Business Desk, ETV Bharat: Petrol prices on Tuesday were hovering at their highest levels in around two years in most parts of the country after rising for a seventh straight day.

In Mumbai, petrol breached the Rs 90 per litre mark, while it was selling at around Rs 84 per litre in Delhi. Meanwhile, diesel prices have also been revised to Rs 80.51 per litre in Mumbai and Rs 73.87 per litre in New Delhi.

Petrol prices have shot up as international crude oil prices have been consistently rising for over the last two weeks as the world jots down vaccination plans to deal with the Covid-19 disease.

Public sector oil marketing companies like Indian Oil Corp. Ltd (IOC), Bharat Petroleum Corp. Ltd (BPCL) and Hindustan Petroleum Corp. Ltd (HPCL) have, therefore, been revising rates of petrol and diesel daily based on the benchmark international oil price and the foreign exchange rate.

But do you know that even if you factor in the recent rise in crude oil prices, the petrol price you pay from your pocket is nearly triple the actual fuel cost? That’s right, petrol and diesel prices are majorly made up of taxes and cess that go directly to the government’s revenue kitty.

For instance, let’s take a detailed look at the break-up of petrol prices in the national capital of Delhi:

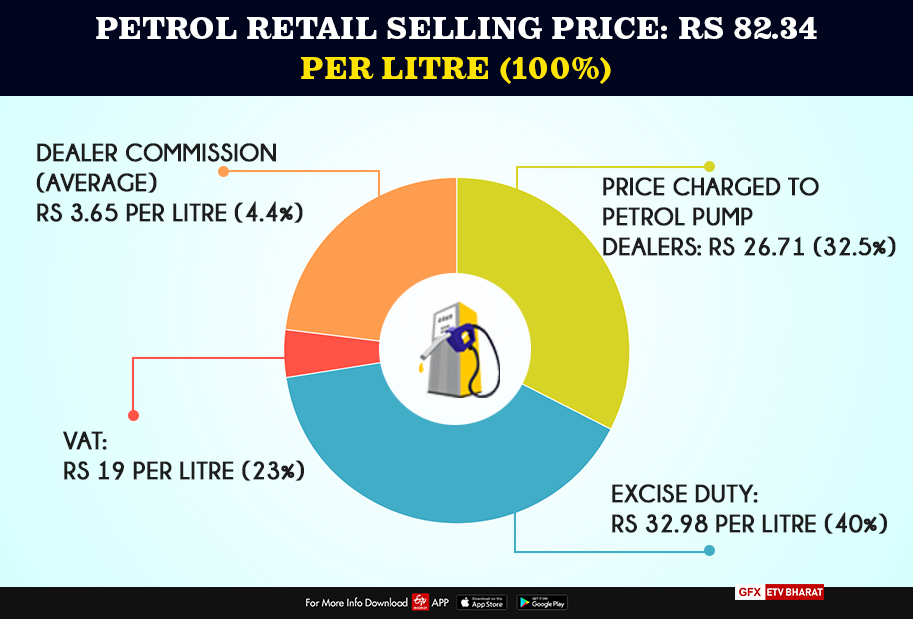

As of 1 December 2020, the retail selling price of petrol in New Delhi was Rs 82.34 per litre. This price has been calculated after taking into account four major components:

1) Basic fuel price cost: This includes the price of crude oil including ocean freight, refinery processing cost, margins of the refinery, margins of the oil marketing company along with all logistics and freight cost. So basically, this is the total fuel price after processing which is ready to be sold at the petrol pump.

In Delhi, the basic fuel price cost is Rs 26.71 per litre, or just 32.5% of the total petrol price.

Read more: Rs 12.5 lakh cr investment needed to realise India's 2030 EV targets: Study

2) Excise duty: The excise duty is the tax central government charges on petrol and diesel prices. The Bharatiya Janata Party (BJP) government has raised the excise duty twice this year, mainly to compensate itself for the shortfall in other tax income.

Before March 2020, the excise duty on petrol stood at Rs 19.98 per litre. In March, it was increased by Rs 3 per litre and then again by Rs 10 per litre in May. Now, it stands at Rs 32.98 per litre. This means, in New Delhi, excise duty accounts for a whopping 40% of the retail petrol price.

3) VAT: Value added tax (VAT) is the tax charged by the state government and its rate varies from one state to another. That is the reason petrol prices are different in every state.

For instance, VAT on petrol is the highest in Maharashtra, Punjab, Telangana, Kerala and Tamil Nadu, while it is the lowest in Goa.

In New Delhi, VAT on petrol has been set at 30%, which translated into Rs 19 per litre, or 23% of the retail petrol price.

4) Dealer commission: This is the margin of the dealer who is running the petrol pump and varies across regions. In Delhi, average dealer commission currently stands at Rs 3.65 per litre, or 4.4% of the retail petrol price.

Adding these four components make the total retail price of petrol in India. So, as shown, the tax component i.e. excise duty and VAT together make up 63% of petrol price in New Delhi.

In simpler words, if you buy petrol worth Rs 100 in New Delhi, Rs 63 directly goes to the government. Or, put in another words, if the central and state governments were completely excluded, petrol in New Delhi could have been selling for just around Rs 31 per litre in New delhi on 1 December instead of Rs 82.34.

Similarly, in case of diesel, which was selling at Rs 72.42 per litre in New Delhi on 1 December, 58% of it was taxes (excise duty + VAT). This means that for every litre of diesel you buy in Delhi, Rs 42.50 directly goes to the central and state governments, with actual diesel price just sitting around Rs 30 per litre.