New Delhi: Extension of the moratorium on loan repayments will not help anybody, and it will only postpone the problem and not solve it, says former Reserve Bank Deputy Governor R Gandhi, adding that both individuals and businesses have enough cash to repay the loans and there is no case for its extension despite the demand from several quarters.

The six-month moratorium on loan and EMI repayments, which was announced by the RBI in two stages in March and May this year, is set to expire at the end of this month. While some bankers and lenders have publicly opposed yet another extension, some in the industry have demanded its extension. The issue has sharply divided the people in the financial and banking industry.

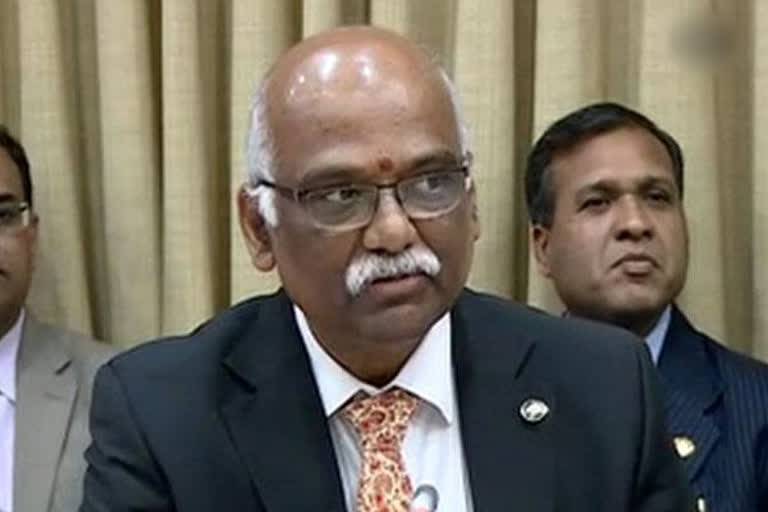

“The loan moratorium should not be extended. It is not going to help anybody whether it is the borrower or the financial institutions, nobody is going to be helped by the extension,” said R Gandhi, former Reserve Bank Deputy Governor.

“Moratorium only postpones the problem further. That way we are not solving the problem,” Gandhi said in the Business and Banking Dialogue organised by Mumbai based payment technology firm EPS India.

R Gandhi, who was head of the economy division of the Reserve Bank, admits that a moratorium on loan repayment was definitely needed in the first three months of the lockdown as that was a period of uncertainty.

Data suggests people have enough cash to repay loans

While referring to the latest official data, the former RBI officer says actual behaviour of borrowers during the lockdown confirms that people have cash to repay loans.

R Gandhi said all types of outstanding loans have come down, whether it is individual loan or corporate loan, every type of business has started paying their dues.

“It means they have capacity to pay back loans including individual borrowers,” Gandhi noted.

He says normally credit outstanding goes up during the times of liquidity crisis as this is the easiest way to avail the credit but people have brought down their credit card dues during the lockdown period.

“Look at the credit extended against fixed deposits, look at the credit outstanding against bond, debentures and equities, these are the assets available to people against which they will raise credit in case of cash problems but actually they have paid off,” Gandhi said in response to a question by ETV Bharat. “It means they have surplus cash available with them.”

Outstanding business loan also declined during lockdown

While talking about the financial data of the lockdown period, the former RBI official says the phenomenon of repaying loans is not restricted to individual borrowers who borrow money to buy home, vehicle or personal loans for some other purpose.

“Look at the businesses, the outstanding amount has come down for every type of business loan,” he said.

Gandhi explains that businesses have voluntarily paid loans during the lockdown period as no banks could have pressurised them, and the option of availing loan moratorium was also available to them during the lockdown.

Banking industry’s staunch opposition to the possibility of yet another extension by the RBI came out in open late last month when HDFC Chairman Deepak Parekh publicly urged RBI Governor Shaktikanta Das not to extend the moratorium.

While participating in a webinar organised by the industry lobby group CII, Parekh told Shaktikanta Das that people were taking advantage of moratorium and not paying loans despite having the capacity to repay.

Though, Rakesh Bharti Mittal, past president of CII and Vice Chairman of Bharti Enterprises, asked for extension of moratorium to alleviate the problem of corporate sector and economy in the same programme.

Gandhi rejects these arguments saying that given the actual behaviour of borrowers during the lockdown it is not correct to assume that people need yet another relief.

Banks, NBFCs will be hit

The top banker highlights the problem faced by the banks that will be further aggravated if the moratorium on loan payment is extended beyond August.

“What about financial institutions and banks if you go on extending the moratorium across the board,” asked R Gandhi.

He says banks have not received interest and principal payments during the moratorium.

“It's the pseudo income. As and when the moratorium is lifted, if these loans become NPAs the banks will have to reverse all these incomes. They will take a big hit on their profitability and their balance sheets that is why a general moratorium is not the answer,” noted the banker.

Targeted moratorium for stressed sectors

The top banker, however, concedes the need for extending the moratorium to the sectors hit hard by the outbreak of Covid-19 global pandemic that is expected to cause a loss of $9 trillion to the world economy.

“There will be some segments like the hospitality sector, aviation sector, and travel and tourism that have been badly affected and some focused, targeted support for these sectors may be needed but it can't be a generic moratorium,” he added.