Hyderabad: Gold has returned more than 18% over rising from Rs 39,850 on 1 January, 2020 to Rs 47,110 on 12 June, 2020 (Rates in Mumbai, 24K 10 grams).

Indian households being the largest holders of the yellow metal in the world have benefited from this rise.

With the interest rates on fixed deposits going down by the day and the stock markets continuing to remain volatile, Indian investors are seeking a safe haven with investment into gold.

Though the COVID-19 triggered nationwide lockdown has caused a decrease in the physical gold purchases, investments in gold funds, ETFs and digital purchases are seeing healthy traction.

The recent offer for Government-backed Sovereign Gold Bonds (SGBs) also saw good participation.

Why Indian households prefer gold?

- Easy convertibility to cash

- High on ornamental value

- Consistent capital growth as an investment

Gold glitters in economic crisis

Gold is expected to do well during periods of turmoil, when the average investor is looking for safety and stability.

The best example of this characteristic is the meteoric rise of gold when there is a stagnation or low growth in the overall economy.

As the experts predict coronavirus would cause one of the worst economic crisis of our times, there is a call for a renewed evaluation of gold’s potential for growth.

Is this the right time to invest in gold?

There is no right or wrong answer to this, neither for gold nor for any investment.

A long term investor need not worry about ‘timing’ the market to find the best buy price as the search for the best time often results in loss of current opportunities and delay.

Read more: Why Frozen Parotas are taxed at higher rate, this is what government thinks

One must avoid the lure of quick money and the fear of missing out on potential gains with investments, especially in volatile times like this.

It would be safe to say that gold must be purchased cautiously and in optimal amounts by the merit of its growth potential but not because it has rallied in the recent past.

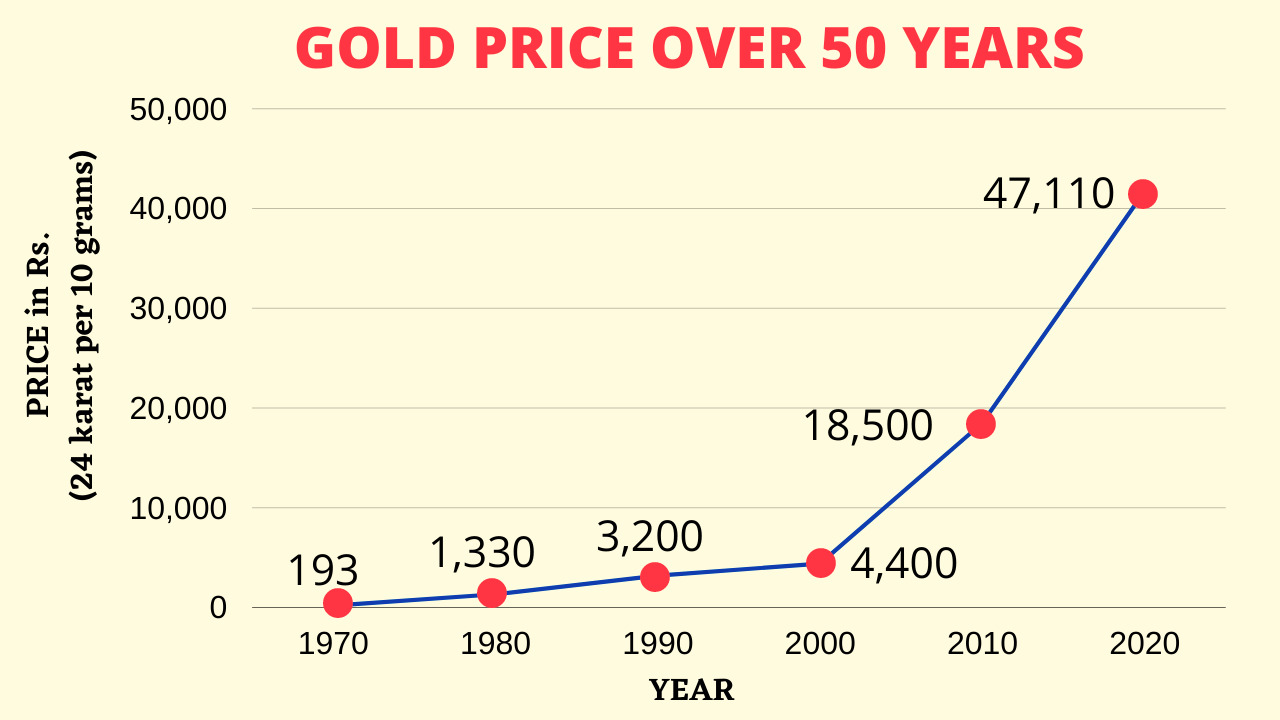

The best way to understand this is to look at the historical prices of gold over a 50-year period i.e. between 1970 & 2020:

The compounded annual growth rate of gold is around 11.3%, a respectable return but much humbler than the recent up-swing.

How should you invest in gold?

- The best mode of achieving exposure to gold would be to make a fixed amount of investment into a gold fund at a regular frequency, similar to a mutual fund SIP.

- This would help leverage the power of rupee cost averaging i.e. averaging the cost of purchase of gold over the time period of investment.

- This also reduces the cost of owning and maintaining gold while retaining all its benefits.

- The optimal asset allocation for gold differs based on the risk appetite and goals of the investor.

- An allocation of between 5 to 15 % of the portfolio into gold in such difficult times is a prudent strategy.

- Gold acts as a hedge in falling markets, offsetting the losses in equities to some extent.

Having said that, each investor must consult a qualified Investment Adviser to evaluate their finances and work out a suitable asset allocation strategy.

(Written by Sankarsh Chanda. Author runs a SEBI licensed investment advisory.)

Disclaimer: The views expressed above are solely of the author and not those of ETV Bharat or its management. Above views must not be construed as investment advice and ETV Bharat recommends readers to consult a qualified advisor before making any investment.

If you have any queries related to personal finances, we will try get those answered by an expert. Reach out to us at businessdesk@etvbharat.com with complete details.