Hyderabad: The central governments over the years have been running various farm support policies to address the issue of farmer distress in India -- a country where agriculture employs more than 50℅ of the Indian work force. One such policy, price deficiency payment scheme (PDPS), has always been a subject of debate as the actual benefit to farmers remains questionable.

A research conducted by economists at the Reserve Bank of India (RBI) and Indian School of Business (ISB) has now indicated that such a policy can indeed adversely affect a farmer’s earnings by pushing down the selling price of crops, thereby also increasing the payment burden on governments.

What is PDPS?

Let us first understand what exactly is PDPS. PDPS was first launched by the Madhya Pradesh government in October 2017 as the Bhavantar Bhugtan Yojana (BBY) for eight crops.

Later, in 2018, it also became a part of the central government’s Pradhan Mantri Annadata Aay Sanrakshan Abhiyan (PM-AASHA) to benefit farmers producing oilseeds.

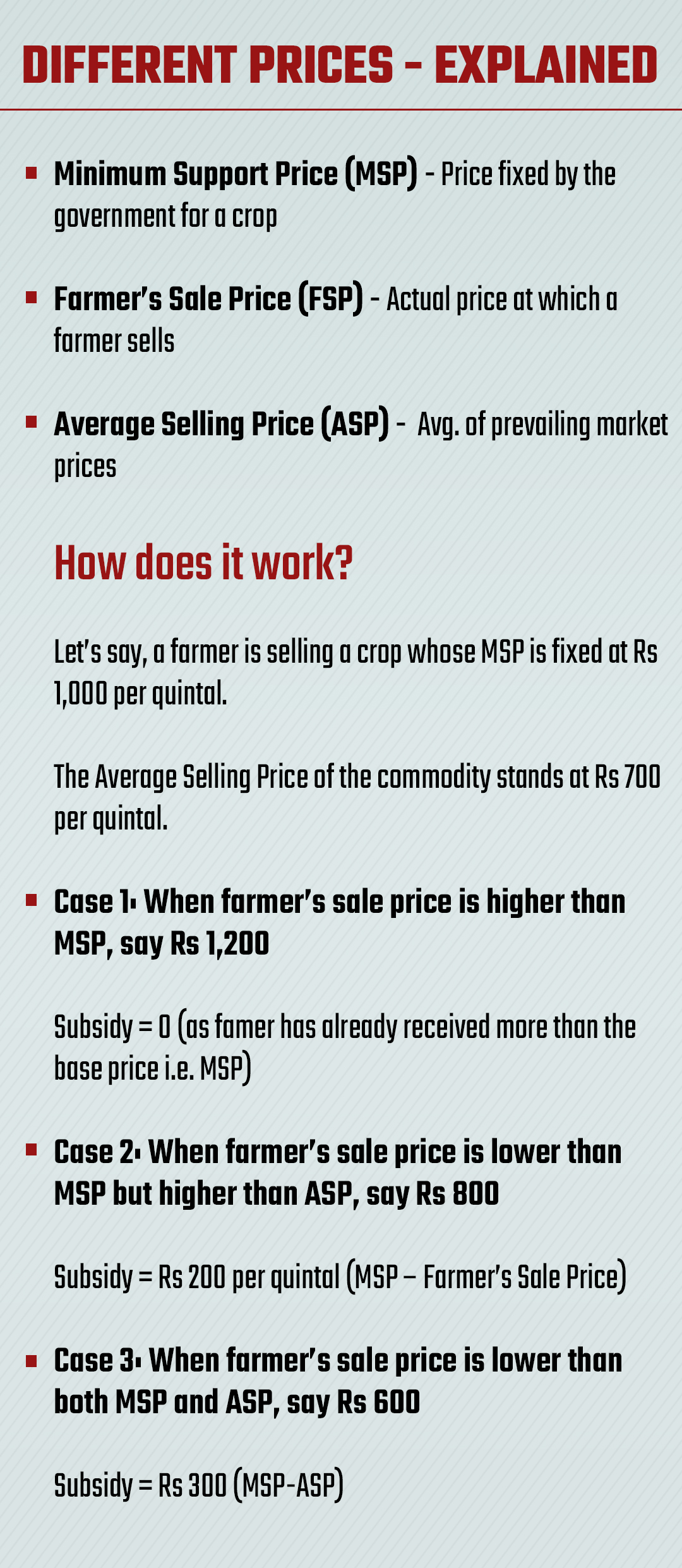

The scheme basically helps farmers by compensating them for losses incurred when wholesale market prices are lower than minimum support prices (MSPs).

Though, the actual amount of compensation is determined by an average selling price (ASP) – a metric set by the government after studying prevailing market prices within the state and markets outside the state where the commodity is traded.

Read more:Know how you can open an account without visiting a bank

So, when a farmer’s selling price is lower than MSP but higher than the ASP, then the difference between the MSP and actual sale price is paid to the farmer. If the selling price is lower than both MSP and ASP, the payout is capped at the difference between MSP and ASP.

The farmers have to register themselves at mandis with details such as the total area sown, likely produce and bank account details. Notably, they are eligible for compensation only if they sold their produce during a particular window in the mandi where they had registered themselves.

The actual difference in the selling price and the modal rate is transferred via direct benefit transfer (DBT) into the Aadhaar-linked account of the beneficiary.

What the research found

The research -- conducted by Abhinav Narayanan, a research economist at RBI, and Shekhar Tomar, assistant professor in the Economics and Public Policy area at ISB – studied pricing patterns and quantity arrival of two major crops Urad and Soyabean during the BBY scheme period in 2017 in Madhya Pradesh.

The research showed that there could be dramatic increase in market arrivals of a crop during BBY window since the government has assured a high price relative to the market.

For instance, quantity arrivals for Urad increased by 43% during the BBY period. Though, there was no significant impact on Soyabean arrivals. But why this difference?

Chances of extra crop arrivals in a BBY mandi are likely to be higher when the difference between MSP and ASP is high, the research argued. In this case, the difference for Urad was a massive Rs 2,479 per 100 kg, while it was just Rs 367 for Soyabean.

“If the gap is high, farmers try and frontload as much produce as possible during the BBY window to make the most of the scheme, thereby dramatically increasing market arrivals,” said Tomar while talking to ETV Bharat.

“The extra supply then leads to a fall in crop prices,” he added. The research found that though soyabean prices were unchanged, urad prices fell 4% during the BBY period due to a supply glut.

After the prices fell, the registered farmers lost since the government now paid the difference between the MSP and ASP, instead of paying the difference between MSP and the farmer’s own sale price.

The unregistered farmers also took a direct hit from the fall in crop prices as they sold their produce at a lower price without any government compensation.

The number of such farmers is likely to be significant as the research showed that the BBY scheme covered 66% of the total sown area under Urad.

The government, too, suffered a loss as it had to pay high deficiency payments due to a lower ASP during the BBY window when compared with other months.

The research estimated that the overall monetary loss for all the three participants due to the supply glut was Rs 95.8 crore, which is 7.3% of the total deficiency payments paid by MP government.

The research, therefore, suggested the government to pay the entire difference between the MSP and farmers’ actual sale price.

It said that this modification to the policy reduces the chances of a supply glut, which can further reduce the overall loss for the stakeholders.

(ETV Bharat Report)