Hyderabad: The Coronavirus and the nationwide lockdown has dealt a body blow to the civil aviation industry. The very same industry, which was pegged as one of the fastest growing ones in India for the past three years, is now under duress.

“This is the biggest crisis that the industry has ever faced,” says Alexandre de Juniac, Director General and CEO of International Air Transport Association (IATA). Around 300 airlines, which account for 82 per cent of the global air traffic are represented by the IATA.

According to the Association, global sealing of borders, followed by the nationwide lockdown has impacted Indian aviation industry and it will have serious implications on its functioning as well as on the country’s economy on the whole.

The Indian aviation kitty

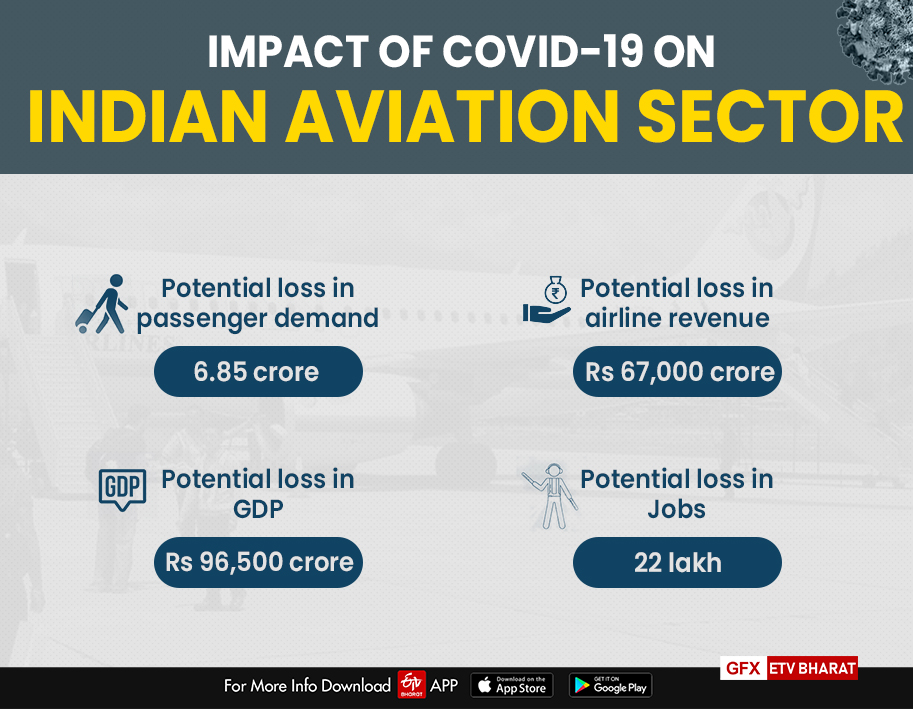

IATA data shows passenger demand in India has slid by 36 per cent, which is about Rs 6.85 crore, compared to 2019. When calculated, this comes to a revenue loss of Rs 67,000 crore having a potential job impact on 22 lakh people. Eventually, this loss will be telling on the country’s GDP figures.

Till now India was the third largest domestic market in civil aviation after the US and China, with a total passenger traffic at 19.96 crore, of which domestic passenger traffic was 16.01 crore and international traffic of 3.94 crore.

The air carriers are now fighting for their survival with acute liquidity crisis. The impact will be severe, driven by the factors like revenue, which is expected to fall drastically. Secondly, other than operational costs, there are fixed and semi fixed costs (including crew cost), which amount to nearly half of any airline’s cost.

The scissors are out

The way out is airlines resorting to cuts while attempting to preserve their workforce and businesses for future recovery, which again is a challenge in itself. Carriers in India have already resorted to cost cutting. Laying off pilots, leave without pay and salary cuts have climbed in the cabin.

- IndiGo has announced a pay cut of up to 25 per cent for its senior employees.

- Vistara has announced a compulsory leave without pay of up to three days for its senior employees in March, 2020.

- SpiceJet has stated that its employees' salaries will be reduced between 10 to 30 per cent.

- Air India has announced a 10 per cent cut in allowances for every employee, except cabin crew, for the coming three months.

- GoAir has slashed salaries of its employees, laid off its expat pilots and introduced leave without pay for employees on a rotational basis.

- Air Deccan is the first casualty of the coronavirus pandemic. The carrier has closed down all its services and sent its staff on ‘sabbatical without pay’ unsure when it would restart operations.

Liquidity crisis

What follows next in the aviation industry, is a severe cash burn, says IATA. Airlines may burn about USD 6,100 crore (Rs 4.6 lakh crore) of cash reserves during the second quarter ending June 30, 2020. Of this, about USD 3,500 crore (Rs 2.6 lakh crore) accounts for sold-but-unused tickets due to across-the-board flight cancellations owing to outright travel ban by the government in order to enforce the COVID-19 lockdown.

Read more: Reliance General Insurance launches COVID-19 protection insurance cover

In response to the current cash crunch faced by the carriers, Indian regulators have relaxed the refund rules.

Airline liabilities

So far, the rule of refund against cancellations has been a deduction of cancellation fee from the refund amount when a passenger cancels a trip. And full refund, in case the flight is cancelled by the carrier.

Now, carriers have opted for issuance of ‘credit shells’ for future travels with an extended period till April 30, 2021. Some have waived off charges on any date change in travel. Market leader Indigo has retained the refund policy along with other options, but in such cases, cancellation fee will be levied.

Asked about the impact of this ongoing crisis, an Indigo spokesperson told Etv Bharat that their quarterly earnings will be materially impacted.

“Over the past few days however, week-on-week, we have seen a 15-20 per cent decline in our daily bookings. We expect our quarterly earnings to be materially impacted. In addition, the Rupee has also depreciated sharply, which will have an adverse impact on our Dollar denominated liabilities primarily on account of capitalised operating leases," Indigo spokesperson said.

Can the tables be turned for Indian carriers?

The rebound in air travel after COVID-19 is expected to take longer than the recovery seen after pandemics in the past. The unprecedented travel restrictions triggered by closure of borders and faltering business is first of its kind. This will lead to higher unemployment, lower business confidence and a fall in consumer spending. Eventually, all these factors will contribute to a delayed recovery in air travel demand.

In view of the present situation, industry experts are calling for extraordinary measures by governments. Australia, New Zealand and Singapore have already announced substantial packages to support their respective aviation industries. But others in the Asia Pacific region including India, are yet to take any decisive or effective action.

Industry body FICCI had informed Civil Aviation Minister Hardeep Singh Puri and Union Finance Minister Nirmala Sitharaman about the bankrupt situation of Indian airlines through a letter on April 1. IATA says, bailout plans in the form of direct financial support, loans, loan guarantees or tax reliefs could be some of the options, which the Government should be actively considering for stopping the carriers from running of cash even before the recovery arrives.

(ETV Bharat Report)