New Delhi: Every taxpayer’s eyes will be on Finance Minister Nirmala Sitharaman when she presents the Union Budget in the Lok Sabha on Tuesday as they are hopeful of some tax relief in terms of personal income tax in the first full budget of Prime Minister Narendra Modi’s third term. The Finance Minister could not have done it in the interim budget presented in February this year due to election year conventions that prohibit any announcement to lure the voters.

However, this time there is no such compulsion and middle-class taxpayers are hopeful as any reduction in the income tax payouts straight away translates into more disposable income in their hands, a direct boost to personal consumption.

Over the years, there is a tendency among tax authorities to simplify and streamline the income tax collection process. The measures include rationalisation of income tax slabs, simplification of income tax forms and streamlining the online income tax return filing process and timely processing of income tax return, including timely reimbursement to the taxpayers.

However, the multitude of tax slabs under the country’s two income tax regimes – the old income tax regime and the new income tax regime – and a plethora of tax deductions and exemptions make it a fairly complex task.

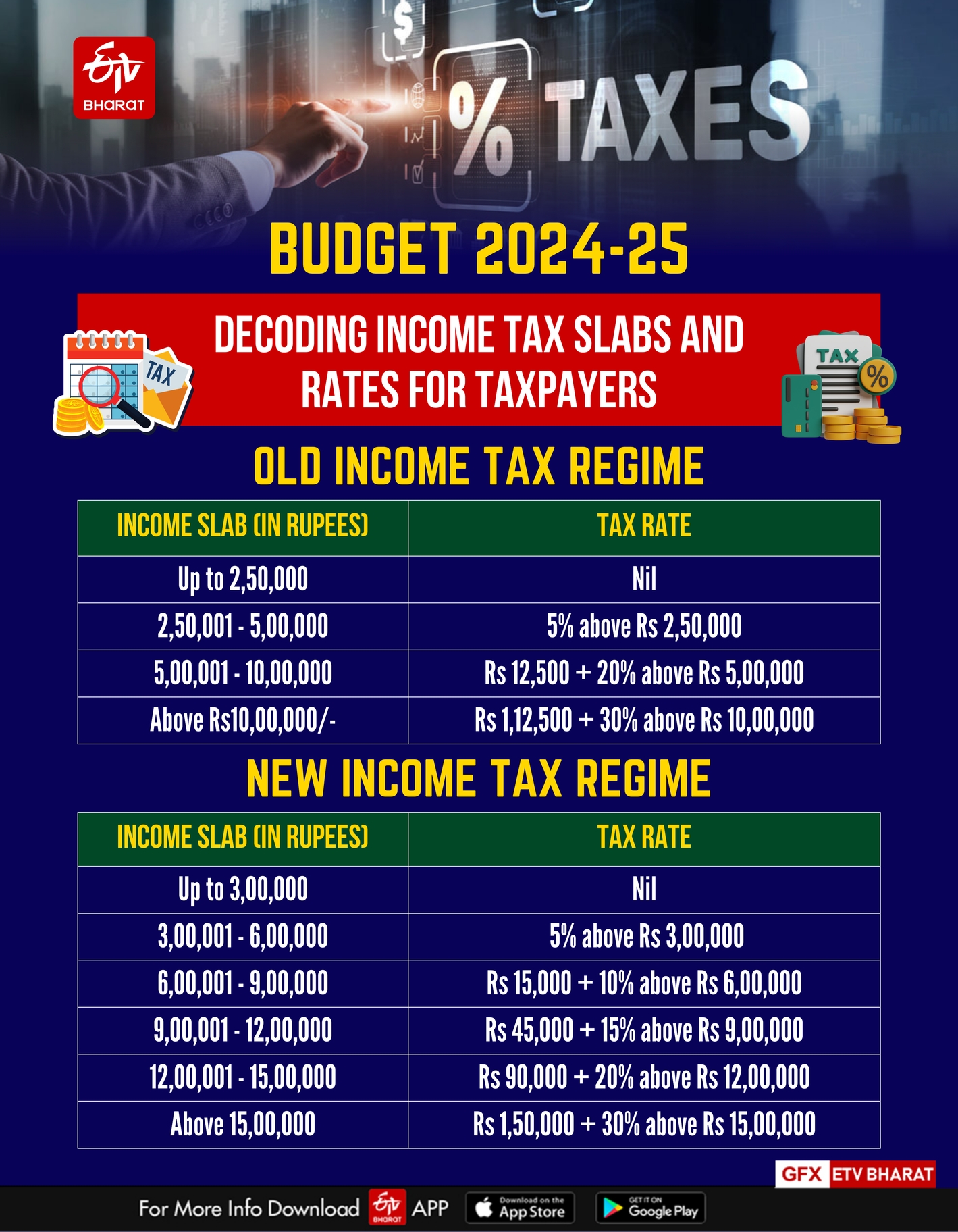

Here is a breakdown of India’s income tax slabs and applicable tax rates under the two income tax regimes and some of the major deductions that can be claimed by income taxpayers.

The Central Board of Direct Taxes (CBDT), the apex body to administer direct taxes in the country, offers two tax regimes for individuals: the old regime and the new regime. Both regimes have different tax slabs and their corresponding income tax rates.

Old Income Tax Regime:

The old income tax regime allows for several deductions and exemptions under Section 80, potentially leading to a lower tax burden. Here's a breakdown of the slabs and rates for the assessment year 2024-25 (income earned in the financial year 2023-24):

| Income Slab (in Rupees) | Tax Rate |

| Up to 2,50,000 | Nil |

| 2,50,001 - 5,00,000 | 5% above Rs 2,50,000 |

| 5,00,001 - 10,00,000 | Rs 12,500 + 20% above Rs 5,00,000 |

| Above Rs10,00,000/- | Rs 1,12,500 + 30% above Rs 10,00,000 |

New Income Tax Regime U/S 115-BAC of IT Act:

The new income tax regime, which has become the default tax regime, has been designed to cut away the cumbersome process of maintaining the record by the taxpayers such as copies of rent receipts, bills and receipts for expenditures incurred among other things. Under the Income Tax of 1961, it is the responsibility of taxpayers to maintain records for six years in case an income tax assessment officer raises a query or intends to verify the expenditure incurred which qualifies for any deduction or exemption under the law.

The new income tax regime Under Section 115-BAC of the Income Tax Act of 1961 offers a simplified tax structure with lower rates but eliminates most deductions under Section 80. Here are the slabs and rates for the assessment year 2024-25:

| Income Slab (in Rupees) | Tax Rate (%) |

| Up to 3,00,000 | Nil |

| 3,00,001 - 6,00,000 | 5% above Rs 3,00,000 |

| 6,00,001 - 9,00,000 | Rs 15,000 + 10% above Rs 6,00,000 |

| 9,00,001 - 12,00,000 | Rs 45,000 + 15% above Rs 9,00,000 |

| 12,00,001 - 15,00,000 | Rs 90,000 + 20% above Rs 12,00,000 |

| Above 15,00,000 | Rs 1,50,000 + 30% above Rs 15,00,000 |

How to choose the right tax regime for you

Deciding between the old and new regime depends on several factors like your total income, investment plans, and the amount of deductions you are eligible for. A taxpayer should carefully analyse his or her financial situation and consult a tax advisor to determine which regime offers the most tax benefit in your case.