Washington: US President Donald Trump has denounced France for its recently passed digital services tax law, and threatened "a substantial reciprocal action."

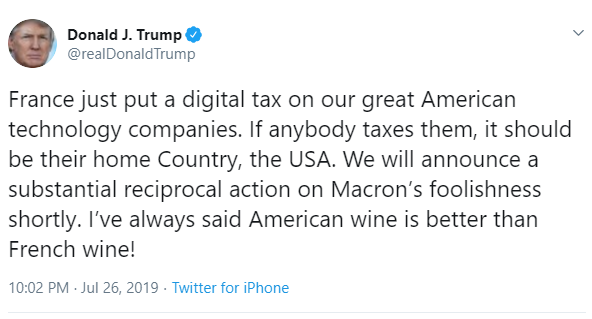

France just put a digital tax on our great American technology companies. If anybody taxes them, it should be their home country, the USA," Xinhua quoted the US President as saying on Twitter on Friday.

"We will announce a substantial reciprocal action on Macron's foolishness shortly," Trump continued, referring to French President Emmanuel Macron.

The White House, meanwhile, released a statement on the issue, saying that the US is "extremely disappointed" by France's decision to adopt a digital services tax "at the expense of U.S. companies and workers."

"France's unilateral measure appears to target innovative U.S. technology firms that provide services in distinct sectors of the economy," White House spokesman Judd Deere said in the statement.

Read More: GST Council meet underway; likely to cut tax on EVs

France has pushed efforts within the EU and on the international stage to change rules that currently enable tech companies, such as Facebook and Google, to reduce their tax bills by shifting profits to low-tax countries like Ireland or Denmark.

The EU member states' finance ministers have failed to agree on an EU-wide digital tax as Sweden, Denmark and Ireland opposed the Paris-backed plan.

The Organization for Economic Cooperation and Development (OECD) countries have also been working on a multilateral solution to incorporate digital tax into the international tax system.

The White House spokesman said the French digital services tax law demonstrates the country's "lack of commitment" to the ongoing OECD negotiations.

The French Senate passed the law two weeks ago, making France one of the first countries to impose a tax on digital giants. The tax was adopted by the National Assembly, the lower house of Parliament, earlier this month.

The new law paves the way for the eurozone's second-largest economy to unilaterally levy a 3-percent tax on much of the internet giants' digital sales in France related to advertising, websites and the resale of private data, and could impact U.S. companies, as well as European and Asian firms.

The bill foresees a 3-percent tax on the French revenues of digital companies with global revenue of more than 750 million euros, and French revenue over 25 million euros.

Noting that the U.S. Trade Representative has already launched a Section 301 investigation into the digital services tax, Deere said the administration is "looking closely at all other policy tools."