Finance Minister Nirmala Sitharaman presented the first Budget of the BJP-led NDA government, which came to power recently, for the third consecutive term. Being the first budget after the general elections, where the BJP suffered electoral losses, there were different expectations from varied quarters of the economy.

As expected, the Budget reflected the changing political realities at the ground level, which is clear from announcements by the Finance Minister for Andhra Pradesh and Bihar. The sops highlight the strategic priority the ruling dispensation gives to these states.

The Finance Minister’s claims that the present government intends to serve four castes, i.e., the poor, women, youth and farmers, with emphasis on employment, skilling, MSMEs, and the middle class suggest the government’s intention to reach out to those segments, who seemed to be unhappy for a while and gave their mandate recently.

Besides the political developments, this budget comes at a time when the global economy faces geo-political challenges, monetary policy tightening in major economies, and uneven growth across nations.

India continues to be a shining star among these challenges as it continued its post-Covid-19 growth momentum and recorded a real GDP growth rate of 8.2 percent in the fiscal year 2024, despite the global and domestic challenges. It is against this backdrop, we need to understand the allocations of budget for the financial year 2024-25.

Boosting Consumption via Employment Generation

While India waded through rough waters of global turmoil and still managed to record a decent growth rate, the data from the Economic Survey 2023-24 raises concerns about India’s gross domestic product (GDP).

The report suggests that the country’s growth is expected to slow down to 6.5 to 7 per cent in the current financial year from 8.2 per cent recorded in March 2024.

Even the International Monetary Fund (IMF) and the Asian Development Bank (ADB) have pegged India’s GDP growth for 2024-25 at 7 per cent. This challenge of potentially low growth could be addressed by adopting the strategies of either boosting consumption expenditure, government expenditure or investment expenditure or by boosting exports. The combination of some of the above strategies could also be attempted, given the domestic macroeconomic conditions and geo-political developments.

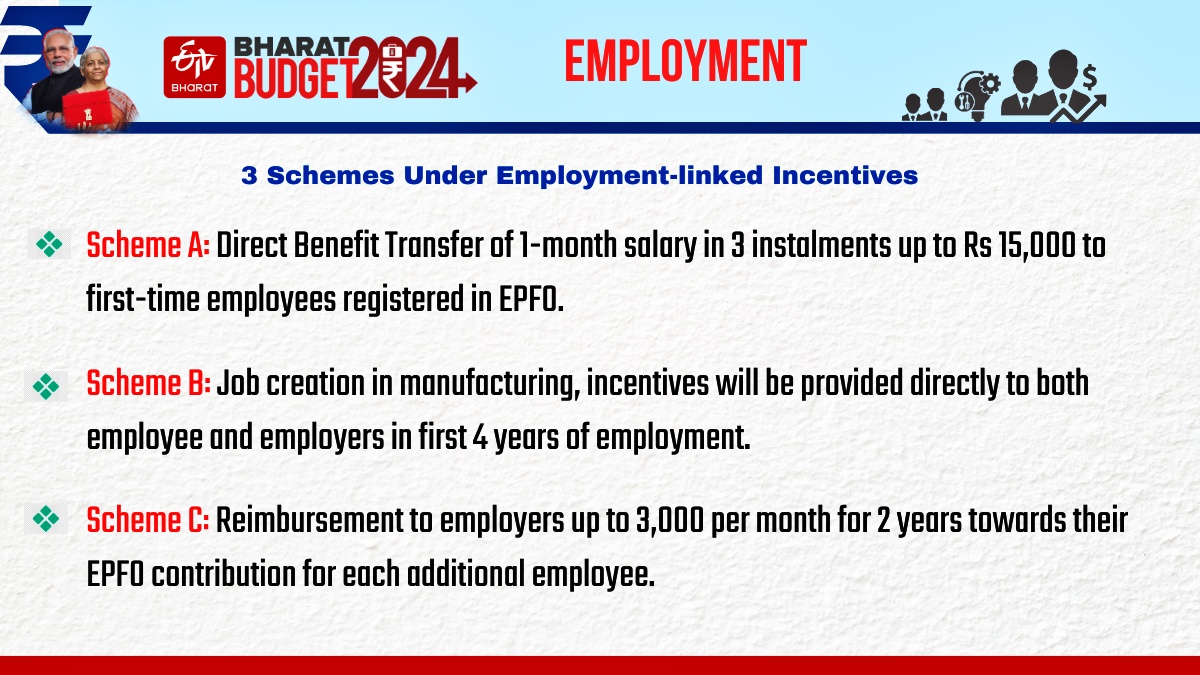

The Budget by and large aims at boosting consumption by creating more employment in the economy. This is because higher levels of employment give more income in the hands of people and they, in turn, demand more goods and services. This demand boosts consumption and thereby propels more production. To produce more, there is a need for higher employment levels. This becomes a spiral and eventually results in a higher GDP and faster economic growth.

It is with this expectation the Union Government allocated Rs 2 lakh crore over the next five years for employment generation schemes. To make the youth employable, emphasis has also been laid upon skilling. As a part of this initiative, a new centrally-sponsored scheme for skilling 20 lakh youth over the next five years has been announced, and the model skilling loan scheme will be revised to facilitate loans up to Rs.7.5 lakh.

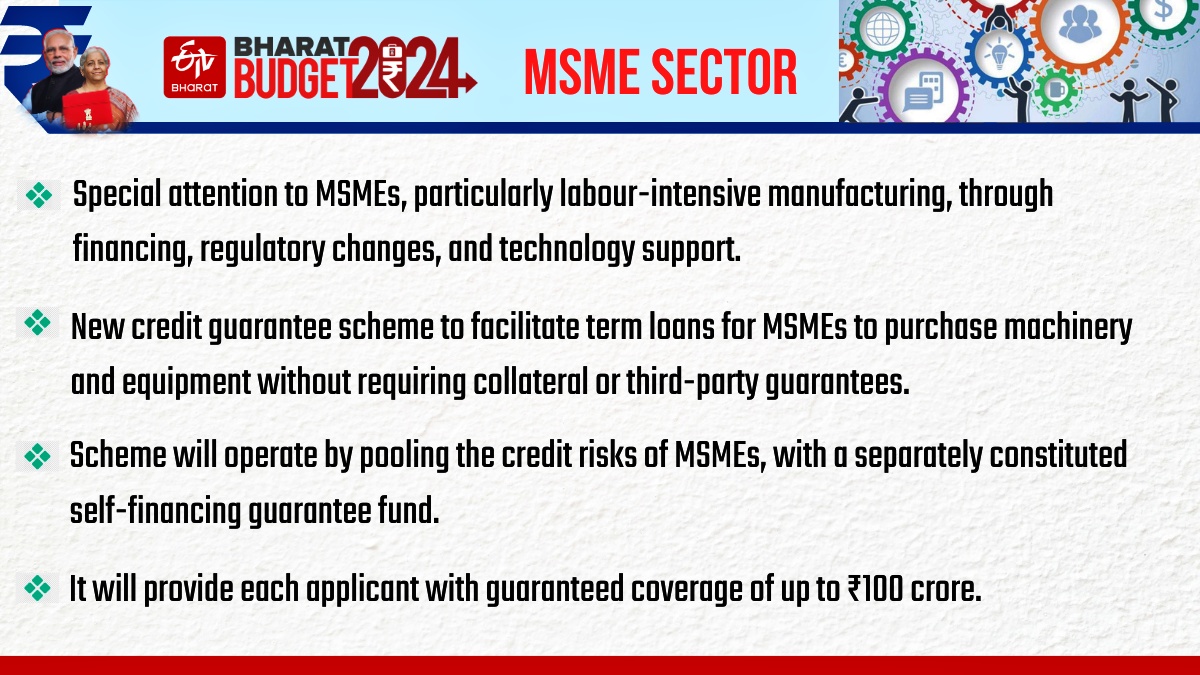

On the other hand, efforts are made to improve credit accessibility to MSMEs, which are largely labour-intensive and have a high potential to generate employment opportunities.

Initiatives like credit guarantee schemes, increasing the limit of Mudra loans to Rs. 20 lakhs, and creating alternate methods to evaluate the eligibility of MSMEs for loans fall in line with the Government’s aim of boosting consumption via employment generation.

However, it is to be noted that it is a long-term process and it takes time to yield the expected results. In the meantime, the Government needs to ensure that people are left with more money in their hands, after taxation, which we call disposable income. People had pinned hopes that the Budget would announce changes in tax slabs to address the concerns of the middle class. The standard deduction was increased by 50 per cent to Rs 75,000, and tax slabs were adjusted for taxpayers opting for the new income tax regime. This would not have a significant impact on consumption patterns, as many taxpayers are filing their income tax returns in the old slabs.

A revision in the tax slabs would have been a great relief to the taxpayers, whose contribution to overall tax revenue is higher than the corporate. It would have boosted consumption at a faster rate. However, contemplating a higher expenditure by the government is constrained by the fiscal targets and its stand on fiscal consolidation.

To drive growth further, the Union government also emphasized an infrastructure development plan for urban and rural markets, which have the potential to create new income-generating opportunities in rural areas. There is also a special focus on agricultural schemes and rural development, which could indirectly boost consumption spending. In addition to this, infrastructure investment by the private sector will also be promoted via viability gap funding, and enabling necessary policies and rules.

Even a market-based financing framework is also proposed. Despite these measures, it is surprising to note that the budget allocation for this year for MNREGA is Rs 19,297 crore less than last year’s expenditure. Even when we see these allocations as a share of the total Budget, this is the lowest in the last 10 years. Higher allocations in this regard would have further spurred rural consumption and overall economic growth. All said and done this budget attempted to balance a difficult trinity of fiscal consolidation, boosting consumption via employment generation and investment growth, to meet the challenge of economic growth. Let’s wait and watch how it will work.

The Author is the Head of the Department of Business Management, H.N.B.Garhwal University, Srinagar Garhwal, Uttarakhand. The opinions expressed in this article are those of the writer. The facts and opinions expressed here do not reflect the views of ETV Bharat.