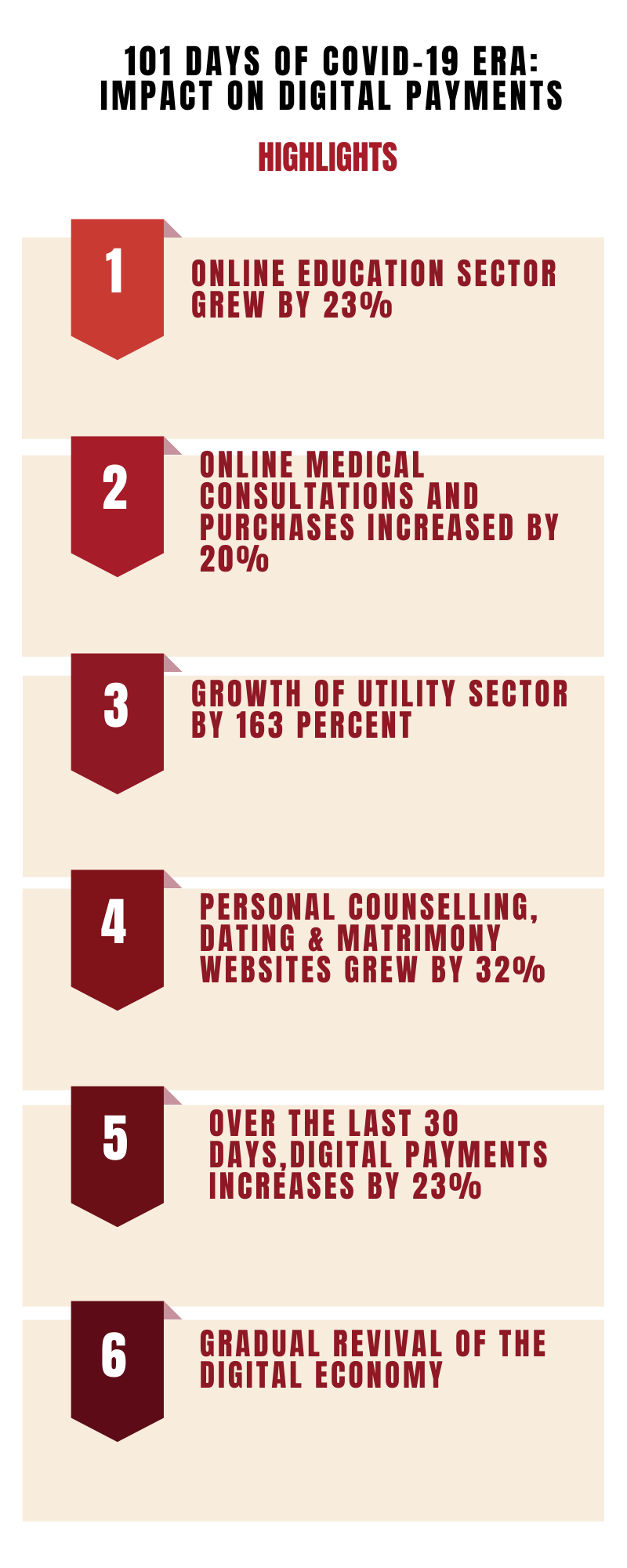

New Delhi: Digital payment transactions in India have rebounded by 23 percent in the last 30 days, full-stack financial solutions company Razorpay said in a report.

The overall digital transactions declined by 12 percent in the last 101 days, compared to a 30 percent drop in the first 30 days of lockdown, said the report titled "101 Days of COVID-19 Era: Impact On Digital Payments".

"The digital payments industry couldn't escape the pandemic crisis, we witnessed a dip of 30 percent in online payments since the lockdown began, and now seeing a rebound of 23 percent over the last 30 days is a sign of gradual revival of the digital economy," Harshil Mathur, CEO and Co-founder, Razorpay, said in a statement.

- During the 101 days of lockdown, March 24-July 2, the online education sector grew by 23 percent as extended lockdown has led to a rise in demand for online courses.

- Also, medical services are picking up as online consultations and purchases have increased by 20 percent, said the report.

- To ensure health and safety from COVID-19, Indians opted to stay indoors and paid bills online. This contributed to the growth of the utility sector by 163 percent.

- The research showed that locked up at home, people have turned to dating apps for companionship and social isolation has also led to a surge in online counseling platforms to connect with mental health experts.

- The social engagement sector -- personal counseling, dating & matrimony websites -- has witnessed a 32 percent growth, said the report based on transactions held on the Razorpay platform between March 24-July 2.

(Inputs from IANS)