Hyderabad: COVID-19 pandemic has shattered the country’s economy. In an unprecedented move factories are closed, transport services restricted and movement of citizens completely halted.

In fact, the global media is calling it as the world’s largest lockdown. As the government suspends all activities to save lives, the lockdown has affected livelihood of crores of people, especially poor and migrant labourers.

While the central government has announced over 1.7 lakh crore worth rescue measures, the Reserve Bank of India, which regulates credit flow in the economy, has announced second set of policy measures on Friday to create adequate liquidity in the system.

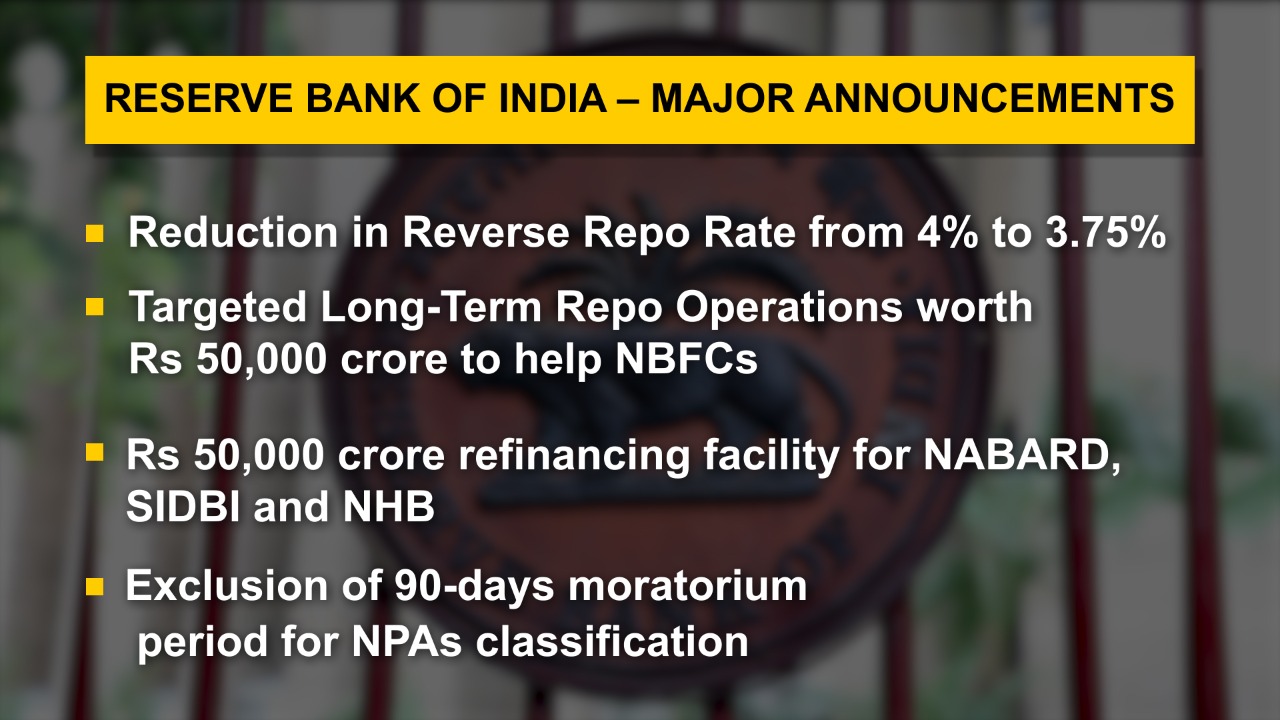

In the second such announcement since enforcement of nationwide lockdown, the RBI has decided to reduce the reverse repo rate by 25 basis points to 3.75%, long-term repo operations to the tune of Rs. 50,000 crore, Rs. 50,000 crore refinancing facility to NABARD, SIDBI and National Housing Bank and extension of resolution timeline by 90 days among others.

All these measures are targeted to equip the financial system, especially Non-Banking Finance Corporations, to meet the credit demand in the post COVID-19 scenario.

Watch the video for comments of R Gandhi (Former RBI Deputy Governor) on the Central Bank's fire fighting mechanisms to deal with the financial crisis triggered by COVID-19.

Read more: Firm, individual from country sharing border with India can invest only after govt approval: