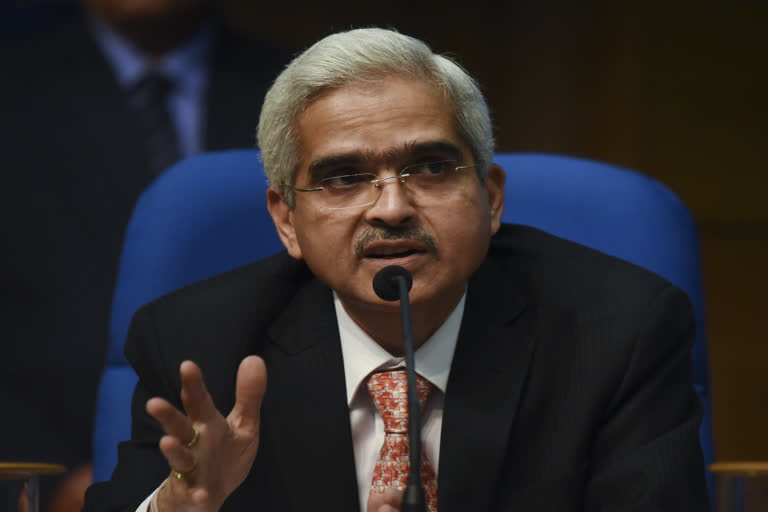

New Delhi: The Micro, Small and Medium Enterprises (MSME) sector has emerged as the growth engine of the economy and is showing signs of revival after the Covid-led degrowth in early part of the current financial year (2020-21), Reserve Bank of India (RBI) Governor Shaktikanta Das said on Thursday.

“MSME has emerged as the growth engine of the economy with a vast network of about 6.33 crore enterprises contributing 30 per cent of our nominal Gross Domestic Product (GDP) and 48 per cent to exports,” he said while addressing an event on the occasion of 185th Foundation Day Celebration of Bombay Chamber of Commerce and Industry.

The sector has been rendered vulnerable by the pandemic necessitating concerted effected effects to combat the stress and focus on the revival of the sector, he added.

The central bank made crucial interventions to support the economy's critical sector, he said.

Das called for increasing digital payment and digital penetration across the country.

“As digital capabilities improve and connectivity becomes omnipresent technological innovation and technology-driven revolution are poised to quickly and radically change India’s economy,” he said.

He said digital technology has the potential to raise the productivity of agriculture, manufacturing and businesses as well as improve the delivery of public services like healthcare and education.

Also read: Benefits of blockchain technology need to be capitalised: Das on cryptocurrency

“In the financial sector this could lead to higher financial inclusion, lesser information asymmetry and reduced credit risk,” he added.

Manufacturing, MSMEs spearheading economic growth

MSMEs are spearheading economic growth in the country after the outbreak of Covid-19 while many contact-intensive services sub-sectors remain severely affected by the crisis, Das said.

However, the recent government initiatives under AtmaNirbhar Bharat Abhiyaan and Union Budget 2021-22 towards developing a vibrant manufacturing sector and infrastructure acknowledges strong linkages they have with rest of the sectors, he said.

Das said the Production Linked Incentive (PLI) Scheme aims to make India an integral part of the global value chain. "This along with reforms in labour market can go a long way in propelling growth to an elevated trajectory for the manufacturing sector and reap its employment potential."

At the same time, MSME sector has emerged as the growth engine of economy with a vast network of 6.33 crore enterprises contributing 30 per cent to nominal GDP and around 48 per cent to exports. The sector employs about 11 crore people, second only to agriculture.

Das said the sector was rendered especially vulnerable by the pandemic, necessitating concerted efforts to combat the stress and focus on revival of the sector.

The government introduced two major schemes: the Emergency Credit Line Guarantee Scheme (ECLGS) and the Credit Guarantee Scheme for Subordinate Debt (CGSSD).

Also read: Need coordinated action between centre, states on tax reduction in fuel prices: RBI Guv

These have been duly supported by various monetary and regulatory measures by the RBI in the form of interest rate cuts, higher structural and durable liquidity, moratorium on debt servicing, asset classification standstill, loan restructuring package and CRR exemptions on credit disbursed to new MSME borrowers.

"These measures will not only help in ameliorating stress in the sector but also open new opportunities," said Das. "Going forward, the RBI stands ready to support the Small Industries Development Bank of India (SIDBI) for greater credit penetration to the MSME sector."

He said digital capabilities have the potential to raise productivity in agriculture, manufacturing and businesses as well as improve the delivery of public services like healthcare and education.

"In the financial sector, this could lead to higher financial inclusion, lesser information asymmetry and reduced credit risk."

(ANI)

Also read: Hopeful that global pharma industry will support India's WTO proposal: Goyal