Hyderabad: The Reserve Bank of India (RBI) on Friday projected that the rise in retail prices would continue till next September.

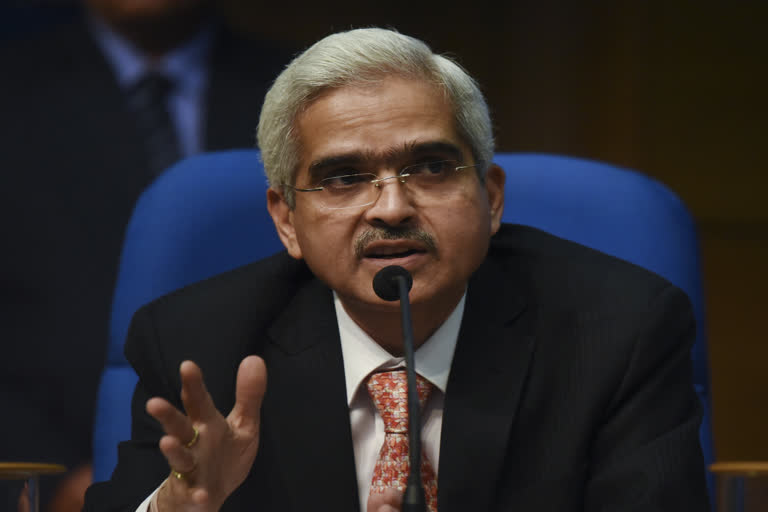

Briefing the media after the monetary policy committee meeting, the RBI Governor Shaktikanta Das has said that the consumer inflation is likely to remain elevated, barring transient relief on account of low prices of perishables in the winter months.

“CPI inflation is projected at 6.8 per cent for Q3:2020-21, 5.8 per cent for Q4:2020-21; and 5.2 per cent to 4.6 per cent in H1:2021-22,” said the latest monetary policy statement.

It may be noted that the Consumer Price Index (CPI), which is the key indicator to gauge consumer prices, had hit a record six-and-half-year high of 7.61% due to high prices of pulses, edible oils, vegetables and eggs.

In fact, the CPI had been over and above the RBI’s upper limit of 6% since last April.

Under the current inflation targeting regime, the Central Bank is mandated to maintain the retail inflation at 4% with a plus or minus 2% relaxation.

Read more: India economy likely to contract by 10 pc in FY21: Abhijit Sen

What is driving the current inflation?

As per the RBI, the current inflation is fuelled by supply chain disruptions.

Although the economy is allowed to operate at near pre-Covid levels, labour shortages and the second wave of infections in Rajasthan, Delhi, Madhya Pradesh, etc are casting a shadow on the expected recovery.

Besides supply chain disruptions, the RBI statement has also attributed excessive margins in the supply chain to the current trend.

“The substantial wedge between wholesale and retail inflation points to the supply-side bottlenecks and large margins being charged to the consumer,” said the RBI statement on the inflation outlook.