The run-up to an election is always a good time for a review of the performance of an incumbent government since it tends to seek re-election on the basis of its supposed performance. As is normal any incumbent government.

Over the past five years, Andhra Pradesh has become a state that is no more a trend setter and instead has become a state that may be increasingly reflecting a text book case of what can go wrong with policies that do not take holistic view of development and instead prefer to push a misguided focus on borrowing to live for that day.

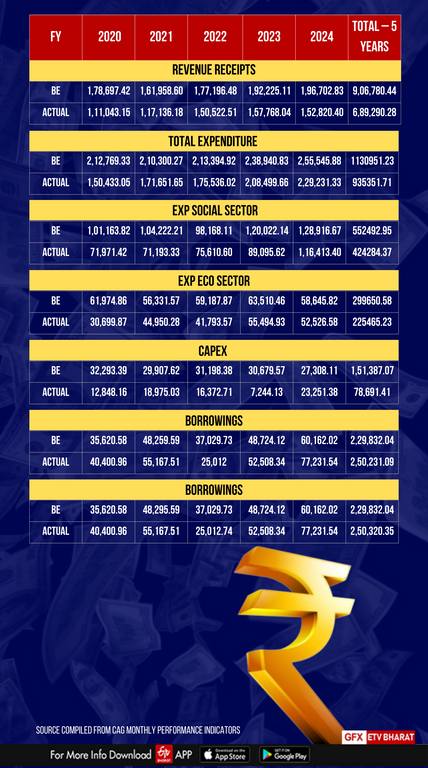

A cursory glance at the revenue and expenditure details as placed in the public domain in the CAG website (Monthly Key Indicators) indicates an interesting facet: that when budgets are presented this government makes it fashionable to talk about poor and spending on poverty alleviation by showing the large amounts purportedly allocated while the actual expenditure is far less – and varies from 29% to 10% less than promised.

Unfortunately, actual amount spent is something that can only be seen after the end of financial year – by which time the government would have undertaken a marketing blitz about the amount that it plans to spend on the poor in the next year. In contrast, in the case of borrowings, they have always been more than the budget estimates.

Even the social expenditure, which the government claims is their priority has never been the as promised in the budget. However, it is obvious that the state is borrowing based on estimation of revenues – which have never been met and have always fallen short. In short, there is a complete mismanagement of public policy that is hurtling the state into the abyss – if it has not already tripped into the abyss.

To make matters worse, the state is on now living on borrowed time and may have crossed the line into insolvency. Such is the precarious nature of its public finances that it is not able to pay salaries and pensions apart from its other financial obligations without recourse to new loans. If these new loans stop, the state will go into a tail spin and utter ruin. Hence, fiscal management is the biggest challenge for the next government. It is also time for the central government to stop its dual game and understand the implications of allowing extreme high levels of borrowings – just to help its political agenda.

Two Characteristics: Taxes and Debt

The two characteristics and biggest legacy that stand out in the past five years are the sharp increase in taxes of all kinds and the huge increase in public debt. The period saw some of the largest tax increases: increase in property taxes, increase in user charges and increase in cost of public services including electricity were some of the sharpest in the history of Andhra Pradesh. The example of property tax is illustrative: the shift to capital value system led to an increase of nearly 45% over the past three years. This is contrast to a no increase in property tax for residential areas in 10 years before that.

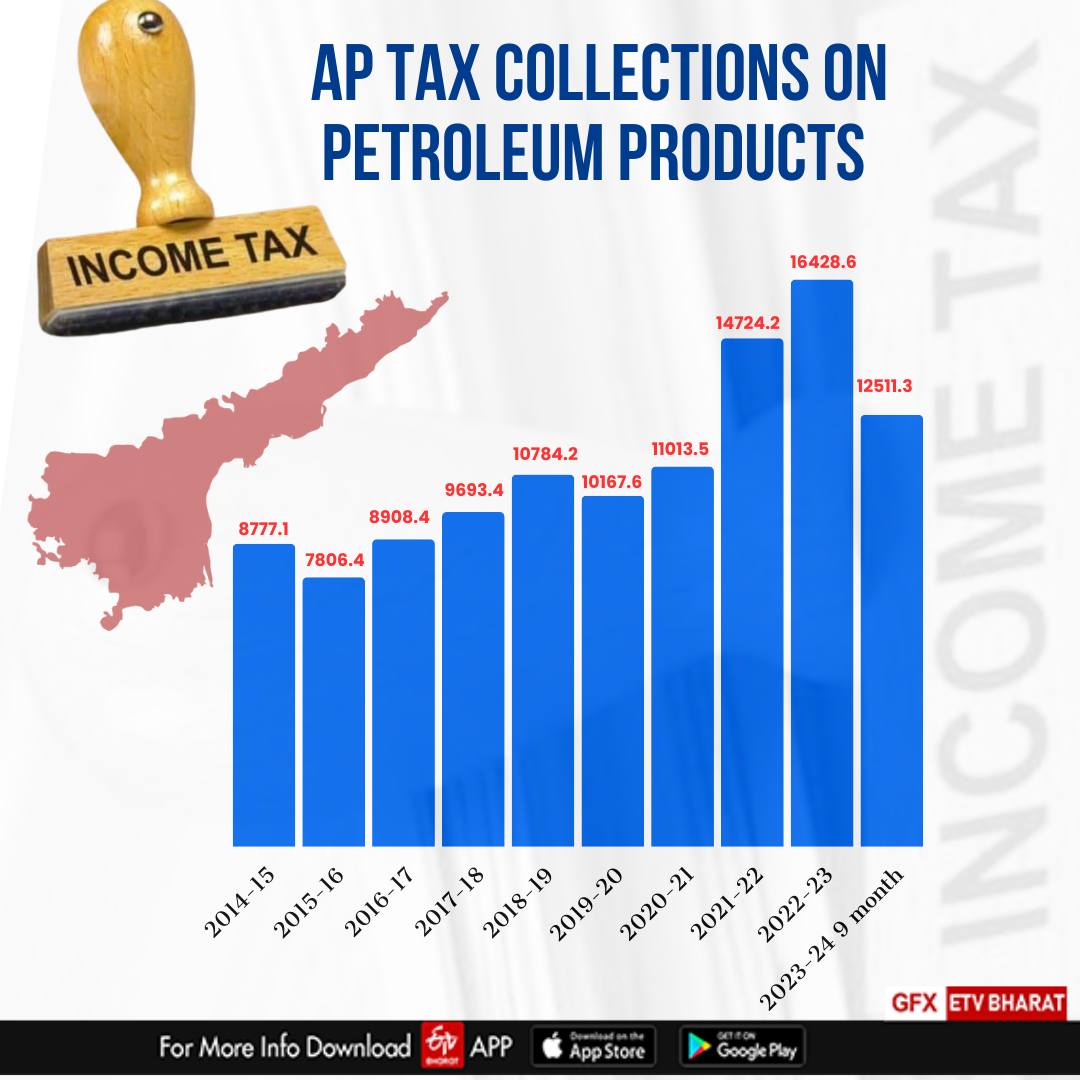

Central government data indicates that the AP's collection of state taxes on petroleum products increased from Rs.10,784.2 crores in 2018-19 to Rs.16,28.6 crores in 2022-23 and in the nine months of 2023-24 it was Rs.12,511.3 crores. AP has the highest tax on Petrol in the country: 31% VAT + Rs.4 per litre VAT + Rs.1 litre Road Development Cess and VAT thereon.

Ironic as it may seem despite collecting cess for road development, roads are in a despicable condition. Tax collections that indicate a near 50 per cent increase clearly outrun any increase due to increased consumption and clearly indicate one that has been largely due to tax increases.

High levels of taxes tend to have a negative impact on savings, consumption and inflation. Unfortunately, despite the high levels of taxes the state has been fiscally profligate and for unknown reasons has had to borrow huge amounts. Publicly the borrowings are purportedly finance the "welfare is development model".

And, these rampant borrowings which have been used to fund consumption rather than capital expenditure and investments has clearly pushed the state into a debt trap. Historically, any state or country which falls into debt trap tends to suffer long years of pain. According to CAD Monthly Key Indictars the state has a net borrowing of a total of Rs.2,50,321.09 crores over the last five years (FY 2019-20 to Feb 2024, i.e, FY 2023-24 (11 months).

And, this excludes guarantees issued by the state. In contrast, the socio-economic survey 2019-20 notes that the outstanding debt of the state at the end of FY 2018-19 was Rs.2,61,989 crores. Hence, the present government has almost doubled the debt in five year and has added more debt than all the other governments in the history of Andhra Pradesh. Except for one year the borrowings have always been far above the budget estimates – even as revenues are often sharply short of budget estimates. Interestingly, despite the claims that the state is borrowing and spending large amounts on social sector, the expenditure has over the past five years been short of budget estimates and it was 71.14%, 68.31%, 77.02%, 74.23% and 90.30% respectively over the past five years.

The same pattern of lower actual expenditure vis-à-vis budget estimates is clear in the expenditure for the economic sector too: 49.54%, 79.80%, 70.61%, 87.38% and 89.57% respectively in the past five years. Thus, the marketing blitz and hype surrounding the “welfare model” seems to exceed the reality as reflected in the statistics.

Lack of Investments

A major deficiency that is bound to have long-term effect is the complete lack of capital expenditure by the government in the last five years. Only last year, in view of the forced requirement by the Central government which linked capex to loans as a precondition did capital expenditure increase. In 2022-23 capital expenditure was Rs.7244.13 crores versus budget estimate of Rs.30,679.57 crores, i.e., about Rs.604 crores per month for 12 months for nearly 5 crore population. Little wonder that infrastructure has collapsed in most of the state. The state of the roads, irrigation and drinking water infrastructure is indicative of this lack of investment. This obvious lack of investments in public infrastructure has had its impact on private investment and by extension job creation. The costs of this lack of investments in infrastructure and capital expenditure are visible on multiple fronts.

A problem that is clearly manifest is the deterioration in the institutional framework. Any form of protest or dissent howsoever mild and justified immediately draws an increasingly vicious response. The pervasive institutional decline is a worrying factor and the exercise of administrative power by the executive wing has been extremely arbitrary.

Industries have had to face arbitrary changes in policy where the powers of all supervisory, statutory bodies have been weaponised in pursuit of special political agendas. The net result of this unreasonable and arbitrary attitude is the huge increase in people who are forced to approach the Hon’ble High Court of Andhra Pradesh with thousand of writ petitions and contempt of court petitions – something that was not seen even in the state before bifurcation and the united state. This institutional decline is already having a major cascading effect in the form of increased narcotics peddling, crime, extortion, gambling and other social vices.

Another casualty of a lack of vision for a holistic development is industrial development and even neglect. While there is little doubt that industries have become capital and technology intensive and tend to reduce lesser number of people than in the past, they still generate substantial jobs while having a positive effect on the larger consumption and their ability to help create indirect employment.

The paucity of statistics about the number of industries established and the inability to show progress is clear: The Socio-economic Survey 2022-23 (the latest available on the AP Finance Dept website) in Schedule A 6.1 titled “Large & Mega Industrial Projects gone in to production” has columns that disclose statistics for March 2014-2021, 2021-22 and 2022-23 (upto December 2023).

Hence, an objective analysis is not possible for period from 2019-2021. Moreover, March 2020 to nearly 6 months of 2021-22 Financial year were affected by COVID and hence it is unlikely that industrial expansion was on the books of any company. The picture for the 2021-2022 and 2022-23 (upto December 2023) indicates the sorry state of lack of industrial development: even by government admission a total of 38 large and mega industrial projects have gone in to production with a total value of Rs.21,026.04 crores generating employment to 20,725 persons.

The confusion is further reflected in the manner in which the term “large and mega” has been used. Based on the statistics provided the average size of investment is about Rs.554 crores and yet the term large and mega has been used. Normally, in the business world, mega project is a term used for projects that is a few thousand crores and preferably above US$1 billion (or about Rs.8000 crores).

Though things are bleak at present, the future will be better.