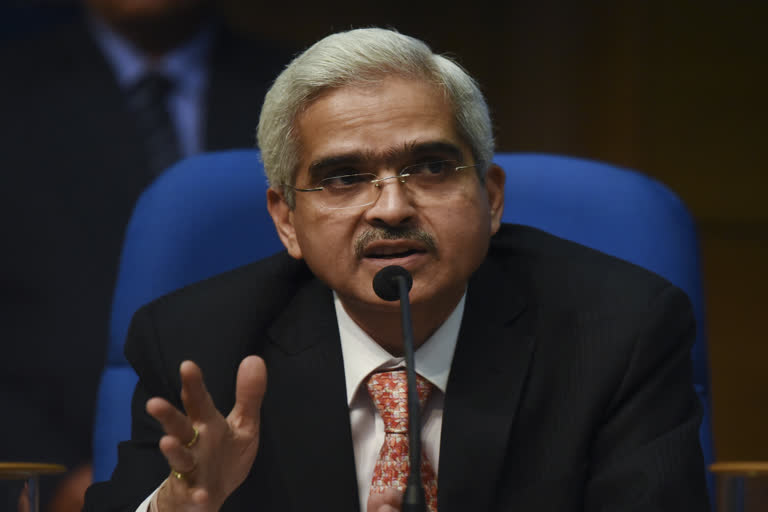

Mumbai: The Governor of Reserve Bank of India Shaktikanta Das on Monday held a press conference to clarify the Bank’s stand on the Yes Bank Crisis and the steps to contain the impact of novel coronavirus on the Indian economy.

Here are few things to know -

- The decision on much anticipated interest rate cut will be taken by RBI's monetary policy committee (MPC) in the upcoming meeting scheduled for March 31 to April 3

- Due to COVID-19, global economy is expected to witness a slowdown with growth rate declining between 0.4 to 1.5 per cent. On the question of impact on India, he said the country is relatively insulated from global value chain, but there will be some impact

- The governor advised banks to encourage customers to use digital banking facilities as far as possible

- RBI has directed banks and financial institutions to assess impact on balance sheet, asset quality due to coronavirus outbreak

- Each bank was advised to form a Quick Response Team, which shall provide regular updates to the top management on significant developments and act as a single point of contact with regulators, outside institutions and agencies

- Allying concerns on Yes Bank, the governor reiterated that depositors’ money is completely safe and if needed the RBI will step in to provide enough liquidity. He also mentioned that bank will resume full services from 6 pm on next Wednesday.

Read more:Yes Bank Depositors' money is fully safe and secure: Shaktikanta Das