Hyderabad: Are you also gearing up to build or revise your portfolio for 2020?

But wondering where to invest your hard-earned money to get the best returns? Equity, Gold, Bank FD or Property?

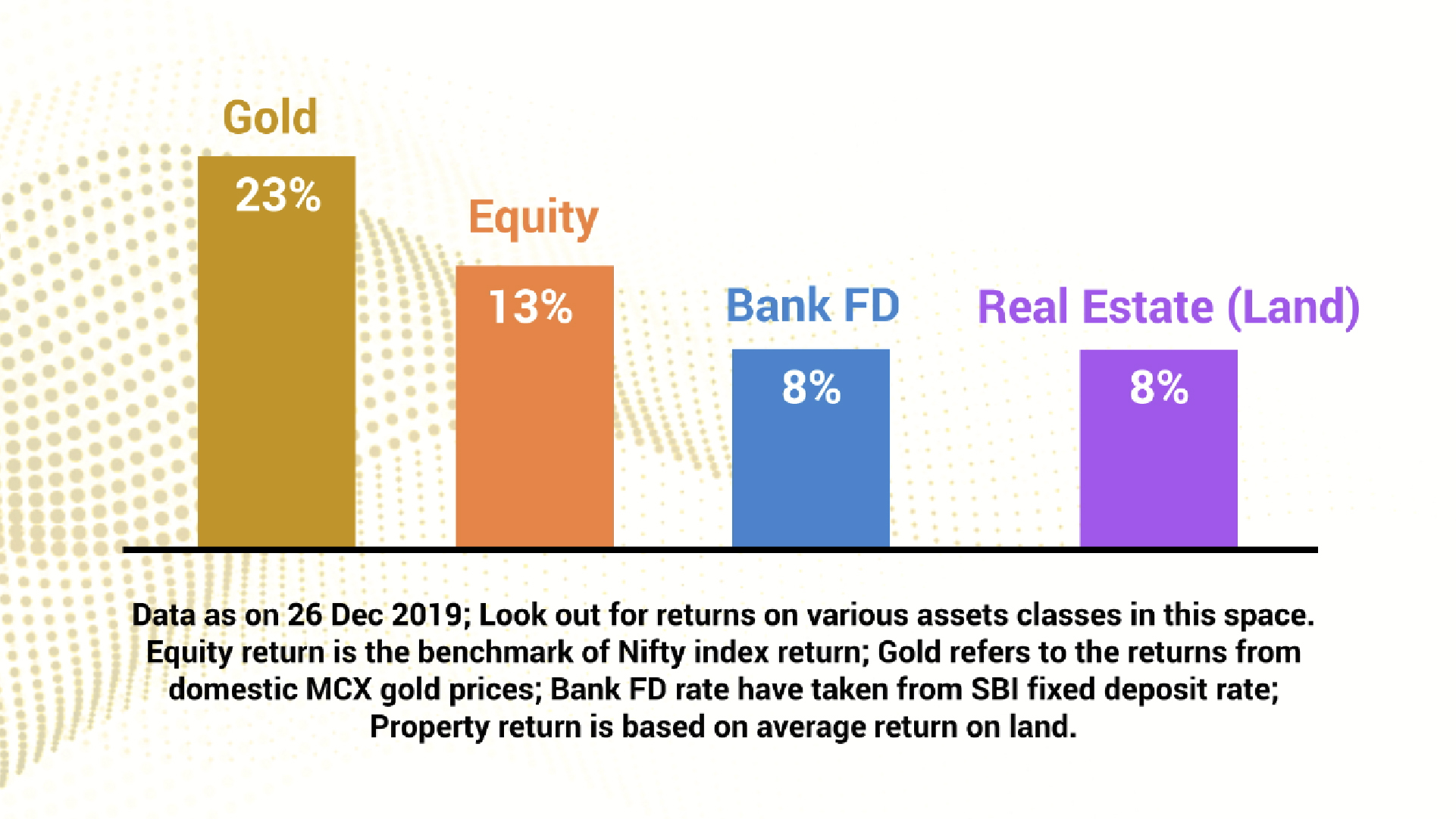

One should always keep in mind the financial goals, historical returns and risk appetite before investing in any assets class. A person needs to know his/her expectations from the investment and choose an ideal investment option for themselves. Before making a new investment strategy for 2020, take a look at how equity, gold, real estate and fixed income (bank FD) have performed in 2019.

Equity

The Indian stock market has been the worst-performing market so far in 2019. The Nifty 50 has delivered nearly 13% returns to investors which is not so impressive. The economic slowdown and the budget proposal of tax surcharge on FPIs spooked investors. Plus, the weak corporate earnings & uncertainty in global markets further pulled the rug from under investors over the past months.

Gold

It is one of the most common form of investment for any Indian. Many families in India treasure gold for ages passing it from one generation to others as a mean of an asset. The best part of investing in gold is that you can invest depending upon your investment appetite.

If we look at the performance of gold versus equity performance in 2019, gold has been blazing the trail alone. Gold has recorded around 23% return in 2019 which is way better than equities.

Read more:Five investing mistakes one need to avoid this New Year

However, gold is a great investment only in times of economic distress. The returns are not certain and the prices are highly dependent on global market scenario.

Bank Fixed Deposit

A Bank Fixed Deposit is a traditional investment option where an investor invests his/her money for a specific period of time and earn interest on it. In 2019 the banking system has failed to impress the investors as deposit rates have fallen continuously.

Nifty Public Sector Unit Bank is one of the biggest loser in the same period. The index has plunged nearly 19% due to terrible scams & NPA & NBFC crisis. Most of the banks are providing 7.5-8% interest on FDs which is not attractive if an investor want to create wealth in the long run.

Bank FDs are good option for conservative investors.

Real estate

The year 2019 has been a looming year for real estate as well. The residential property failed to offer any respite to investors. According to property brokerage firm Anarock, housing sales in 2019 saw a 4-5 per cent annual growth with over 2.58 lakh homes sold during the year. Overall property sales have witnessed nearly 8% growth.

The commercial space segment is showing some good momentum. However, the outlook for this sector is going to remain negative due to fragile market conditions.

Keeping these factors and market scenario in mind, an idle portfolio may consist 30-40% investment in equities (direct or indirect), rest to be divided among fixed income securities, gold and real estate.

Investors with average risk profile should keep minimum 30-40% in safe fixed income securities such as bank deposits and government bonds, 30-40% in equities and rest in gold and real estate.

Happy investing!

(Authored by Indu Choudhary. She is a Mumbai-based personal finance expert.)

Disclaimer: The views and investment tips expressed above are solely of the author and not those of ETV Bharat or its management. ETV Bharat advises users to check with certified experts before taking any investment decisions.)