New Delhi: The bad bank or a large asset reconstruction company (ARC) as announced by the finance minister Nirmala Sitharaman in the budget will be set up within a month or two, said a senior official in the ministry of finance.

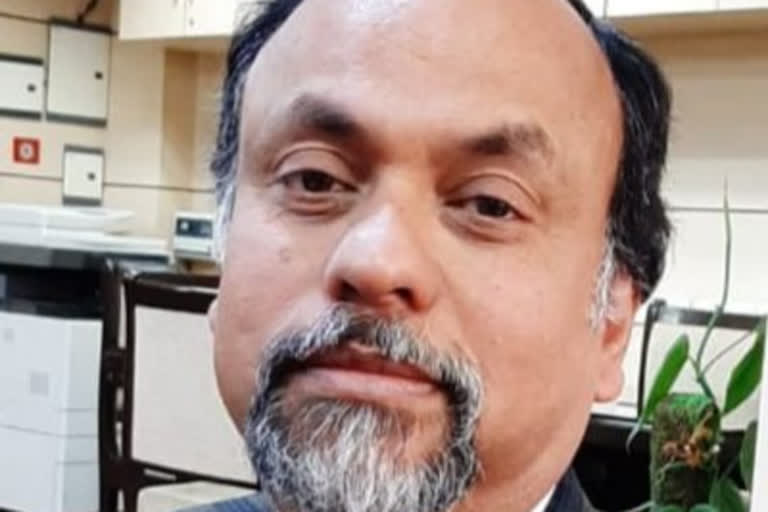

“We hope that it happens in a month or two and it will give much-needed comfort to the banks,” said Debasish Panda, Financial Services Secretary in the ministry of finance.

In a post budget interaction with ETV Bharat, Debasish Panda said the new asset reconstruction company will be owned by public sector banks and some private sector banks can also join in.

"The Asset Reconstruction Company will be basically a warehouse for stressed assets. Thereafter it transfers those assets to the AMC, which is an asset management company, to manage it through a team of professionals, then try to sell it to a potential investor to maximize the value of those assets,” Panda told ETV Bharat.

Panda said it will lead to aggregation of NPAs and a faster and time-bound resolution of bad loans.

New ‘Bad Bank’ will acquire large assets

In response to a question about the need of another asset reconstruction company, which is also referred to as a Bad Bank as it will acquire bad loans or non-performing assets (NPAs) of banks, Debasish Panda said existing asset reconstruction companies cannot acquire large non-performing assets due to inadequate capital.

Panda said the new asset reconstruction company will be looking at the size of assets worth more than Rs 500 crores.

“Banks have already identified some 70 assets which are legacy NPAs,” he said.

The officer said there were hardly 3-4 ARCs which have the capacity to deal with such large assets and other ARCs are very thinly capitalized so they cannot handle projects of this size.

Talking about the urgency to float the new bad bank soon, the officer said if the issue was not resolved early then there will be an erosion of the value of these non-performing assets and banks will only get a scrap value.

RBI to have supervisory powers

Talking about the regulatory supervision of the new asset reconstruction company, the top officer in the department of financial services said, the new asset reconstruction company or the ‘Bad Bank’, will be under the supervision of the banking sector regulator Reserve Bank of India.

Read: RBI open to examine proposal on bad banks: Shaktikanta Das