Business Desk, ETV Bharat: Most listed companies in India have announced their earnings for the first quarter ended June 2020 (Q1), providing a glimpse into the damage caused by the coronavirus-induced lockdown on specific industries.

A research report by CARE Ratings, based on a study that assessed Q1 performance of 1,666 listed companies, said that net sales of the overall sample declined 25.3% year-on-year in the June quarter compared with 5.7% growth in the corresponding period last year.

“Corporate performance for the first quarter of FY21 very closely mimics the record contraction in India’s GDP growth of -23.9% for the same period,” CARE Ratings said.

Meanwhile, net profits of these companies dropped by almost 60% during the quarter as against a growth of 4.7% in corresponding quarter last year.

Nonetheless, there were certain industries categorized as “essentials”, which performed well compared with the other sectors, the report noted.

Sector-specific revenue impact

Out of the 65 industries/sectors, 51 recorded a contraction in net sales, while 14 recorded positive growth during Q1 FY21.

The industries which were the worst-hit and recorded steep declines in net sales included airlines, trucks, hotels, diamond and jewellery, auto and auto ancillary and electrodes, according to the report.

However, the performance of the banking sector was a bright spot. Public sector banks recorded a growth of 20.8% in net sales and 32.1% in net profits during the June quarter. Private sector banks, too, performed exceedingly well in both the parameters, according to the report.

In addition, agriculture-based commodities like sugar and fertilizers, work-from home services like information technology – software, and some service-oriented sectors like stock broking and telecommunications bucked the broad trend of weak sales growth.

Pharmaceuticals and drugs sector also witnessed solid growth in Q1 due to the essential nature of the underlying commodity and also due to the COVID-19 pandemic.

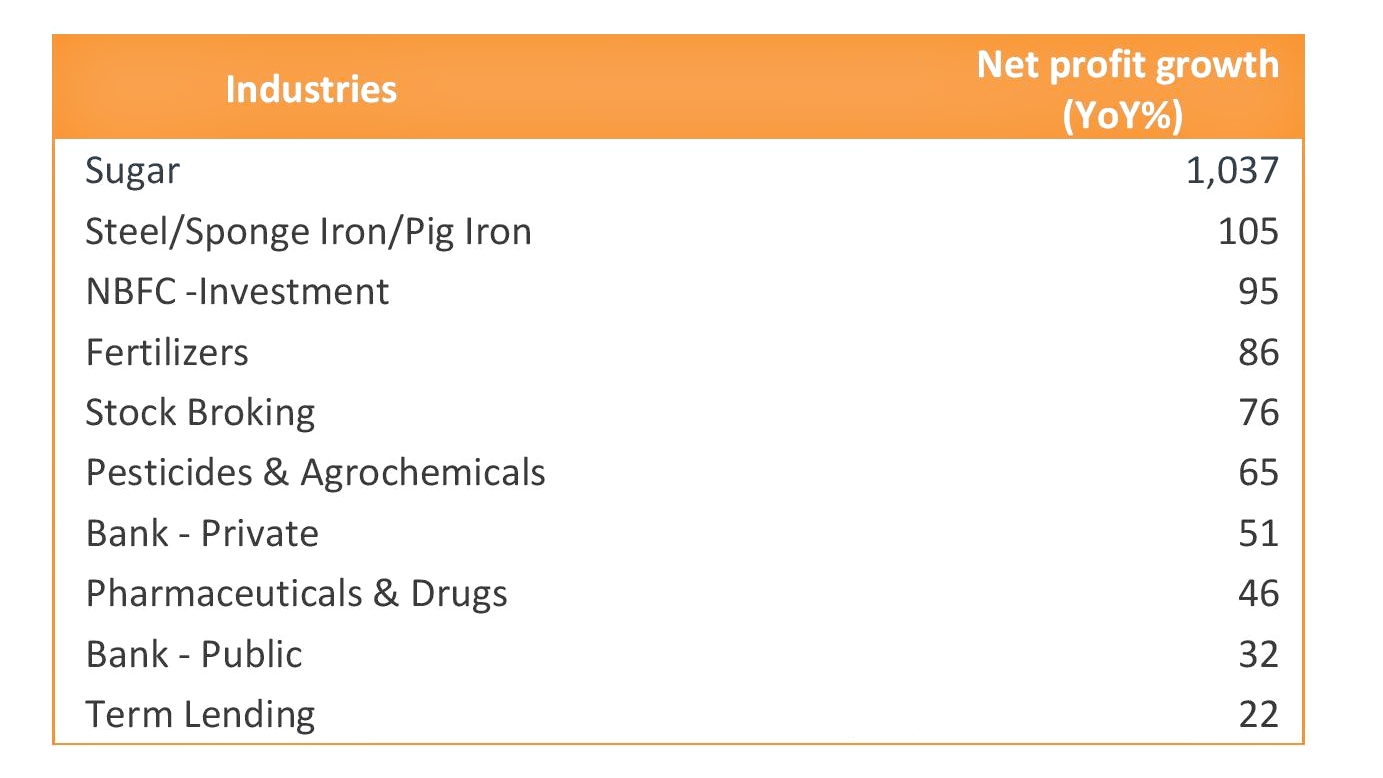

Sector-specific profit impact

In terms of bottom line, only 19 of the 65 industries recorded net losses in Q1 FY21, reflecting the expenditure rationalization done by companies during the times of crisis.

The highest losses were posted by the telecom sector, followed by airlines, trucks, auto ancillary and retailing, said the report.

Telecom is the only industry which has recorded a positive net sales growth in Q1 FY21 on account of increase in average data consumption, but witnessed huge losses during the quarter due to AGR (adjusted gross revenue) payments.

Sugar, meanwhile, was the best performing sector with profit growth of a massive 1,037% over a year ago, followed by steel (105%), NBFCs (95%), fertilizers (86%) and stock broking (76%).

Read more:India's GDP contraction should alarm everyone: Raghuram Rajan