So, the excuse of losses is an outright wrong claim. The under-recoveries, to whatever extent they are shown, are also not losses. In simple terms, the under-recoveries are the difference between the actual price the petroleum product is sold and a notional price.

India exports petroleum products

Fourth, high dependence on crude imports. True, domestic production of crude is only 34.20 Million Metric Tons (MMT) against the consumption of 213.22 MMT (2018-19 figures) which means 84% import dependence.

But India imports crude than is domestically consumed. It refines the additional and sells the products outside India. The Petroleum Oil and Lubricants (POL) exports in 2018-19 were worth Rs.2,67,697 crore (the weak rupee gives additional benefit here which is not much talked about as happens in the case of import burden).

Petroleum product exports account for 11.60 of the total exports in the country. So, import dependence is not a good excuse for high petrol and diesel prices.

There is, therefore, no justification in not sharing the oil sector benefits with the people through lowering the prices. Needless to add, the high petrol and diesel prices have a high cascading effect on the prices in general and have the potential to further cripple the corona ravaged economy.

The government would do well to review its turbid petrol pricing policy, at least now, to stop increasing the prices of petrol and diesel and thereby of the other goods.

(Article by Dr P.S.M Rao, Development Economist. Views expressed above are author's own.)