New Delhi: The Union government on Friday issued a notification to the Shri Ram Janmbhoomi Teerth Kshetra Trust, a body created for the construction of the Ram Temple in Ayodhya, exempting the donations made to it from income tax for the financial year 2020-21.

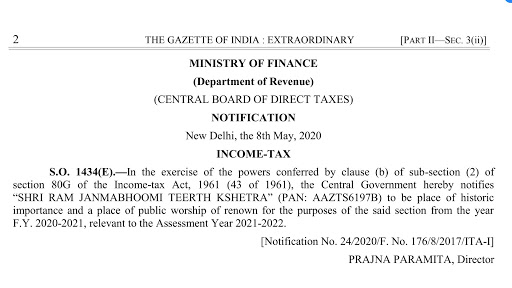

In a gazette notification issued by the Central Board of Direct Taxes (CBDT) dated May 8, 2020, defined the trust as a “place of historic importance and a place of public worship”, thereby allowing tax exemption to donations made under Section 80 G of the Income Tax Act.

Section 80G of I-T Act permits 100 percent donations made by taxpayers to specified “charitable institutions” such as temples, mosques or churches, and relief funds, to be deduced while computing their taxable income, subject to a maximum limit of 10 percent of their gross total income.

Also read: SC sets August 31 deadline for Babri demolition verdict

The 15-member Shri Ram Janmabhoomi Teertha Kshetra was set up in February this year to oversee the construction of a Ram temple in Ayodhya, following the Supreme Court decision in the Ram Janambhoomi-Babri Masjid case.