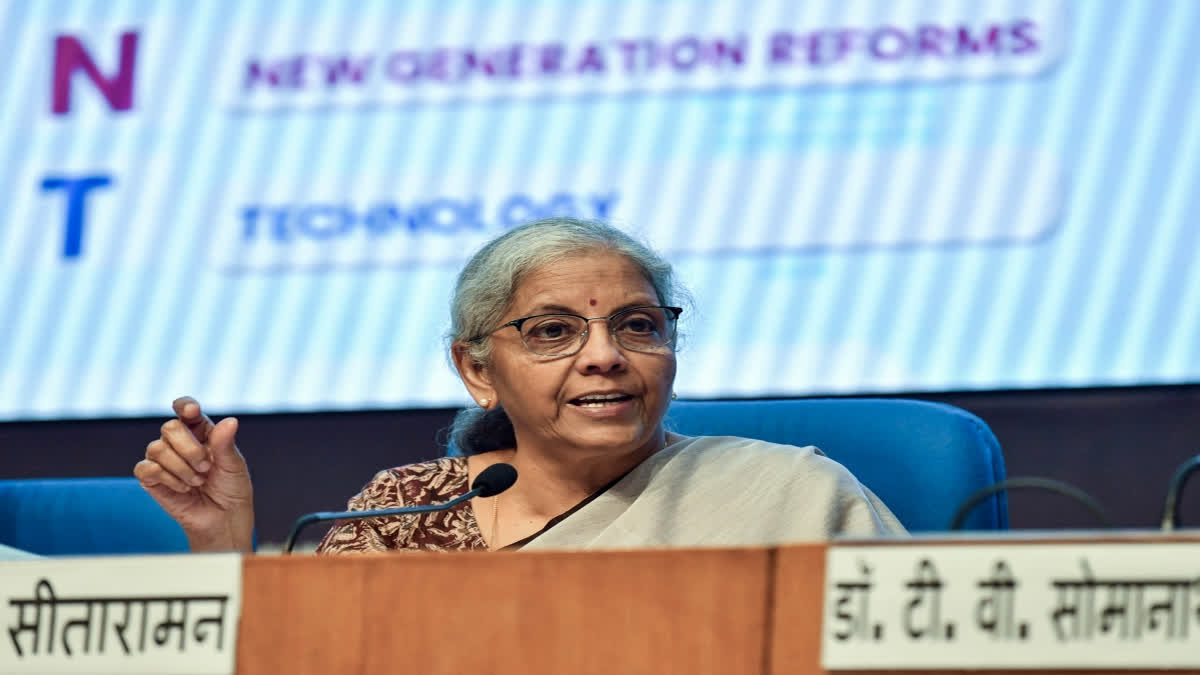

New Delhi: Finance Minister Nirmala Sitharaman's Rs 48 crore lakh record budget for the current financial year not only gives details of the Centre's revenue receipts and expenditure for the year but it also provides additional data on the health of the government finances. It shows how the Government of India manages its finances by collecting taxes and borrowing from the market and how it discharges its debt liabilities by paying a huge amount of the budget as interest payment every year.

It is true that more than half of the total budgeted expenditure of the Centre is met by the revenue collected by it. For example, this year the Centre’s net revenue collection has been estimated at Rs 25.83 lakh crore against the total expenditure of Rs 48.2 lakh crore. It means, the Centre's revenue collection will account for nearly 54 per cent of the total expenditure this year.

Centre’s revenue collection includes the collection of taxes such as income tax, corporate tax, custom and excise duties, its share in the GST, among others. In addition to revenue collection, the finance minister has estimated that the government would collect over Rs 5.45 lakh crore in non-tax revenue this year. These include interest receipts, dividend and profits of central government companies and banks, external grants, other non-tax revenues and collection from union territories.

These two receipts account for Rs 31.28 lakh crore of the total budget of Rs 48.2 lakh crores, which is nearly 65 per cent of the total expenditure this year. The remaining more than one-third of the total expenditure is arranged by borrowing money. This year the government intends to borrow Rs 16.13 lakh crore to meet its expenditure.

In other words, of every 100 rupees spent by the government, 35 rupees have been arranged by borrowing money from the market and other sources.

How the government borrows money

The Reserve Bank of India, which is the banker and currency manager for the government of India under the Reserve Bank of India Act of 1934, draws up the government's borrowing calendar for a year. There are several sources of the government's debt financing, the biggest one is market borrowings through government securities that are called G-Secs. This year the government is expected to borrow over Rs 11.63 lakh crore through this route.

Then the government also issues treasury bills or T-bills for short-term loans. This year, T-bills are expected to account for borrowing of Rs 50,000 crore. The third source is securities against small saving funds (SSFs). This year the government would arrange Rs 4.2 lakh crore through this route. Then it also arranges money through other receipts or internal debts, external borrowings and draw down of cash balance.

This entire borrowing, the difference between the government’s total expenditure and its receipts is known as fiscal deficit which indicates the government’s borrowing requirement in a year. It has been estimated at over Rs 16.13 lakh crore or 4.9 per cent of the country’s GDP.

Borrowing to pay interest on earlier loans

There is another twist to the fiscal health of the government finances. The data shows that nearly one-fourth of the total budget goes into interest payment alone. As per the budget estimate, the government would pay Rs 11.63 lakh crore this year in interest payment alone. It means that out of the total borrowing of Rs 16.13 lakh crore this year, 11.63 lakh crore or over 72 per cent of the total borrowing will be utilised in paying interest for loans earlier taken by the Government of India.

The budget data showed that the Centre’s interest payment liability in the three year period (2022-23 to 2024-25 period) is more than Rs 31 lakh crore. Moreover, the interest payment liability alone is much more than the capital expenditure of the country which has been estimated at a record Rs 11.11 lakh crore in this financial year.

High borrowing good or bad?

It’s a difficult policy choice for any government. Usually borrowing is not favoured by economists as it demonstrates that the government is not able to generate enough resources to meet its own expenditure and run its developmental work and welfare programmes. However, on the other hand, big borrowing is not considered bad if the government spends the borrowed money on development work such as on creation of infrastructure which leads to job creation and has multi-plier impact for the country’s economic growth.

For example, the government is borrowing heavily since Covid-19 global pandemic hit the world in 2020 as the country’s fiscal deficit surged to 9.2 percent of the GDP in 2020-21. However, during this period, there was another paradigm shift in capital expenditure of the country which also increased from Rs 4.26 lakh crore in FY 2020-21 to Rs 11.11 lakh crore in FY 2024-25, as per the budget estimate.