Hyderabad: Finance Minister Nirmala Sitharaman on Wednesday announced Union Budget 2023-24. Among other announcements, she mentioned a 33.4 per cent hike in capital expenditure and higher allocations to some crucial sectors including the railways.

Though the centre lays down a number of economic aspects transparently before the entire nation while presenting the budget, many citizens are curious as to where the government gets its money from and where it spends it. Here is a short explainer of it.

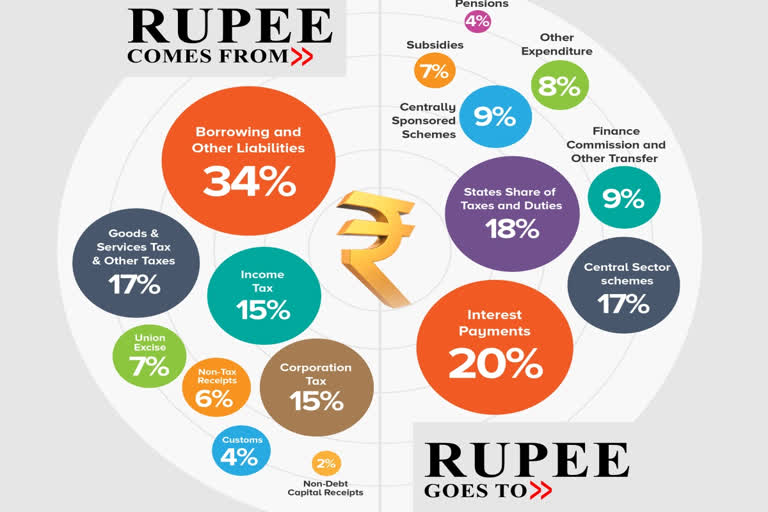

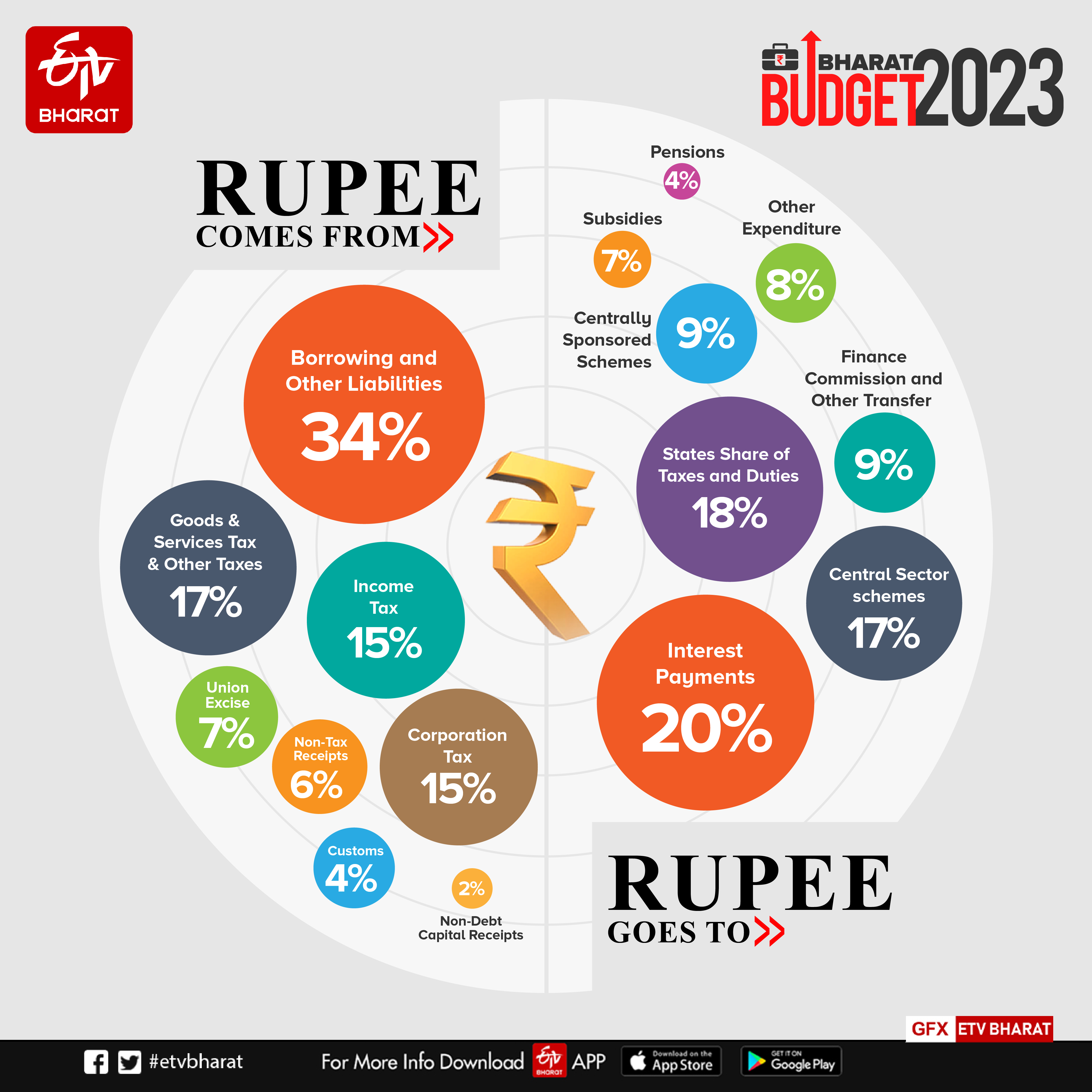

Where does the rupee come from?

In the budget presented on Wednesday, it was stated that the borrowings and other liabilities constitute the highest income procured by the centre, comprising 34 per cent of the total income. Next come the GST and other taxes, accounting for 17 per cent of the total income. Income Tax and Corporation Tax make up 15 per cent of the total income.

They are followed by union excise duty at 7 per cent. Non-tax receipts like rent, penalties and fines come next making up to 6 per cent of the total income, while the customs and non-debt capital receipts account for 4 and 2 per cent of the total income. In the overall income this year, the collections from GST and non-tax receipts have gone up by one percentage point, while that from borrowings and customs have fallen by one percentage point.

Where does the rupee go?

When it comes to expenditure, the highest amount goes towards paying interest on borrowings, accounting for 20 per cent of the total expenditure. The money given to the states in form of taxes and duties accounts for a total 18 per cent. Allocations towards the central sector and centrally sponsored schemes are the next two big expenses comprising 17 and 9 per cent of the total expenditure respectively.

Next come the Finance Commission and other transfers making up to 9 per cent and Defence comprising 8 per cent of the total expense. Subsidies at 7 per cent and pensions 4 per cent come next. This year, the spending towards the state's share of taxes and duties saw a spike and that towards subsidies has dipped by one percentage point each.