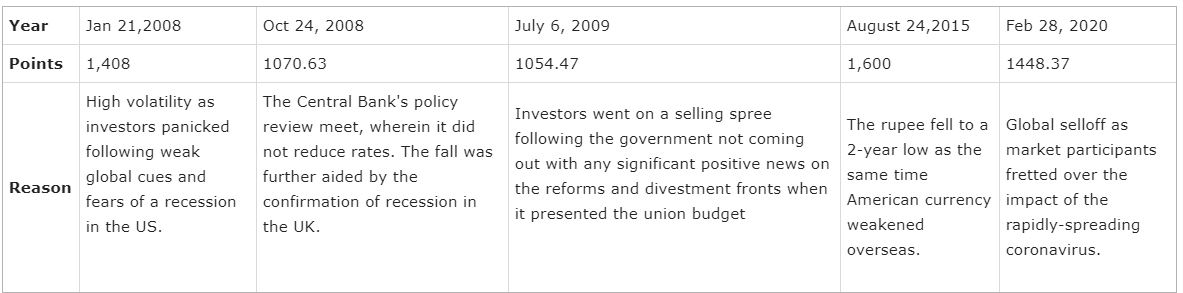

Mumbai: Continuing its downward spiral for the sixth straight session, equity benchmark Sensex plummeted 1,448 points on Friday following a manic global selloff as market participants fretted over the impact of the rapidly-spreading coronavirus.

The BSE Sensex ended lower by 1448.37 points or 3.64 per cent at 38,297.29 while the broader Nifty slipped 431 points or 3.71 per cent 11,201.75.

Minutes before the closing bell, the Sensex was trading nearly 1,500 points lower with none of its 30 constituent stocks withstanding the carnage.

Uncertainty and panic among investors took the 'Fear Index' or India Vix higher by 30 per cent to 22.89. The intra-day jump in the 'VIX' was among the highest in recent past.

Relentless selling across stock markets comes as the number of coronavirus infection cases jumped even outside China, the epicentre of the outbreak.

Wall Street's benchmark index, Dow Jones Industrial Average closed (down 4 per cent) with record losses on Thursday.

Top gainers and losers

The top losers in the Indian markets were Tech Mahindra, Tata Steel, Bajaj Finance, Mahindra and Mahindra followed by HCL Tech and SBI.

The biggest negative contributors of the decline in Sensex was Reliance Industries.

Global market

China's Shanghai SE Composite Index was trading 3.71 per cent lower while Japan's Topix tumbled 3.6 per cent. Hong Kong's Hang Seng plummeted over 3 per cent.

Besides, the futures markets pointed at no near-term relief for the global markets. FTSE 100 Index Futures pointed at a rough start. The index was down 3.44 per cent, NASDAQ 100 Future also traded lower by 1.29 per cent.

Read more: Economy was neglected at the cost of social and political agenda: Raghuram Rajan

Equity markets are falling sharply as fear of recession is rising where investors are looking for safe-haven instruments like Yen, US bonds and Gold, Meena said.

"It is still difficult to predict the extent and impact of coronavirus but the equity markets are in critical condition and they are looking for some positive triggers on the front of coronavirus for any kind of respite," Meena added.

The coronavirus (COVID-19) outbreak is likely to be declared a pandemic and focus is now shifting from China to South Korea, Iran, Italy and Japan -- where cases are escalating fast, even Germany, Brazil and several others have joined the list, a new report said on Friday.

The World Health Organization (WHO) has said that the coronavirus outbreak has reached a "decisive point" and has "pandemic potential" as the toll in China, the deadly disease's country of origin, increased to 2,788 on Friday.

Gold slumps Rs 222 on weak global cues

Gold prices on Friday fell by Rs 222 to Rs 43,358 per 10 gram in the national capital in line with weak trend in global markets, according to HDFC Securities.

The precious metal had closed at Rs 43,580 per 10 gram in the previous trading session.

Silver prices also declined by Rs 60 to Rs 48,130 per kg from Rs 48,190 per kg.

(Input from Agencies)