Jaipur:Jaipur-based professional Rishab Jain has voiced his concern over the escalating cost of education in the country, which he believes is increasingly becoming a luxury beyond the reach of many middle-class families. With his daughter preparing to start Grade 1 next year, Jain shared the shocking fee structure of one of the schools in the city that he is considering for her education.

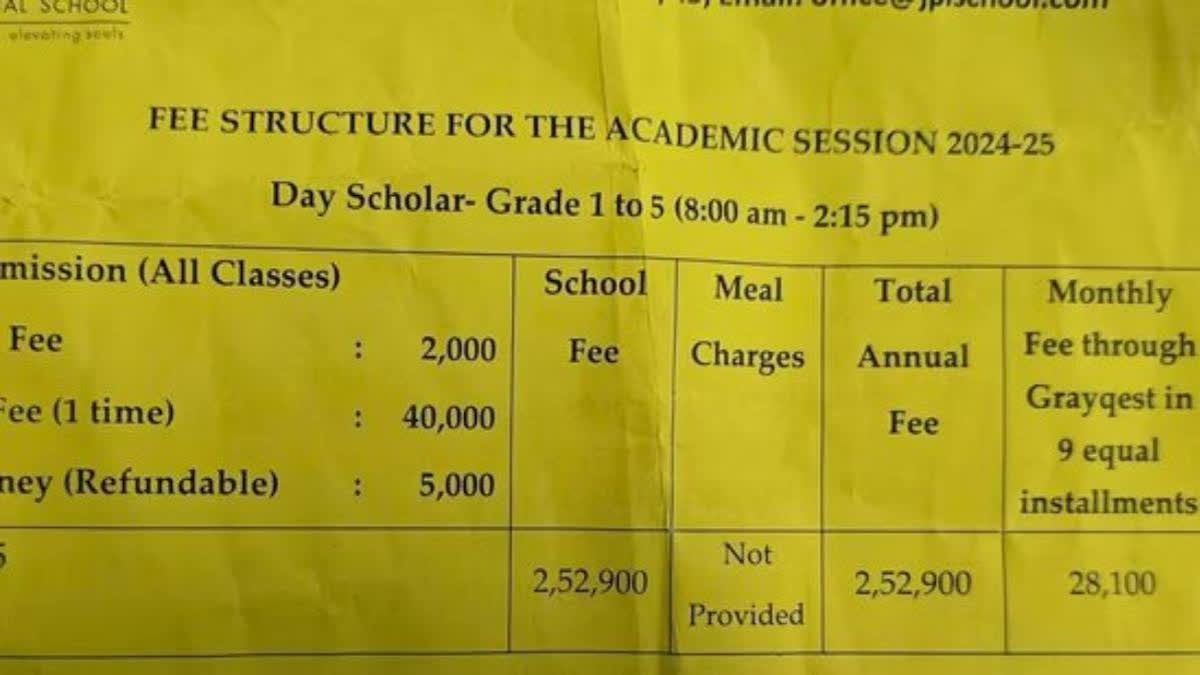

Jain's post on X, which quickly gained attention on social media, breaks down the annual costs for a Class 1 student, which total a staggering Rs 4,27,000. Here's the breakdown of the fees:

- Registration Charges: Rs 2,000

- Admission Fees: Rs 40,000

- Caution Money (Refundable): Rs 5,000

- Annual School Fees: Rs 2,52,000

- Bus Charges: Rs 1,08,000

- Books & Uniform: Rs 20,000

Jain pointed out that this fee structure is not an anomaly; other good schools in the city have similarly high fees. The total cost of Rs 4.27 lakh per year for just one child, he argues, is a financial burden many middle-class families cannot afford, even with an annual income of Rs 20 lakh.

In his post, Jain explains why this is a major concern, especially for families earning a middle-class salary. He writes: "Can you afford it even if you earn Rs 20 lakh a year? NO!!!," he says bluntly.

Jain goes on to explain why earning a decent salary, such as Rs 20 lakh a year, is not enough to comfortably afford quality education for children. He argues that a significant portion of such an income is eaten up by various taxes and essential expenses. For someone earning Rs 20 lakh annually, Jain points out, nearly 50% of that income is deducted by the government in the form of Income Tax (as high as 30% + cess for individuals in the highest tax bracket), GST, VAT on petrol, Road Tax, Toll Tax, Professional Tax, Capital Gains Tax and Land Registry Charges.

Additionally, middle-class families are also required to pay for essential services like health insurance, term insurance premiums and contributions to retirement schemes like the Provident Fund (PF) and the National Pension Scheme (NPS). After these mandatory expenses and deductions, the remaining income--sometimes as low as Rs 10 lakh--is divided between daily expenses like food, rent, utility bills and EMIs for loans.