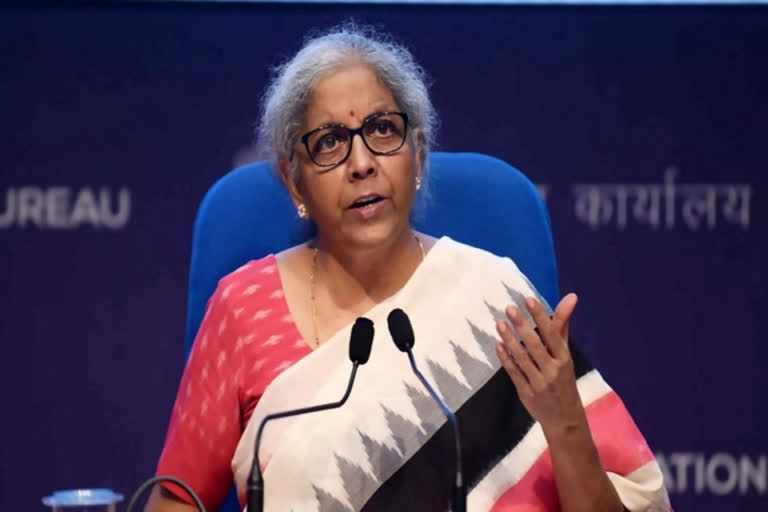

New Delhi: New Delhi: Within the next hour Union Finance Minister Nirmala Sitharaman will present the Union Budget 2023-24 in Parliament on Wednesday. Since it will be the last full budget of the Narendra Modi-led BJP government before the 2024 Lok Sabha elections the expectations regarding sectors such as health, real estate, and Income Tax are high.

This year the Budget session will be conducted in 27 sittings till April 6 with a month-long recess to examine the budget papers. The first part of the session will conclude on February 13. Parliament will reconvene on March 12 for the second part of the Budget Session and conclude on April 6.

With an eye on the Covid-19 pandemic, a key expectation from this year's Union Budget will be the increase in healthcare expenditure. Pertinently, the Budget 2021-2022 and 2022-2023 focused on the country's healthcare sector.

The Centre in 2022-2023 announced that it will roll out an open platform for the National Digital Health Ecosystem which consists of digital registries of health providers and health facilities, unique health identity and universal access to health facilities. The Finance Minister in her speech announced the launch of the National Tele Mental Health Programme, which included building a network of 23 telecentres to support the mental well-being of individuals, and families.

Elaborating on the issue Dr Ashutosh Raghuvanshi, Senior Vice President, NATHEALTH and MD and CEO, Fortis Healthcare, "India is amongst the most preferred destinations globally for medical tourism and therefore, increased policy support is required to encourage, facilitate medical value travel to India, develop MVT as an organized sector."

"Another critical area is addressing the shortage of healthcare professionals - by identifying doctors, nurses and technical staff willing to work in Tier 2/3 cities and looking at non-traditional ways to double the number of doctors. We should look at best practices adopted in universities abroad (fall/summer admission pattern) to increase seats in existing medical colleges," he added.

Another sector that will be of key interest is real estate. Industry leaders and other stakeholders are hoping to see several major reforms which will prove a much-needed to boost to it.

The area of interest for the real estate sector is tax incentives. Real estate developers and investors are hoping for tax breaks and other financial incentives to help lower the cost of developing new projects and make it more profitable for them. This can also encourage more investment in the sector and help boost the economy as a whole.

Another key area of focus for the real estate sector is affordable housing. Industry experts said many people are struggling to find affordable housing options with the increasing cost of living and rising real estate prices. The government is expected to announce new initiatives and funding for affordable housing projects to make them more accessible to a wider range of people.

Atul Banshal, Director Finance, Omaxe Ltd. said, "The budget should consider reducing stamp duty as that will assist it in resuming a robust real estate market and complete housing for all missions for the central government. The government must consider increasing the tax rebate on home mortgage interest from Rs 2 lakh to at least Rs 3 lakh. It is also necessary to have separate deductions for principal repayments, which are currently included under Section 80(c).

"It should also be raised from the current limit of Rs 1.5 lakhs to Rs 3 lakhs. Currently, there are no regulations governing brokerage fees; neither the buyer nor the developer is required to pay the required commission on each transaction, he said. In the last budget Rs. 48,000 crore was allocated for the completion of 80 lakh houses in 2022-23 under the PM Awas Yojana.

As for the tourism industry hopes are high in States such as Himachal Pradesh which depend heavily on tourism revenue. Local travel agents and hoteliers' said they want special budgetary provisions in the field of tourism, which contributes significantly to the state GDP."We have numerous issues with our tourism industry. We are hopeful of special provisions for hill states such as Himachal, especially in the tourism sector. There are no regular flights and also no big airport where large aircraft can land. Both rail and air connectivity need to be boosted," Mohender Seth, president of shoppingmode HP Tourism industry Stakeholders Association told ANI.

He added that the tourism industry took heavy losses due to the Covid-19 pandemic and in small cities like Shimla, local issues were also hurting the tourism business. Hotel businesses are also looking at a special package to boost religious tourism and sought separate allocations for the development of infrastructure.

As for the Railway Budget, which will be presented in the Parliament as part of the Union Bidget, passengers are expecting that there will be no hike in fares. "The Railways still need to pay a lot of attention to the cleanliness of the trains. Also, the trains that were stopped at the time of Covid should be made operational again," Rajan Kumar, a passenger told ANI.

Regular railway passengers also demanded an increase in the number of trains across the country. Students demanded that the Railways run separate trains to make it easier for them to appear for outstation exams. They said they often have to travel to other cities for sit for competitive or other exams and find it tough to book seats in regular passenger trains. (with Agency inputs)