Mumbai: Benchmark BSE Sensex tanked 1,769 points to slide to a three-week low on Thursday as a spiralling conflict in West Asia triggered selling in oil, banking and auto shares, wiping out Rs 9.78 lakh crore investor money in a single day.

Falling for the fourth day running, the BSE Sensex tumbled 1,769.19 points or 2.10 per cent to settle at 82,497.10, its lowest closing level since September 11. During the day, it plummeted 1,832.27 points or 2.17 per cent to 82,434.02. As many as 29 Sensex scrips closed in the red while only one stock ended in the green.

Market capitalisation of BSE-listed companies dropped by around Rs 9.78 lakh crore to Rs 4,65,07,685.08 crore (USD 5.54 trillion). The NSE Nifty slumped 546.80 points or 2.12 per cent to 25,250.10 with 48 of its constituents ending lower.

Continuous foreign fund outflows and rising crude oil prices dented investors' sentiment, analysts said. From the 30 Sensex firms, Larsen & Toubro, Reliance Industries, Axis Bank, Asian Paints, Tata Motors, Bajaj Finance, Maruti, Bajaj Finserv, Kotak Mahindra Bank, Titan, Adani Ports and HDFC Bank were the major laggards. JSW Steel emerged as the only gainer.

"The domestic market took a sharp downturn following Iran's launch of ballistic missiles at Israel, sparking fears of retaliation and escalation in the war, Vinod Nair, Head of Research, Geojit Financial Services said.

New SEBI regulations for the F&O segment have raised concerns about reduced trading volumes in the broader market. Lastly, with attractive valuations in China, FIIs have redirected their funds, adding pressure on Indian stocks," Nair added.

The BSE midcap gauge tumbled 2.27 per cent and smallcap index dropped 1.84 per cent. All indices ended lower. Realty tanked 4.49 per cent, while capital goods (3.18 per cent), auto (2.94 per cent), services (2.87 per cent), industrials (2.75 per cent) and oil & gas (2.52 per cent) were among the major losers.

A total of 2,881 stocks declined while 1,107 advanced and 88 remained unchanged on the BSE."Fears of FPIs and FIIs switching to China from Indian equities were prevalent, especially considering the sharp valuations of domestic markets compared to China," said Devarsh Vakil, Deputy Head of Retail Research, HDFC Securities.

In Asian markets, Hong Kong settled lower while Tokyo ended in the positive territory. Markets in mainland China will be closed for the rest of the week due to the holiday. European markets were trading mostly lower. The US markets ended marginally higher on Wednesday.

Foreign Institutional Investors (FIIs) offloaded equities worth Rs 5,579.35 crore on Tuesday, according to exchange data.

Global oil benchmark Brent crude climbed 1.37 per cent to USD 74.91 a barrel. Equity markets were closed on Wednesday for Mahatma Gandhi Jayanti.

In the top 10 biggest falls ever, three of the biggest falls were in 2024 and the highest fall was recorded on June 4 when the Sensex tanked 4389.73 points. The second was August 5, 2024, which was 2222.55 points due to Russia-declared war against Ukraine and the third happened today due to the rising tension in the Middle East and fears of a potential Iran-Israel conflict.

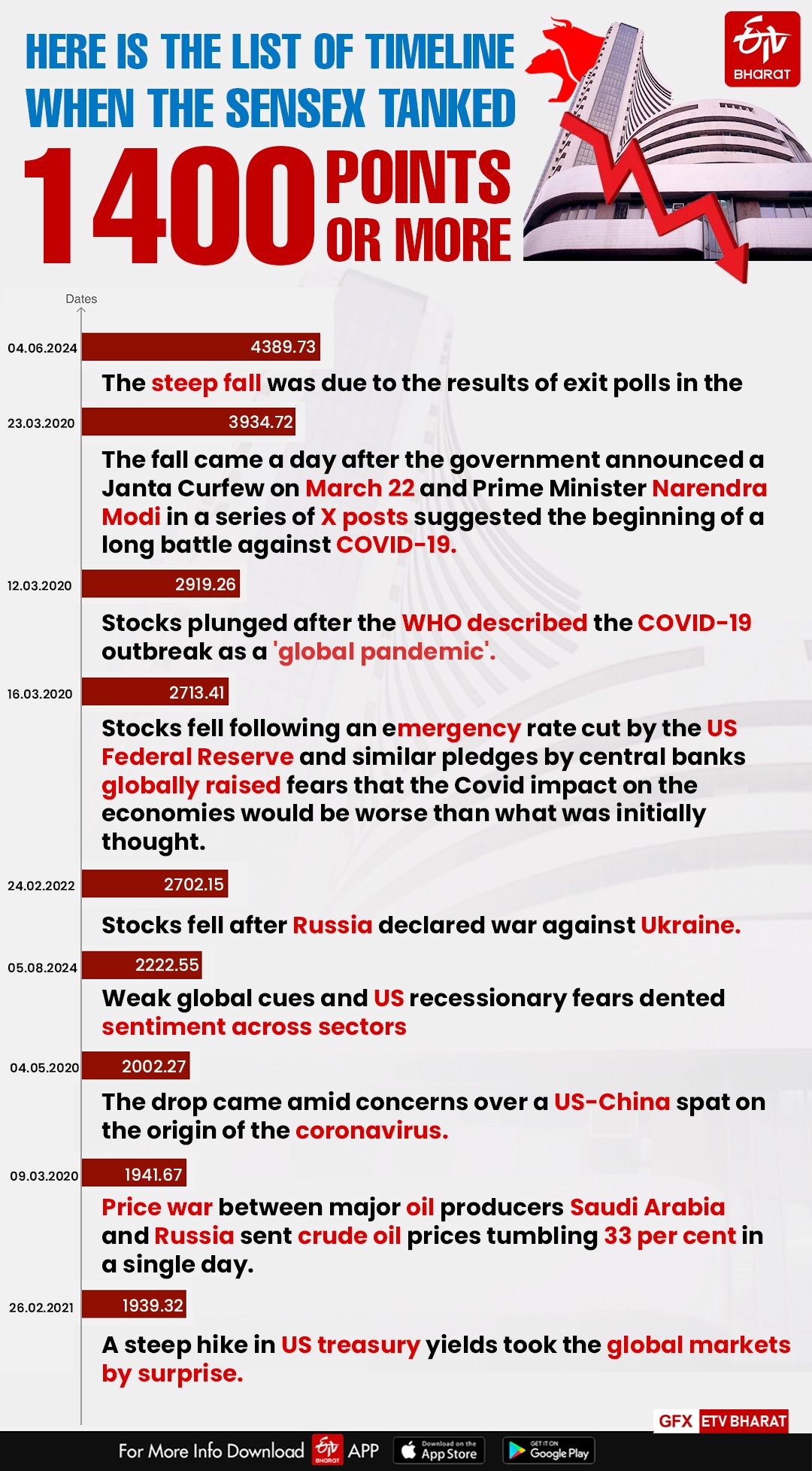

Here is the list of Timeline when the Sexsex tanked 1400 points or more

04.06.2024 - 4389.73 - The steep fall was due to the results of exit polls in the Lok Sabha polls.

23.03.2020 - 3934.72 - The fall came a day after the government announced a Janta Curfew on March 22 and Prime Minister Narendra Modi in a series of X posts suggested the beginning of a long battle against COVID-19.

12.03.2020 -2919.26 - Stocks plunged after the WHO described the COVID-19 outbreak as a 'global pandemic'.

16.03.2020 -2713.41 - Stocks fell following an emergency rate cut by the US Federal Reserve and similar pledges by central banks globally raised fears that the Covid impact on the economies would be worse than what was initially thought. 24.02.2022 - 2,702.15 - Stocks fell after Russia declared war against Ukraine.

05.08.2024 - 2,222.55 - Weak global cues and US recessionary fears dented sentiment across sectors

04.05.2020 - 2002.27 - The drop came amid concerns over a US-China spat on the origin of the coronavirus.

09.03.2020 - 1941.67 - Price war between major oil producers Saudi Arabia and Russia sent crude oil prices tumbling 33 per cent in a single day.

26.02.2021 - 1939.32 - A steep hike in US treasury yields took the global markets by surprise.

03.10.2024 -1769.19 - Rising tensions in the Middle East and fears of a potential Iran-Israel conflict.

14.02.2022 -1747.08 - Russia could invade Ukraine at any time

18.03.2020 -1709.58 - Threat of economic fallout emananting from pandemic Covid-19 continued to weigh on investor sentiment.

12.04.2021 - 1707.94 - Unabated surge in coronavirus infections in the country triggered fears of fresh lockdowns

26.11.2021 -1687.94 - Nervousness on the new coronavirus variant and expectations of the US increasing the pace of tapering has led to recent market weakness.

17.01.2024 -1628.01 - Weak global sentiment

24.08.2015 -1624.51 - Fears about a potential slowdown in the Chinese economy. This was due to the devaluation of the Chinese Yuan a few weeks prior to the crash causing a fall in the rates of other currencies and high selling volumes of stocks. In the Indian markets, this was worsened by a poor monsoon season in India and disappointing earnings in the first quarter of the Fiscal.

24.01.2022 -1545.67 - Asian share markets slipped as investors braced for a Federal Reserve.

28.02.2020 -1448.37 - Rapid outbreak of coronavirus across geographies and the consequent economic fallout.

21.01.2008 -1408.35 - A change in the global investor confidence.

Read More