Hyderabad: There is no exaggeration in saying novel coronavirus or COVID-19 has changed the lives of the entire humankind.

The impact of this pandemic is imposed on us in numerous ways.

Unlike bird flu and swine flu, there is no concrete evidence so far on the origin of this virus.

However, currency notes and coins joined the long list of suspected mediums that propagate novel coronavirus (COVID-19).

Doctors monitoring its spread are saying this infectious virus can live up to three hours on currency notes.

Read more:Financial service providers step up measures to fight coronavirus, urge digital usage

“Evidence suggests that currency notes are a source of infection and dangerous to health, more so because many of pathogens on them are multi-drug resistant strains,” a recent SBI report said quoting experts.

The report, which was released last week, further noted that out of hundred notes of Rs 100, 50, 20 and 10 denominations collected in Karnataka in 2016 for a study 58% carried disease causing pathogens.

Coins - No Exception

The SBI report also revealed that a scrutiny of 48 coins by the King George’s Medical University in Lucknow showed that almost all the samples were contaminated with bacteria, fungus and parasites.

What is the solution?

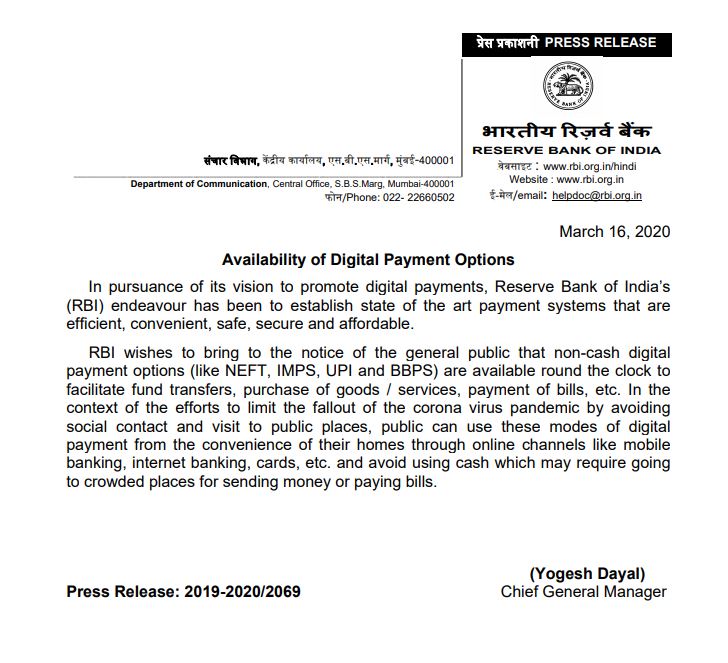

In view of corona outbreak, on the RBI's direction banks have been sending text messages asking customers to avoid cash transactions and, instead, embrace digital payment options like UPI, Mobile Banking, IMPS, etc.

As a measure of 'social distancing', experts are also suggesting similar measure.

-

This is the time to ensure Social Distancing.

— Narendra Modi (@narendramodi) March 22, 2020 " class="align-text-top noRightClick twitterSection" data="

Digital Payments help you do that. Let’s listen to these stalwarts and adopt digital payments. #PaySafeIndia @NPCI_NPCIhttps://t.co/qsNcs0EhKIhttps://t.co/imtK8x98XThttps://t.co/yzKPHiXEvDhttps://t.co/TMuZdPqR2O

">This is the time to ensure Social Distancing.

— Narendra Modi (@narendramodi) March 22, 2020

Digital Payments help you do that. Let’s listen to these stalwarts and adopt digital payments. #PaySafeIndia @NPCI_NPCIhttps://t.co/qsNcs0EhKIhttps://t.co/imtK8x98XThttps://t.co/yzKPHiXEvDhttps://t.co/TMuZdPqR2OThis is the time to ensure Social Distancing.

— Narendra Modi (@narendramodi) March 22, 2020

Digital Payments help you do that. Let’s listen to these stalwarts and adopt digital payments. #PaySafeIndia @NPCI_NPCIhttps://t.co/qsNcs0EhKIhttps://t.co/imtK8x98XThttps://t.co/yzKPHiXEvDhttps://t.co/TMuZdPqR2O

For a country like India which has a large chunk of rural population, switching to polymer/plastic currency notes from the current cotton-based paper notes is one of the solutions.

“Countries like UK, Australia and Canada have switched to polymer notes to reduce the risk of spreading infections through currency. Therefore, the possibilities of usage of polymer notes in India should also be examined,” the SBI Report concluded.

Wash hands after handling currency notes, appeals IBA

Banking lobby Indian Banks' Association (IBA) has made an appeal to people to wash their hands after touching or counting currency.

IBA has also asked customers to use online and mobile banking channels for making their transactions and avoid visiting bank branches as it could pose a risk to banks' front desk staff.

"Wash your hands with soap for at least 20 seconds before and after physical banking/currency counting/AEPS (Aadhaar-enabled payment system) transactions," IBA said in a public appeal.

The banking association has launched a campaign 'Corona Se Daro Na, Digital Karo Na'.

It is encouraging people to use credit or debit cards for making payments instead of currency.

(With inputs from PTI)