Jaisalmer: A man from Rajasthan's Jaisalmer recently received a notice to pay Rs 1,39,79,407 in GST to the CGST Delhi-North Commissionerate, weeks after falling victim to online fraud and providing his PAN and Aadhar card details to an unknown person.

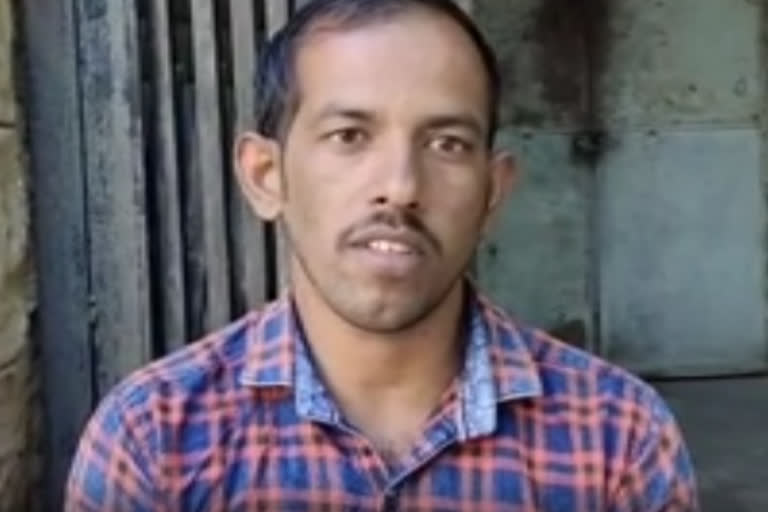

Narpatram, a resident of Ridwa village in the district, noted he had a meager supply of Rs 4,000 per month from family members and lacked the means to pay this huge amount sought by the GST department via the December 2022 notice.

"I could not understand the language initially. After asking someone, I came to know that a company had been registered in Delhi using my details and facilitating a GST number," he added.

Also read: Delhi excise scam: Court grants interim bail to 5 accused

"When I learned that the company registered a turnover of crores and I would have to file the tax, I was shocked. At the Sadar police station, too, cops refused to register an FIR at the time," Narpatram said. He also said that he then recalled the telephonic conversation and the fact that he had provided the OTP he received on his phone along with other details. According to to the notice a company had been opened in Delhi using the information he provided.

In the notice dated December 22, 2022, Praveen Kumar, (Superintendent) CGST Delhi-North Commissionerate, informed the former that the incident had been identified as 'fraudulent passing on of ITC credit' by the company in question, M/s Econse Enterprises.

"Strict legal action has already been initiated against the supplier including the arrest of the offenders, where required" it noted, adding that the probe would conclude only after legal action against the accused, recovery of inadmissible ITC, and imposition of penalties. The amount indicated is not the final amount and has been determined by the probe so far, the commissionerate also stated.