Thiruvananthapuram:Kerala Finance Minister K N Balagopal has called for a review of the central-state tax sharing ratio of the Goods and Services Tax (GST), and said that 60 per cent should go to the states, whereas it is shared equally now.

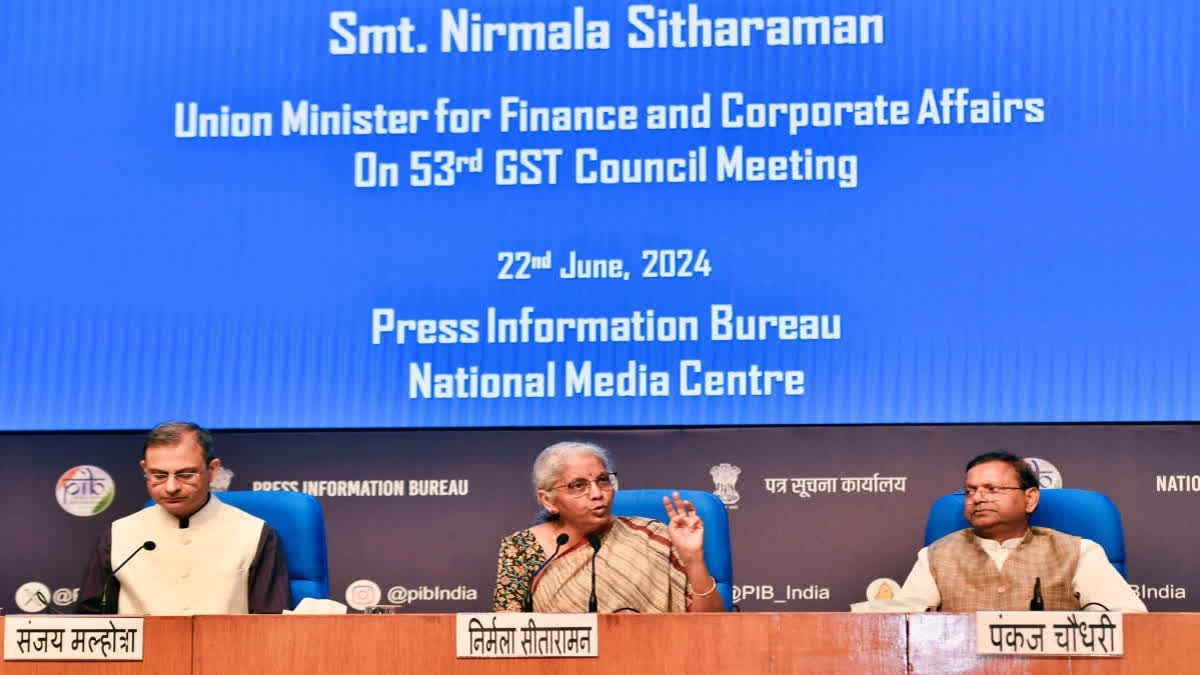

Currently, the ratio is 50:50 and it should be changed to 40:60 in favour of the states, the minister said in the GST Council meeting held in New Delhi on Saturday, according to a statement issued by his office here on Sunday. Speaking about the significant issues addressed during the meeting, the state FM said a favourable decision taken with regard to the Integrated Goods and Services Tax (IGST) is expected to be greatly beneficial for Kerala.

Generally, a GSTR-8 return is also required to be filed detailing the GST charges by e-commerce operators while doing business through e-commerce platforms, he said.

It was decided in the meeting to include in the GSTR-8 return the details about the state to which the tax should go, along with the amount of tax, Balagopal said, adding that it is a crucial decision that is expected to benefit Kerala a lot.

Those who sell goods and services from other states in Kerala through e-commerce platforms like Amazon and Flipkart collect IGST from the consumers here, but due to the non-specification of the consumer state in the returns submitted by them, Kerala is not getting the tax share, the minister explained.

The new decision taken during the GST Council meeting will help to resolve this, he said.

Kerala had sought a solution to this issue by listing out facts, which it found out through various studies, and the GST Council has accepted this, he said.

During the meeting, Kerala made it clear that the issues in the GST system were the reason for the reduced IGST share that the state receives. The union government informed the meeting that the central revenue from IGST was also decreasing, he said.

Based on this, it was decided in the meeting to check whether the reason for the reduced share was due to any lapse in the IGST system, Balagopal further said. It was also decided to re-examine the issue within 10 days with the participation of state GST officials, he said, adding that the loss of revenue can be checked only by identifying and fixing the problems in the system.

Checks on all matters will be continued after the presentation of the union budget, and the next meeting of the GST Council will be held in August or September, the statement said, quoting the state FM.