New Delhi: Reserve Bank of India on Wednesday started its crucial Monetary Policy Meeting to determine the benchmark interest rates known as repo rate and reverse repo rate and other crucial ratios for the country’s banking sector such as statutory liquidity ratio and cash reserve ratio that have profound impact on the country’s banking sector such as prevailing interest rates for businesses and retail borrowers and liquidity in the country’s financial system.

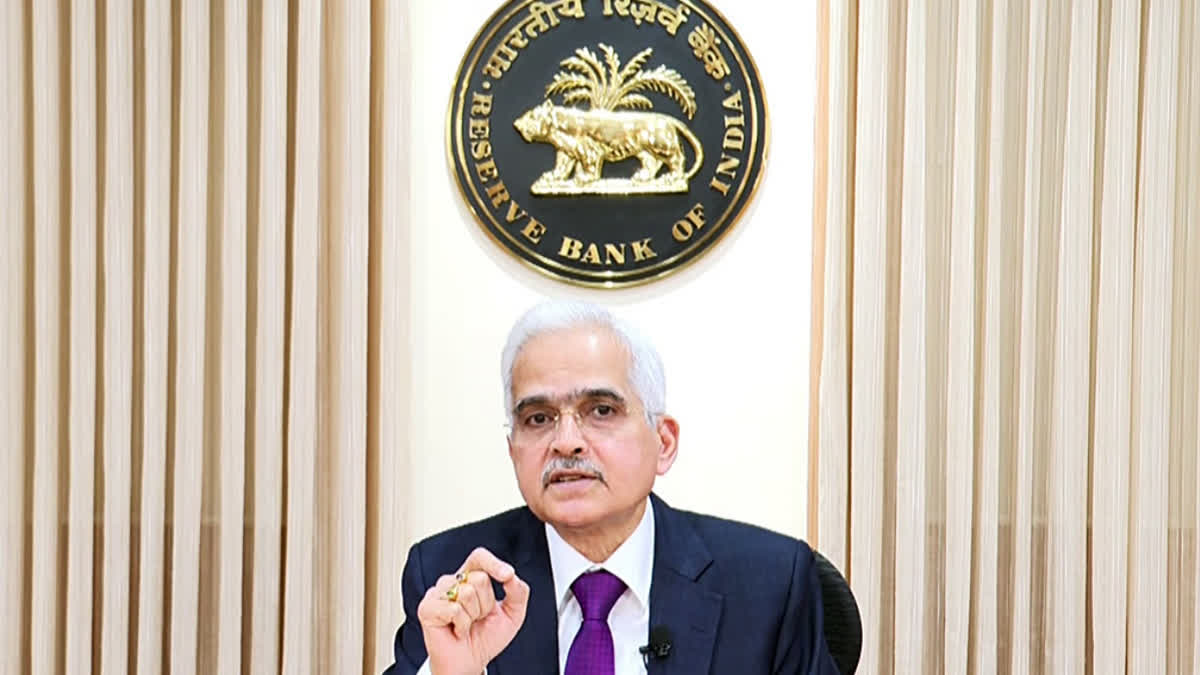

RBI Governor Shaktikanta Das is expected to announce the decisions taken by the MPC tomorrow (December 6). Under Section 45ZL of Reserve Bank of India Act of 1934, the RBI is required to hold at least 4 meetings of the Monetary Policy Committee (MPC) to decide the benchmark interest rates and reserve ratios for the banking sector to maintain the momentum of economic growth in the country while managing the inflation under the target band set by the government under Section 45ZA of the RBI Act.

The last meeting of the Monetary Policy Committee this year comes in the backdrop of two worrying developments as India’s economic growth rate nosedived to a nearly two-year low of just 5.4 percent in July-September period this year while retail inflation (measured as Consumer Price Index - CPI) surged to 6.2 percent in October which is above the target band set by the Central Government for the Reserve Bank under the law.

These two developments have complicated the task of the Monetary Policy Committee which is headed by the RBI Governor Shaktikanta Das. Now the committee members, who include RBI Governor Shaktikanta Das, Deputy Governor Michael Debabrata Patra, and economists and experts such as Dr. Nagesh Kumar, Saugata Bhattacharya, Professor Ram Singh, and Dr Rajiv Ranjan, will mull over the options before the committee to maintain growth while managing inflation under the target band.

Addressing a meeting of central banks of the global south last month, Governor Shaktikanta Das has emphasised that the cardinal principle of any monetary policy was to balance economic growth and inflation. He said the RBI could effectively maintain balance between price stability and growth within the space provided by the flexible inflation targeting (FIT) framework.

“The flexibility of this framework is embedded in the law itself, which defines the objective of monetary policy, namely, to maintain price stability while keeping in mind the objective of growth. Thus, while primacy is accorded to price stability, the law enjoins upon the Reserve Bank to pay due regard to growth considerations also,” said Governor Das.

And this is the path of giving primacy to containing inflation that the RBI has been following since it withdrew the economic stimulus measures that were announced in the wake of Covid-19 global pandemic to shore up the economic growth.

In May 2022, the RBI reversed its Covid era policy of low interest rate regime and increased the repo rate by 2.5 percent between May 2022 and February 2023 to contain the inflation.

However, since February 2023, it is maintaining the repo rate at 6.5 percent despite calls from industry and several other quarters to reduce the benchmark interest rate to support the economic growth.

Union Ministers call for affordable interest rate regime

In fact, it prompted finance minister Nirmala Sitharaman last month to call for making the interest rates to be “more affordable”. Addressing a conference organised by State Bank of India (SBI), the finance minister on November 18 highlighted that high interest rates are causing stress for borrowers and urged banks to make lending more affordable.

“India’s growth depends on industrial expansion, and lower interest rates would be crucial in achieving the country’s vision of a Developed India,” she had said.

Sitharaman was not the first Union Minister to call for a lower interest regime. Days before finance minister Sitharaman’s public statement for affordable interest rates, commerce and industry minister Piyush Goyal had echoed similar demands.

Goyal urged the Reserve Bank of India to reduce interest rates to support economic growth which was predicted to decline in the second quarter of this fiscal (July-September period). However, the quantum of decline in the GDP growth rate, which plunged by more than two percent on a year-on-year basis, surprised many observers as the country is the fastest growing major economy in the world.

Like several other experts, Goyal also recommended that the RBI consider excluding food prices when making decisions on monetary policy, as they have been a significant driver of inflation.

For example, India’s retail inflation surged to 6.2 percent in October this year mainly on account of double digit growth in the food inflation which turned out to be 10.87 percent on a year-on-year basis.

While the target for the RBI is to maintain the retail inflation at 4 percent, it has a margin of two percent on either side of the target set by the government under the law.

In any case, monetary policy committee members have a difficult challenge of striking a fine balance between high inflation while supporting economic growth.

Some experts suggested that the RBI may resort to Covid-era measures of reducing the cash reserve ratio (CRR) that will create more liquidity in the banking system without cutting the benchmark interest rate.