The latest report by 'Xpheno', a talent solutions firm that also tracks deals and investments among start-ups caused a stir among the business circles with its findings about the rising debt of Indian startups.

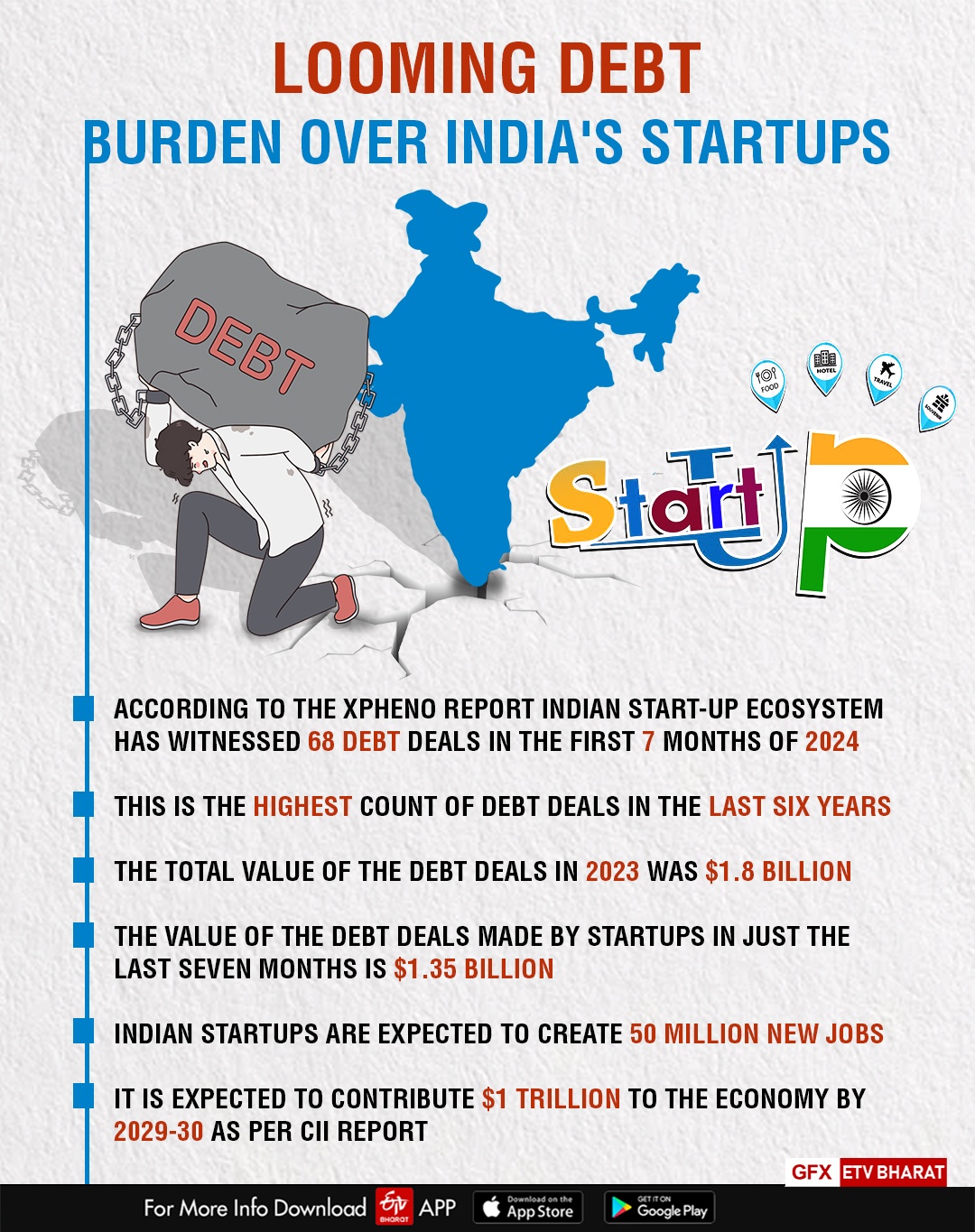

The report says that the Indian start-up ecosystem had witnessed 68 debt deals in the first seven months of calendar year 2024. This is the highest count of debt deals in the last six years. What is more concerning is the fact that the total value of the debt deals in the whole calendar year of 2023 was $1.8 billion and the value of the debt deals made by startups in just the last seven months is $1.35 billion, which is a whopping 75 per cent jump, compared to the last year.

These figures are a cause for worry, as the startup ecosystem in India has been contributing to India's growth story to a large extent. Fintech, e-commerce, Software services, Autotech, etc, are some of the sectors, where the startups are excelling and are contributing to job growth, besides trade promotion.

In fact, Indian startups are expected to create 50 million new jobs and contribute $1 trillion to the economy by 2029-30, as per the report of the Confederation of Indian Industry (CII). Given such a strategic importance, the health of Indian startups is key to a stable economy. Thus, it is pertinent to understand the reasons underlying this phenomenon of rising debt and contemplate the way ahead.

Debt Financing and Startups:

When a firm finances its business activities by taking a loan, with a promise to pay back the principal amount along with interest, we can say that the firm is financed by debt. Generally, startups need funds for their expansion or to reach higher revenue levels and increase the value of their firm. They could raise the required capital either by debt or equity or in hybrid mode.

The decision of a firm about the mode of fund-raising is determined by a plethora of factors like transactional expenses, agency costs, access to capital, taxation norms etc. Many startups resort to debt financing with the fear of losing ownership, if they raise the funds through equity. The tax benefits that comes with debt financing also attracts firms towards it.

The rising debt levels of Indian startups is not a new phenomena. It has been underway since 2021. It was the year, where there was huge funding for startups, especially 'Unicorns' i.e., startups with a valuation of $1 billion or more. As a result, collective debt amassed by 115 Indian 'Unicorns' touched Rs 50,000 crore in 2022 alone.

These companies raised such huge levels of debt by using various debt instruments like convertible notes, term loans, and structured transactions etc. They predicted that there will be access to more liquidity through Initial Public Offerings (IPOs), which will put them in a comfortable position.

However, during the later months of 2022, things turned around, due to global economic developments, which delayed the IPOs. This stressed out the startups financially, and their firm's valuation got affected by these developments. With the drying up funds and raising debt burdens, many startups resorted to raising funds from equity on difficult terms, while other startups got mired into more debt to just sustain in the market.

The Way Ahead

Although debt financing has its benefits, it also comes with the costs. For instance, the competitiveness of the startups will be eroded if there are large debt obligations. This is due to the fact that the debt repayment becomes burdensome, as time passes and it restricts their cash flows, thereby impending their growth.

On the other hand, higher debt affects the credit ratings of the firm and the interest rates may also take a toll on the earnings of the firm. It is in this context the startups need to remember that the debt is serviced from their cash flows. Keeping these flows stable is very important. However, most of the startups end up with losses initially so it is always better to avoid debt in the beginning stage.

It is not to say that startups should not go for debt financing. They should be rational in doing so. They can contemplate about debt financing if their startup is already making profits, from which they can pay the creditors. Otherwise, they face the risk of losing their ownership to the creditors.

In addition to this, start-ups need to have clarity of the purpose, for which the debt is being raised. They need to identify specific reasons like meeting working capital requirements, to support an acquisition plan or to enhance the credit. Then they need to identify the sources of debt which match their requirement.

Moreover, they also need to have a proper understanding of the financial instruments they are using for debt financing, and their implications for the business in case of debt default. However, many startups seem to be raising debt from the market, without this exercise, thus resulting in huge leverages, and thus resulting in losses. The situation of huge debt piles up is largely a result of such lack of homework at the desk level.

Another important that is being noticed is that many startups simply resort to debt financing just because equity is not available. Instead, they need to raise debt to postpone raising equity until it becomes affordable. Once the equity becomes affordable to them, they can repay the debt and resort to equity financing at a cheaper cost.

However, for this to happen, there needs to be a clear repayment plan, which is missing in many startups. This in turn is resulting in debt pile up. Thus, it is time for the startups to wake up and introspect about their debt positions, whether they are sustainable, and take corrective measures.

It will go a long way in averting a bigger debt crisis, that is looming over the Indian startups. Any further delay will be detrimental to their future and the future of lakhs of employees working in these startups.

(The Author is Head, Department of Business Management, H.N.B.G.arhwal Central University, Uttarakhand)

(Disclaimer: The opinions expressed in this article are those of the writer. The facts and opinions expressed here do not reflect the views of ETV Bharat)